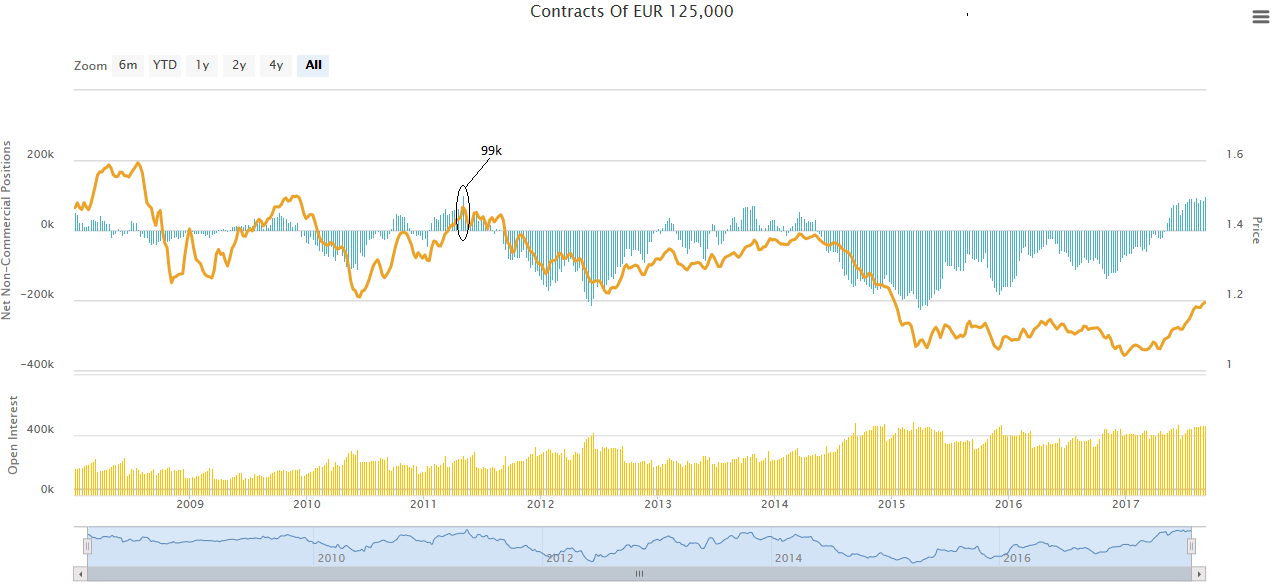

Euro At Risk of Pull-Back After Bets On Futures Exchanges Reach 6-year High

Data from global futures exchanges is showing the number of bullish 'bets' on the Euro has reached a record high and this suggests the potential for a sharp reversal in the currency's uptrend.

The latest data reflects the current positive sentiment for the single currency as a result of the improving economic outlook for the Eurozone and the anticipation of the end of quantitative easing in the region.

The data - known as Commitment of Traders, or COT for short - shows the number of bullish Euro futures contracts bought in the previous week, ending Tuesday September 5, reached a new high of 96k.

Only one time before did Euro contracts exceed this high, in 2011 when they registered 99k on Tuesday, May, 3.

Analysts use COT figures to try to forecast market turns.

Normally they look for extreme positioning as a contrarian signal, so for example, they would interpret an extremely high number of bought long contracts as a possible sign the pair was overstretched and, therefore, due a turn lower, and vice versa for an extremely large position of sell contracts.

Potential for Euro Retracement Grows

In the case of the Euro this would suggest positioning is overstretched to the upside, and indeed analysts at Credit Agricole appear to share this view.

"According to our FX positioning gauge, speculative EUR long positioning has risen again to multi-year extremes. While we believe the longer-term trends should remain on the upside, the current degree of positioning suggests heightened downside correction risks in the short-term," says Credit Agricole's FX Strategist Manuel Oliveri.

Whilst we agree that COT data for the single currency is overstretched and, therefore, warns of a correction in the Euro, we also note how the number of bets keeps rising each week and that this is a bullish sign in itself.

We would prefer to wait for the number of bullish bets to fall - ideally by a substantial amount - before calling for a reversal in the Euro, using the COT data, although we also acknowledge the currency may already be losing ground in certain pairs.

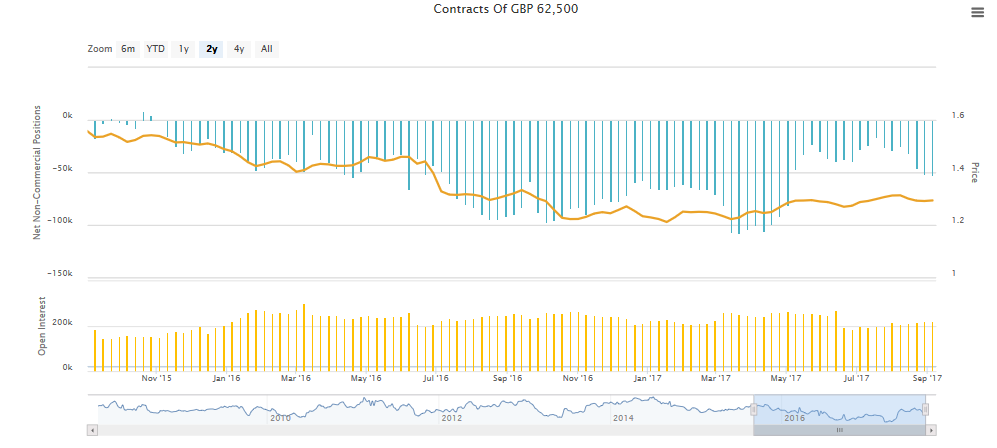

Pound Positioning Negative But Not Extreme

Whilst some have remarked on how COT data for the Pound is showing very negative positioning and that this is an indication the currency may be about to reverse higher, historically positioning is not as bearish as it has been in the past.

The number of bearish contracts held in March, April and May 2017, for example, was much higher than now.

Once again, we also tend to want to see contracts pivot higher before forecasting a potential reversal in the trend of the underlying currency, and like the Euro which keeps seeing positioning rise, GBP keeps seeing bearish positioning rise week on week, so we are not ready to call a reversal higher yet, despite signs Sterling may in fact already be rising - especially versus the Euro.