Rising Euro to Restrain Eurozone Growth in 2018

A rallying Euro, spurred on by the economic recovery in the Eurozone, will ironically become further growth's main headwind in 2018, says UBS.

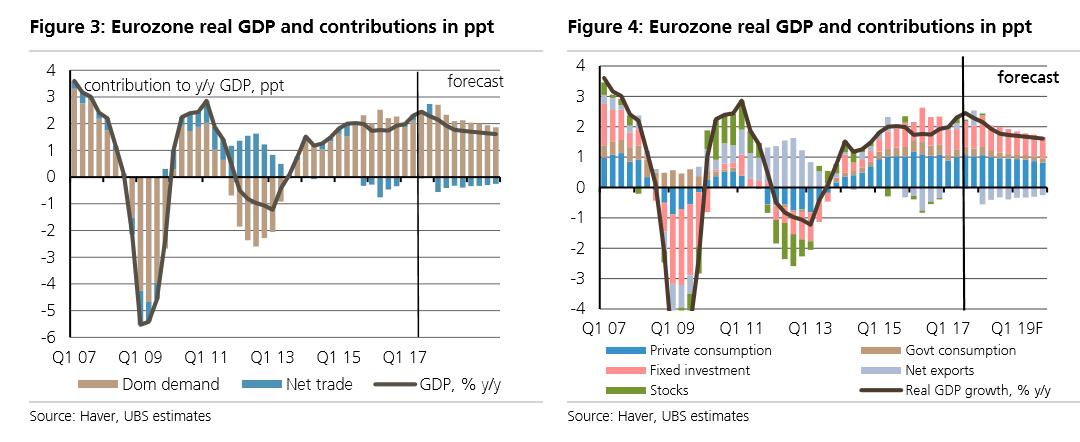

Growth in the Eurozone has reached a respectable 2.5% so far this year, and it is forecast to end the year at 2.3%, according to analysts at Swiss lender UBS.

But, in 2018 a change will come, however, growth will stall to only 1.9%, says the bank.

The reason? A strengthening Euro, which will reduce the competitiveness of exports leading to a fall in trade.

"We think the slowdown in GDP growth from 2.3% this year to 1.9% in 2018 will be mainly driven by a weaker contribution from foreign trade. Given the appreciation of the Euro in recent quarters, which we project to continue in 2018 and 2019," says UBS Economist Rienhard Cluse.

A stronger Euro will make Eurozone exports more expensive to foreign buyers, leading to a drop in demand and fall in export volumes.

In the present year trade has strengthened, contributing 0.1% to GDP, says Reinhard, but this won't continue, nor does it appear to be the norm.

Last year trade was a drag on growth, shaving -0.5% off GDP.

Next year, however, the stronger Euro will once again be a drain on growth, as the main culprit of the slowdown in growth from 2.3% to 1.9% will be trade.

The other main drivers: consumption, government spending and investment are expected to remain broadly unchanged, but exports will decline, pushing overall growth down in their wake.

"We expect the contribution of net exports to GDP growth to swing from +0.1pp in 2017 to -0.4pp in 2018. In other words, foreign trade alone is likely to lead to a GDP growth slowdown of 0.5pp between 2017 and 2018," says Reinhard.

What does UBS mean by a strong Euro?

UBS meanwhile forecast the Euro to continue rising with EUR/USD rising to 1.25 by end of 2018 and 1.30 by end of 2019.