Record Inward Investment Helps the Pound Avoid Brexit Armageddon

- Written by: Gary Howes

Over the past year, a key concern for the UK economy and its currency, is that the Brexit vote and the subsequent Brexit would scare-off foreign investors.

Why invest in a country whose relationship with its main trading partner is likely to be compromised? In an environment of elevated uncertainty it becomes increasingly difficult to get investors to part with their hard-earned capital.

These fears have been most apparent in the fall in the value of the Pound which dropped over 10% in reaction to the vote.

But latest data from the Department for International Trade suggest the fears - and perhaps the hefty downward reaction in the Pound - might be unfounded.

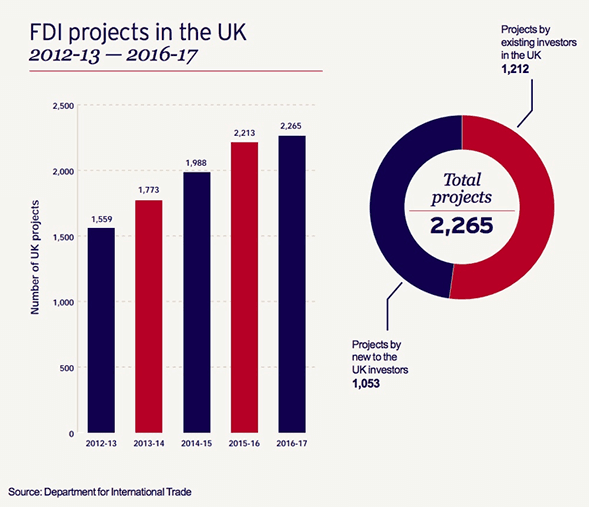

Latest data show the UK attracted over 2,200 new inward investment projects in 2016 to 2017 which represents a record.

This means investor cash is flowing into the country and propping up the currency despit all things Brexit.

In short - the "kindness of strangers" appears to be in good supply.

It was Bank of England Governor Mark Carney who first coined the phrase “kindness of strangers” to describe how important foreign inward investment was for the stability of the economy.

The reason the UK relies on the “kindness of strangers” perhaps more than other countries is due to the trading deficit it holds with the rest of the world.

The UK exports less than it imports, creating a deficit on its current account. The current account is in effect the UK’s bank account with the rest of the world.

The country is therefore a net debtor.

The Pound would have to undergo a massive downward adjustment if it were to truly reflect the state of the UK’s current account deficit which hovers in the 2-5% of GDP range.

But, because of inward investment from “kind strangers”, the Pound can trade above the values that would be dictated by the current account as this inflow of money bids the Pound higher.

“Almost one year on since the EU referendum, the UK continues to attract record levels of inward investment and remains extremely attractive to foreign investors,” says International Trade Secretary Dr. Liam Fox.

This robust inward investment will certainly go some way in explaining why the Pound has formed a base against the Dollar and Euro.

In fact against the Dollar, the Pound appears to actually be itching to embark on a more sustained recovery.

The US retains the top spot investing in 577 projects in the UK, with China (including Hong Kong) remaining in second place with 160 projects.

In third place is France with 131 followed by last year’s third place India and Australia and New Zealand with 127 projects each.

But for the Pound to remain elevated investments must keep coming, unless the country can finally start exporting enough to exceed its huge import bill.

While exports have picked up over recent months thanks to the fall in the Pound, it appears there is a huge amount of work to still be done.