British Pound to Find Little Benefit in a Bank of England Interest Rate Rise

An interest rate rise at the Bank of England could allow Pound Sterling to advance on the Euro, but researchers say such a move would represent a mistake that will ultimately weigh on the UK economy.

The British Pound's nearer-term outlook rests largely with the Bank of England, and we can report some upside relief for the currency might be found as a result of this focus.

But, longer-term, the clouds of Brexit still loom large and the Bank must play its cards right in a high-stake game of economic poker.

Whether or not the UK is embarking on a future of higher interest rates is therefore important for the economic outlook and for Sterling.

Typically, a higher interest rate regime would unlock the door to a more sustained recovery in the Pound.

But, analyst Kathrin Goretzki of Italian lender Unicredit S.p.A. believes the Bank has good reason for avoiding a rate rise and believes the chance of such an outcome is less than evens.

Markets are pricing in a 50% probability.

Without a rate rise in 2017 the overall path higher for interest rates will simply not be steep enough to warrant a stronger Pound in 2018.

And, even if there is a rate hike, UniCredit don’t see the Pound rising as much as would normally be expected.

This is largely due to the uncertainties posed by Brexit, which has changed the currency’s relationship with interest rate differentials.

And ultimately, analysts at UniCredit believe raising interest rates at the Bank of England would represent a policy mistake.

Limited Impact of a Rate Rise on the Pound

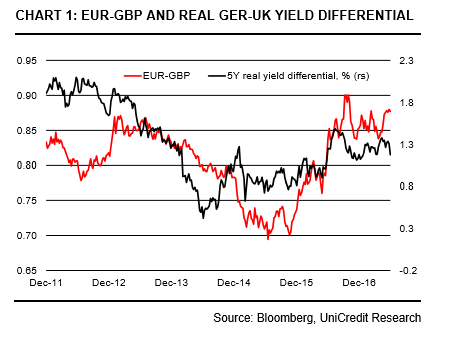

Yield differentials, which represent interest rate expectations, and are a major driver of exchange rates have already moved in anticipation of a rate hike.

As can be seen, if the Euro-Pound relationship had followed historical precedent, the Euro would be weaker and the Pound Stronger.

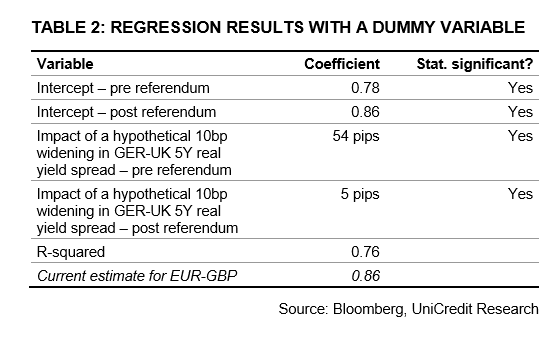

"Based on the current real yield differential, the model’s 'short-term fair value' is estimated at 0.85," says Goretzki.

This is a Pound to Euro rate of 1.1765.

The analyst believes that even were signals of an impending rate rise to harden, yields would be lucky if they rose 10bps; this is hardly the stuff required to get the Euro falling.

The problem for Sterling-bulls though is that these aren't normal times and we should therefore not expect currency markets to behave as we they traditionally would.

There are two reasons for this.

1) The Pound simply doesn't respond to yields like it used to owing to Brexit - a new trading relationship with Europe could mean a new relationship for bonds and currencies.

2) Inflows of foreign capital are expected to dry up because of Brexit. Foreign investors simply won't have the confidence in Britain they once had. However, it is worth pointing out that latest data from the Department for Internation Trade shows 2016-2017 to have set a record for inward investment. So this point is p for debate.

Lasting Impact of Rate Hike Ultimately Diminished

Yet, due to Brexit the long-term positives associated with higher interest rates are unlikely to feed into a materially stronger Pound we are told.

