Euro Ticks Higher on Bullish Economic Forecast Issued by European Commission

The European Union (EU) is set to continue growing at a modest rate, according to a quarterly economic report authored by the European Commission.

For the first time in ten years all the countries in the EU are expected to experience growth throughout the forecast period between 2016-2018, according to the report.

The most significant headwinds for the region are expected to come from uncertainty over the impact of US economic policies on the global economy as well as the rise of far-right anti-EU political parties in Europe during key elections in 2017.

The report revises up growth estimates in the EU to 1.8% in both 2017 and 2018, from 1.6% in 2017 and 1.8% in 2018 made in the Autumn 2016 Commission forecasts.

A similar upward revision is made for the Eurozone of 1.6% and 1.8% in 2017 and 18 from a previous 1.5% and 1.7%.

The release of the upbeat report was accompanied by a marginal fluctuation higher of a tenth of a cent in the EUR/USD currency pair to 1.0646 from 1.0636, reflecting the improved outlook for the region.

Highlights

The report highlighted the positive impact on the EU of an improvement in the outlook for global growth.

Both increasingly positive prospects in developed and developing economies could increase demand in markets for EU exports.

“Growth prospects for advanced economies outside the EU have improved over recent months, largely due to expectations of fiscal stimulus in the United States, which have resulted in higher long-term interest rates and an appreciation of the US dollar.

“Growth in emerging market economies is also set to firm up to 2018, although to varying degrees across countries and regions. Overall, this could give a boost to European exports of both goods and services following a weak 2016,” the report noted.

EU unemployment continues to fall and is forecast to fall even more quickly than in the Autumn report.

The EU Unemployment Rate is expected to reach 7.8% in 2018, which is below the 7.9% previous estimate, and above but close to the 7.5% low reached in 2007.

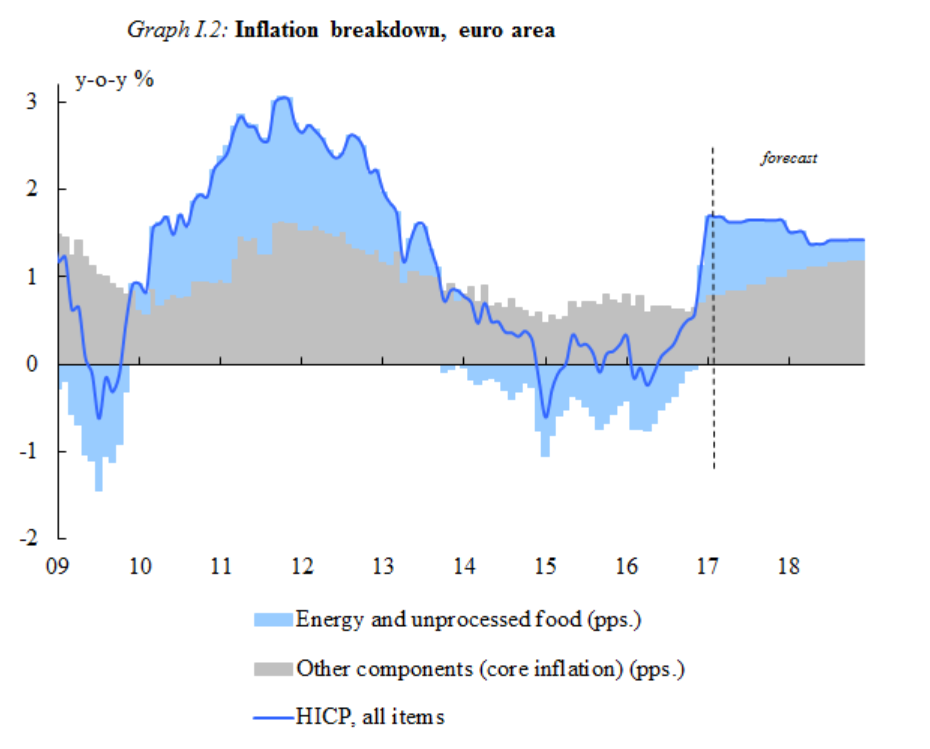

Inflation in the EU is forecast to rise to 1.8% in 2018 on the back of rising oil prices. This is close to the target of “at or just below 2.0%” set by the ECB.

Core Inflation, however, which is a more accurate indicator of demand, is only set to rise gradually.

