The Euro-to-Dollar: Technical Forecast, News and Events For the Next Five Days

The Euro-to-US Dollar could extend its short-term bearish bias if data from the US continues to favour more Dollar strength, whilst the Euro is vulnerable to a monetary policy U-turn by the European Central Bank (ECB).

Looking at the charts first and we note that the Euro-to-US Dollar has started to move down in a new, short-term downtrend, which is expected to extend, in the absence of any signs to the contrary.

The daily chart shows the new step sequence of lower highs and lower lows indicative of a downtrend.

The exchange rate has just approached the August lows (red line) and the S1 monthly pivot (blue line) at the 1.1657 and 1.1662 respectively and these could supply an obstacle, although a decisive break below them, confirmed by a move under 1.1610 would probably lead to an extension down to the next downside target at 1.1500.

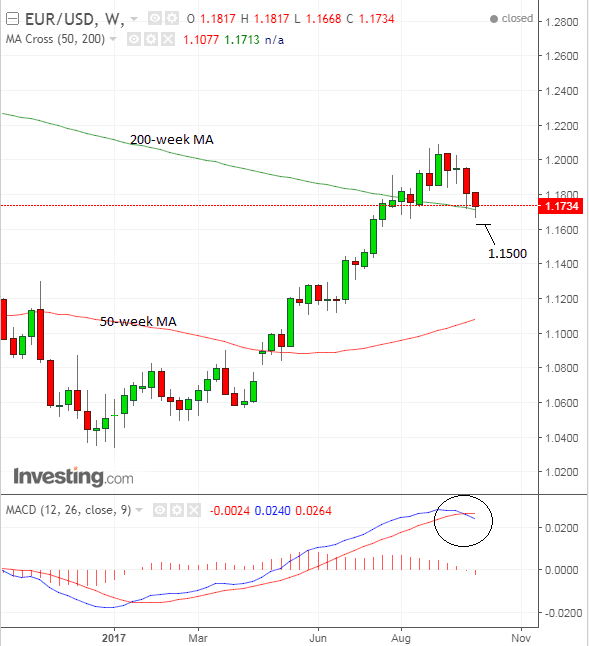

The weekly chart (see below) is showing that the pair has pulled back to a key level in the form of the 200-day moving average (MA) which is often the locus for reversals, however, a clear break below last week's lows would signal a decisive break and continuation of the fledgling bear trend.

The MACD has crossed its signal line which supports the bearish outlook and the exchnage rate is forecast to continue falling to the next target at 1.1500.

News and Data for the Euro

In the week ahead priobably the main focus for the Euro will be what happens in Catalonia, where there is a possibility the regional government could declare independence after 90% of voters in the referendum voted for independence.

Whilst only a minority of the population voted - that is 40% - the government may still declare independence and it has to by law within 48-hours of the result.

It still seems highly unlikely that Catalunia will gain independence as it has much to lose and little to gain from breaking away.

It would not be a part of the EU and would have to reapply, with Spain no doubt attempting to veto its memebrship. It could take years to reapply.

Financially, it is also heavily relient of Madrid help ever since it was bailed out after the Eurozone crisis in 2012, so again, if it went against Madrid those all important taps would be swithced off.

"The situation would become more difficult if Catalonia declared independence and Spain refused to extends its loans. Two thirds of Catalonia’s debt (€52.5bn) is with the liquidity funds for autonomous regions (FLA) which the central government set up in 2012 to finance regions which had been cut off from capital markets. The extension of outstanding bank loans to the region also requires Madrid approval since EFSF support was given in 2012," said Commerzbank's Deputy Head of Economic Research (Germany), Dr. Ralph Sorveen.

On the downside, however, the Catalan's spirited resistance may trigger copycat seperatist attempts in other EU states, and worse still for the Euro, and the European project, doom Macron's plans to unify the EU fiscally: part of the Catalan's grievance with Madrid is that they contribute more in tax revenue than what they recieve in public money to spend.

The same appears to be true of German misgivings about bailing out Greece - and if the sentiment were more unversally shared than expected it could halt moves to deeper unification.

Subdued Minutes

The Euro has started the new week on the back foot after the publication of the European Central Bank's (ECB) September meeting “minutes”, which "did not reflect an overly hawkish central bank," according to BK Asset Management's Managing Director, Kathy Lien.

"They felt that even with a reduction in their Quantitative Easing program, substantial stimulus is still needed," she said.

The ECB does not appear impatient to curtail stimulus, which is a negative rapprochement for the Euro.

"All of this suggests that while the central bank is committed to reducing bond purchases, it won’t be raising interest rates anytime soon," added Lien.

In light of the more ambivalent minutes there may be unusual attention brought to bear on Thursday's speech from ECB President Draghi.

On the data front, the main release are German.

Industrial production is first off, out at 7.00 BST on Monday October 9 and expected to show a 0.7% recovery.

Then the trade balance is out at 7.00 on Tuesday.

German CPI for September is out at 7.00 on Friday, and is forecast to show a 0.1% rise - this will be a key foretaste of Eurozone inflation out next week before the October ECB rate meeting.

Eurozone Industrial Production, meanwhile, is out at 11.00 on Thursday, and is forecast to show a rise of 0.5% in August compared to July.

News and Data for the Dollar

The release of FOMC minutes will be the most important event for the Dollar, followed by inflation and retail sales data, the preliminary reading of Michigan Consumer Sentiment, and JOLTs job openings.

The Fed meeting minutes released at 7.00 BST on Wednesday October 11, should reflect the current hawkish tone of the meeting statement, the dot plots and the commentary of most Fed speakers.

"The FOMC minutes scheduled for release on Wednesday should be hawkish and with gas prices rising and wage growth increasing, economists are also looking for a very sharp recovery in retail sales that should take USD/JPY back to its highs near 113.50," Said Kathy Lien.

Commenting on the strong wage growth reflected in the Labour Bureau report last Friday, Lien expects the dollar to continue trading strongly:

"With manufacturing- and service-sector activity accelerating and wage growth rising, we expect the dollar to extend its gains in the coming week."

Inflation data for September, out at 13.30 on Friday, will be a key release for the Dollar, as it will need to come out strongly to support the Federal Reserve's hawkish rhetoric.

The market clearly thinks it will with a consensus forecast of a rise in headline Inflation of 2.3% compared to the 1.9% of the previous month.

Core Inflation is forecast to come out at 1.8% from 1.7% previously.

Retail Sales and Core Retail Sales are also out at the same time as inflation.

The former is expected to rise by 1.6% in September, bouncing back from -0.3% in August.

Core Sales are expected to show a 0.3% increase from 0.2% in the previous month.

"We see a 1.7% jump in retail sales, reflecting a hurricane-induced surge in demand concentrated in autos," say TD Securities in a note on up-and-coming releases.

The see risks from a less-hawkish than expected Fed minutes as markets have fully-priced in a hawkish comment.