After analysing the data using complex statistical regression techniques, Goretzki comes to the conclusion that such has been the negative impact of Brexit on capital flows a rate rise will not have the same impact on demand for the Pound as normal.

The table of results below shows that under normal conditions a 10 basis point widening in GBP-EUR 5-year yield differentials, which represent interest rate expectations, would lead to a fall of 56 basis points of EUR/GBP before the referendum.

After the referendum, however, her analysis suggests the same 10 basis point change in yield differentials would cause a fall of 5 basis points.

“Since the referendum result, the sensitivity of EUR-GBP to fluctuations to 5Y real yield differentials has sharply diminished,” says Goretzki.

Not as Hawkish as They Say...

Unicredit’s Goretzki thinks the market is over-interpreting recent statements from UK central bankers as adding more of a hawkish twist to them than they were intended to convey.

Bank of England chief economist Andy Haldane (who used to err towards the dovish side) suggested on 21 June that some monetary policy tightening is needed “well ahead of market expectations“.

Governor Mark Carney then also surprised at an ECB conference in Portugal the following week when he said that “some removal of monetary policy stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen”.

These comments, "were seen by the market as a move towards a more hawkish tone. We have already expressed our disagreement with this interpretation,” says Goretzki.

Goretzki’s base case is for there to be no rate hike in 2017, or even for the duration of Brexit negotiations.

“We see this reaction as premature and maintain our view that the BoE will stay on hold during the time of Brexit negotiations. UK sentiment is showing signs of deterioration, real incomes are being squeezed and inflation has risen while wage growth remains stagnant,” she said.

Foreign Investments

Brexit exposes the UK and the Pound to the possibility that capital inflows will dry up as investors avoid uncertainty.

Normally money flows in the direction of rising interest rates but due to fears of how Brexit could impact on companies’ ability to trade across borders, outside investment, as measured by Foreign Direct Investment (FDI) has fallen.

Therefore, even an improvement in UK interest rates may not garner the same inflows – and therefore demand for the Pound – as it would do were there no Brexit factor.

The real-world data measuring capital flows in and out of the UK reflects Goretzki’s analysis, and a widening deficit in the Portfolio balance is already starting to raise concerns.

“The recent data suggest that there is a noticeable deceleration in portfolio investment inflows and an acceleration in portfolio investment outflows,” said Goretzki.

This poses a significant threat the financing of the current account deficit as previously portfolio surpluses were a major offsetting factor.

A wider current account deficit reflects diminished demand for the Pound which weakens to attract more demand and attempt to right the imbalance.

Then there is also a concern due to an increasing deficit in Foreign Direct Investment (FDI) inflows.

FDI used to show a surplus as more foreign companies and individuals wanted to invest in the UK than UK investors wished to invest abroad, however, Brexit uncertainty has lessened the attractiveness of the UK as a destination for investment so the flow has diminished.

Euro v Pound Outlook

What does this mean for Sterling's outlook?

The Pound may struggle to gain significantly if Unicredit’s analysis proves accurate and any gains due to the BOE growing more hawkish may come under increasing pressure at the 0.86 level.

Unicredit’s new, Brexit-modified model this suggests a ‘lower-bound’ of 0.86 for EUR/GBP, even with a rate hike.

“Of course, the implied “short-term fair value” of EUR-GBP stands at 0.86 currently i.e. around 2% lower than spot. Therefore, one could argue that at the very least we should expect a correction downwards. Notwithstanding near-term volatility, we highly doubt that such a (potential) drop would last. This is because flows to and from the UK have started reversing course,” says the strategist.

The current rate is 0.8780.

From a Pound to Euro exchange rate perspective this equates to a Pound to Euro exchange rate of 1.1628 which is higher than the current level seen at 1.1389.

Importantly it implies the scope for strength is limited, but it also supports the view that the worst has passed for Sterling.

It also stands in stark contrast to the more bearish forecasts out there, for example, HSBC's view that the exchange rate is going to parity.