GBP/EUR Exchange Rate Reversal Underway

The Pound to Euro exchange rate has jumped 0.50% in mid-week trade as Sterling recovers from oversold conditions and the Euro takes breather from its streak higher.

We believe the Pound's recovery and Euro's fall is finally fulfilling a reversal in this under-pressure exchange rate that our studies have hinted at for some days now.

"We assume that technical considerations were also the main driver of this move," says analyst Piet Lammens with KBC Markets in Brussels who sees profit-taking on the recent, protracted rally in the Euro.

For sure, GBP/EUR remains caught in a strong downtrend across all timeframes, and to state an oftstated investment maxim, "the trend is your friend until the bend at the end."

GBP/EUR's downtrend began in May and has seen the exchange rate fall a considerable amount, from 1.18 to 1.08 during that period.

Without any evidence suggesting the contrary we would normally expect the trend to continue.

Nevertheless, there are signs, albeit feint, that it may be losing strength and even a possibility that the pair could be about to reverse and go higher.

The first of these signs is that the exchange rate made an intraday recovery on Tuesday which presented itself as a Japanese hammer reversal candlestick on the daily chart.

According to candlestick lore, hammer candlesticks are more reliable if they are immediately followed up by another upday.

Today has started out looking like an upday but it will need to close higher to provide better confirmation.

The outline of the May to August downtrend is such that it also suggests the possibility of a reversal on the horizon.

We stress this is just a possibility so should be interpreted with caution, but looking at the whole move down we note how the shape of the downtrend is broadly divided into three parts - a clear and straight downtrend, followed by a messier more consolidative period in June and July, in which there was a relatively strong correction, and then another clear untroubled descent in August, much like the May move.

Here is a classic example:

The tripartite structure of this move is similar to that of a 'measured move' and more importantly the length of the first (a-b) and third (c-d) sections are similar, indicating the move may well be complete - what then follows is likely to be a rebound higher, if not a complete reversal.

This combined with the hammer candlestick provides a case for a correction higher although without a stronger recover in the actual price itself we are not in a position to change the bearish tenor of our forecast.

The MACD is also still falling in line with the exchange rate, which is a bearish sign, and if the exchange rate breaks below the hammer's lows at 1.0741 it would reconfirm the downtrend, to a target at 1.0700.

Fundamental analysts are also looking for Sterling to catch a break against the Euro which is looking overextended at current valuations.

"At the current level, it is difficult to chase the currency higher ahead of the ECB meeting next week and as long as speculators’ positioning remains so extended," say analysts at UniCredit Bank in a mid-week briefing. "It seems likely we may be entering a period of consolidation as investors decide to take a breather, interpret the ECB’S message on 7 September and reassess."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Solar Eclipse Heralds Change

Whilst it may sound far-fetched, the August 21 solar eclipse may also be a sign of change.

Investment banker J P Morgan, founder of the bank after his own name, for example, once said that millionaires don't believe in astrology, billionaires do.

Traditionally eclipses are associated with endings and beginnings and the solar eclipse on August 21 may well mark the end of the current market trend and the start of a new one.

According to astrologer by Marlene Pfeifle, CAP, "near the date of the eclipse, before and after, there is a marked increase in volatility. Eclipses have coincided with market reversals in either direction."

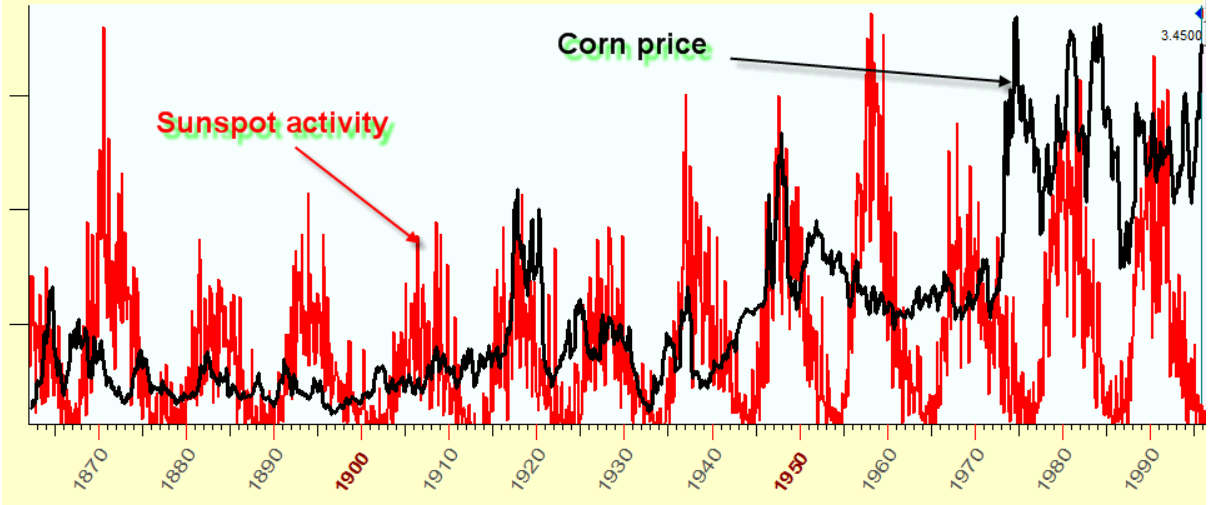

This is backed up by my own observations, and is not as far-fetched as it seems - scientists have known for centuries that there is a close correlation between the price of commodities and the number of sun-spots on the sun, such that the two appear to be related.

As such changes in the sun seem to have an influence on financial markets.