Pound Forecast to See Downside Pressure Against Euro Ease this Week

A strong start to the week for the Pound to Euro exchange rate which is seen trading back at 1.1443 at the start of the new week.

"Sterling is rallying this morning, with reports suggesting that Article 50 seems likely to be triggered this week, potentially as early as tomorrow," says Robin Wilkin, an analyst with Lloyds Bank.

Pound Sterling has suffered losses against the Euro over the course of February, going as low as 1.1378 on Friday, before recovering and closing above 1.1400.

Thus the exchange rate behaved as we said it would in our previous week's analysis with our forcast target at 1.14 being met. It is encouraging for us to note the exchange rate ended the week at our given target.

But what does the outlook for the week ahead suggest?

We believe the down-move has now reached a key target and downside pressure may ease.

Nevertheless, the short-term trend remains bearish, which favours a continuation lower and if the exchange rate can pierce through the S2 monthly pivot at 1.1374 it would provide a signal for such a continuation.

A break below 1.1340 could confirm the pivot as breached and, giving a green light to a move down to the 1.1290 lows.

Direction in Pound Sterling will largely rest with the markets reaction to the potential triggering of Article 50 by the UK government being of interest.

The UK's elected House of Commons looks set to send the Brexit Bill back to unelected House of Lords, unammended.

This would be seen as a defeat for the opposition parties in the House of Lords and Conservative Party rebels that sought to tamper with the Bill.

It also leaves the Government with the opportunity to trigger Article 50 this week.

The Pound has nothing to be scared of in the triggering of Article 50 as the event has been priced into the exchange rate now.

The next drivers for Sterling in this regard will be the nature and tone of the negotiations once they get underway.

Brexit will soon get real.

Also of interest is the outcome of the monthly Bank of England (BoE) meeting due to be held on March 16 at 12.00 GMT.

Although no-change in policy is expected, the minutes which are released at the same time as the decision, will show how members deliberated on monetary policy issues.

Whilst some commentators had seen the BoE moving towards a tighter monetary policy stance - i.e. looking to raise interest rates, something that is supportive of Sterling - but this has probably changed since the spring Budget statement.

There is now a heightened possibility that the BoE will have to keep monetary policy expansive and interest rates low due the Chancellor’s fiscally tight budget, in which he gave away only 3bn in stimulus, according to Jonathan Loynes at Capital Economics.

“Fiscal policy is still set to provide a significant drag on GDP growth over the next few years – very similar to that planned in the Autumn Statement. As such, the onus will remain on monetary policy to support the economy,” says Loynes in a note seen by Pound Sterling Live.

Such a policy will keep the pressure on Sterling, particularly versus the Dollar where interest rates are contrastingly set to rise.

On the ‘hard’ data front, the main release for Sterling is labour market data on Wednesday March 15, although the unemployment rate is not expected to change from the current 4.8%.

Average Earnings are forecast to slip to 2.4% from 2.6% previously and the Claimant Count to go down by 5.0k from -42.5k previously.

Any improvement on those figures could give the Pound to Euro exchange rate a mid-week fillip.

Data, Events to Watch for the Euro

What of the Euro?

The main data release for the Euro in the week ahead will be inflation data for February, which is forecast to continue the recent up-trend, which saw a 1.8% rise in January and is forecast to show a 2.0% rise in February.

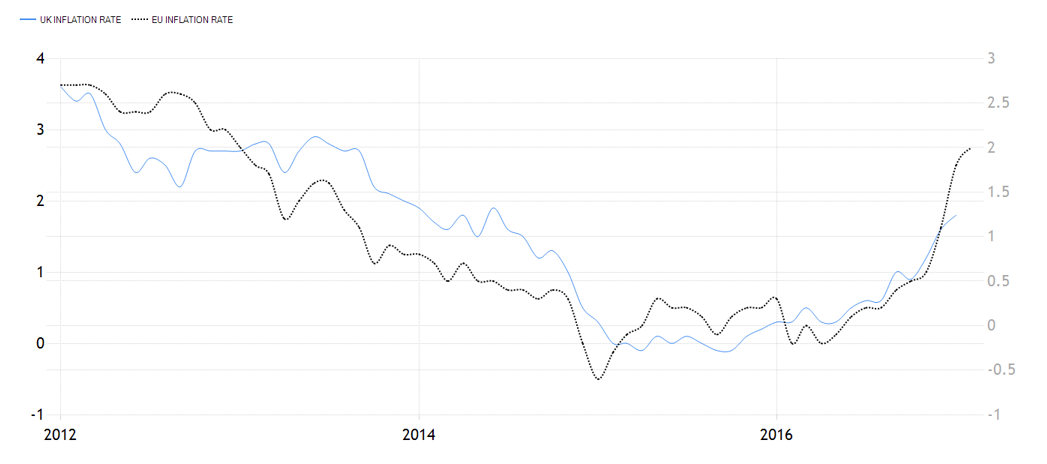

Inflation in the Eurozone has outstripped that even in the UK as shown in the chart below, and this has helped fuel the downtrend in GBP/EUR since higher inflation generally indicates the possibility of higher interest rates, which push up the value of the currency.

The Euro could be set to continue outperforming other counterparts in the week ahead due to a positive upgrading of inflation expectations by the ECB in its March statement, from 1.3% to 1.7% in 2017, and a positive general economic outlook as voiced by ECB president Draghi at the post-meeting press conference.

“This past week, the ECB left monetary policy unchanged and as President Mario Draghi spoke, the EUR/USD raced above 1.06. Nodding to the improvements in growth and inflation, the central bank raised its 2017 and 2018 GDP forecast by 0.1% and boosted this year’s inflation forecast to 1.7% from 1.3%,” says BK Asset Management’s Kathy Lien.

“Draghi admitted that economic risks are less pronounced and the ongoing economic expansion should be firm and continue to broaden. Draghi's less-dovish comments encouraged traders to take profits on short euro positions and while dollar and euro bulls will need to battle it out, the euro should outperform other currencies,” she continued.

The weight of political uncertainty may also ease on the Euro in the week ahead, following Dutch elections on March 15.

The anti-EU PVV party has seen its share of the vote fall in opinion polls recently, which showed a decline to 22% from 35%.

Assuming the results come in more or less in line with these polls the PVV are unlikely to have the mandate to form a government and exact change.

“Electoral risks finally start to be resolved and we see low risks here. Anti-EU PVV support has fallen, now suggesting a toss-up with VVD (current government’s senior party). Even as the largest party, it is unlikely they would join a coalition, and even then, a Nexit referendum is non-binding. Polls close 8pm GMT, with results dribbling out. Reaction should be muted post-Fed, with a sharper move lower on surprise PVV strength (@35 seats out of 150),” say TD Securities in a note seen by Pound Sterling Live.