EUR/USD: Technical Forecast for the Week

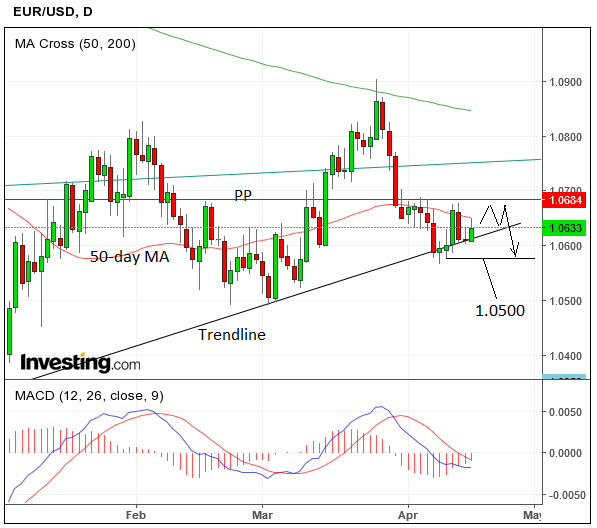

The Euro / Dollar exchange rate is moving in a tight sideways range between 1.0600 and 1.0685.

Our technical studies of the pair's near-term prospects suggest the possibility this sideways move will continue over the next five days given the lack of market moving hard data.

The chart continues to have a downside bias, however, after the steep fall from the late March 1.0900 highs, and eventually a breakdown may be on the cards.

The trendline (black line) is an obstacle to the short-term downtrend, however, and must be clearly breached before a continuation can be expected.

Confirmation that it has been pierced would come from a move below last Tuesday’s lows at 1.0577.

Such a move would probably extend to a target at 1.0500 at the same level as the early March lows.

Data to Watch for the Euro

The most significant event on the horizon for the Euro is the French Presidential election on Sunday, April 23, and for much of the week the most recent polls will dictate how the Euro trades.

As far as ‘hard’ data goes, however, the key releases will be April purchasing manager surveys for manufacturing and services sectors, released at 9.00 GMT on Friday, April 21.

The CPI data out on Wednesday at 10.00 is merely a revision.

Data to Watch for the Dollar

Housing is said to ‘lead the economy’ so economists watch it closely – a strong rise or fall will be weathercock for the trajectory of the overall economy.

Housing data plays a big role in the week ahead, with Building Permits and Housing Starts in March out on Tuesday, April 18 at 13.30 GMT.

Building Permits are forecast to rise to 1.245 million from 1.216, and Housing Starts fall to 1.264m from 1.288.

Existing Home sales is then out on Friday, April 21 at 15.00 GMT, and is forecast to show a 2.0% rise in March from February.

Another major release will be the Philadelphia Fed Manufacturing Index in April, out at 13.30 on Thursday, April 20. It is forecast to fall to 26.9 from 32.8.

The Dollar has lost ground on a combination of falling Retails Sales – which showed a decline for the second month in a row, dropping -0.2% in February, last Friday, Trump’s negative Dollar rhetoric and geopolitical risk aversion.

These, especially the slower Retail Sales - which is expected to lead to a lower GDP result for Q1 – will now probably make the Federal Reserve delay raising interest rates in June.

“Friday’s reports pretty much guarantee that the next Fed move will be in September and not June as the weakness of spending will weigh on first quarter GDP growth. Fed fund futures are currently pricing in a 56.7% chance of a rate hike in June and a 76.3% chance of a hike in September,” says Kathy Lien, managing director of BK Asset Management.

As such any commentary from Fed officials adding evidence to Lien’s hypothesis of a delay in raising rates might weigh even more on the Dollar.