Private consumption is set to be the main engine of growth although rising inflation will erode household buying power offsetting rising rates of consumption.

Investment is set to continue growing, but only moderately.

Projects supported by the Commission’s Investment Plan for Europe are expected to spearhead increasing public-private investment partnerships in general.

However, the report moderates the previously more optimistic view of investment contained in the Autumn report, saying a lack of growth in the area now brings into doubt the sustainability of the recovery.

“The share of investment in GDP remains below its value at the turn of the century (20% in 2016 compared to 22% in 2000-2005). This persistent weakness in investment casts doubt over the sustainability of the recovery and the economy's potential growth,” said the report.

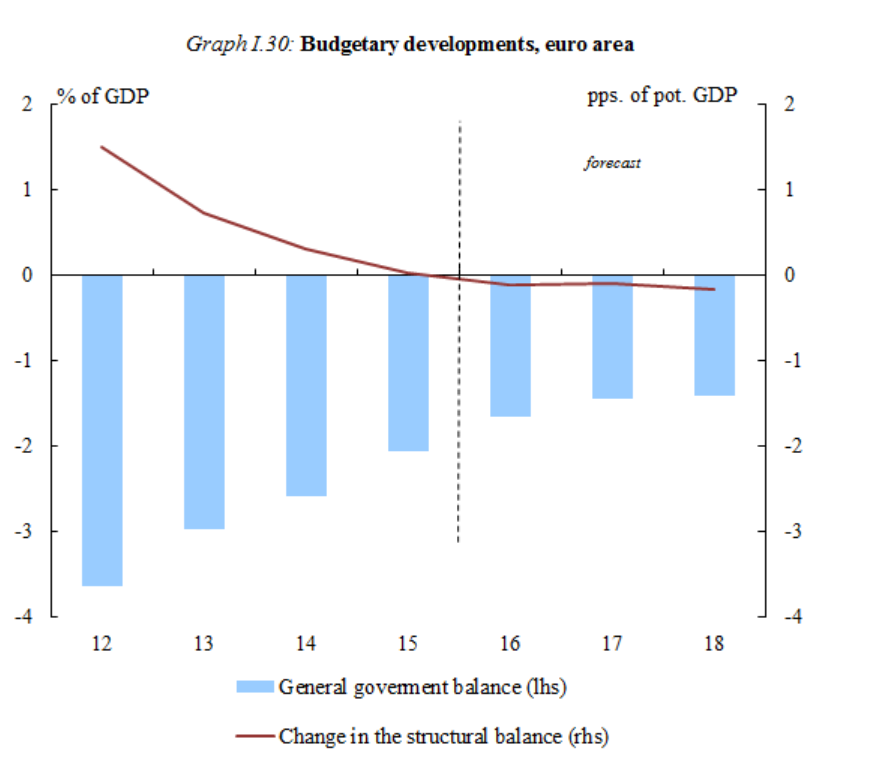

A fall in the aggregate debt of the region is a positive sign in the commission’s forecasts, signalling hope that the fiscal status of members are finally shaking off the excesses if the pre-crisis period.

“The aggregate euro area public deficit and the government debt-to-GDP ratio are expected to fall further in 2017 and 2018. The public deficit for the euro area is expected to decline from 1.7% of GDP last year to 1.4% in 2017 and 2018.

“This decline reflects lower interest spending due to exceptionally low interest rates. It also reflects further improvements in the labour market: more people are paying taxes and contributions, and fewer are receiving social transfers. The debt-to-GDP ratio is expected to diminish gradually from 91.5% in 2016 to 90.4% in 2017 and 89.2% in 2018,” said the report.

Downside Risks to the Forecasts

The main downside risks for the region stem for political sources – mainly the effect of Donald Trump’s radical policy agenda in the US, the outcome of elections in Europe and the triggering of Article 50 by the UK and negotiations as to the new status between it and the EU.

“The balance of risks remains on the downside although both upside and downside risks have increased. In the short term, fiscal stimulus in the United States could have a stronger impact on growth than currently expected.

“In the medium term, risks to the growth outlook stem from legacies of the recent crises; the UK's vote to leave the European Union; potential disruptions to trade; faster monetary tightening in the United States, which could have a negative influence on emerging market economies; and the potential consequences of high and rising debt in China ,” concludes the report.