Upside Risks for British Pound are Building: Bank of America Merrill Lynch

- Written by: Gary Howes

Foreign exchange analysts at Bank of America Merrill Lynch Global Research have written to clients saying that the days of Pound Sterling weakness are limited and that they should be looking to a long-term upturn in coming months.

However, this is by no means a straightforward forecast as they do warn that multi-year lows could be tested again ahead of any great recovery.

Whatever the case, Sterling does appear to have found a base from which it can stage a long-term recovery.

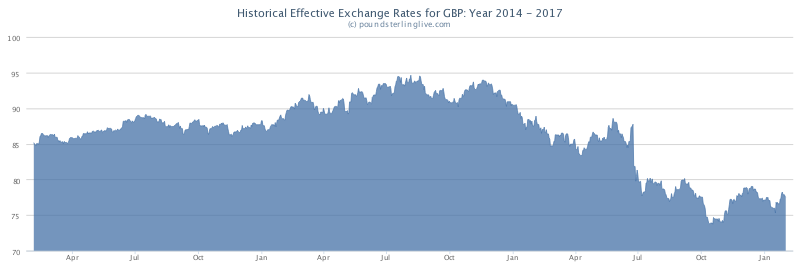

If we look at the Pound’s Effective Exchange Rate (EER) we can see the currency has been in decline since the start of 2016 but it appears forays below the 75 level are unsustainable:

The EER is the Pound’s value against its most important trading partners and serves as a useful indicator of overall health and direction of the currency.

But with Brexit still to come, why would the Pound now be forming a base as surely the hard adjustment in the economy still lies ahead?

“Although we retain a near-term bias for further GBP weakness, we think the medium-term fundamentals look more positive,” says Kamal Sharma, an FX Strategist with Bank of America Merrill Lynch Global Research in London.

The call comes as the Bank of England has upgraded its growth forecasts for the UK economy from 1.4% to 2.0% for 2017 in its February Inflation Report.

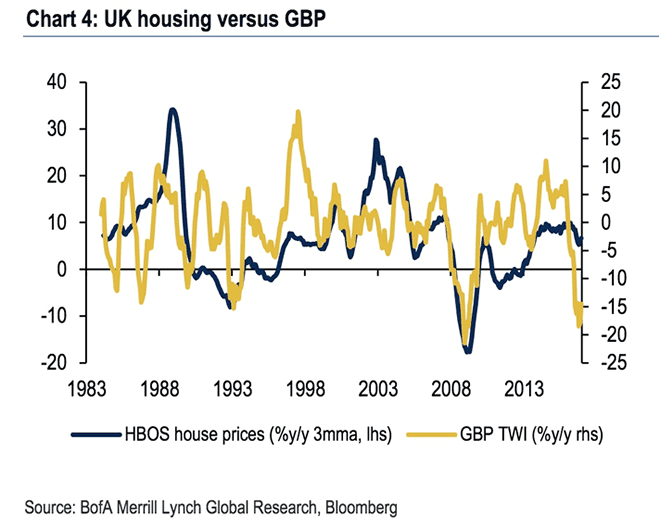

“GBP looks cheap versus macro drivers such as the labour & property market and against the backdrop of improving global growth,” says Sharma.

Bank of America believe that some of the traditional macro drivers for GBP, such as global growth and the UK housing and labour markets, are unlikely to be significantly impacted by the Brexit negotiations in the coming months.

"As a result, the divergences between these key drivers and GBP, which have built up as political risk premium has dominated price action, could be closed. In our view, with some of main pillars that have historically driven GBP through the business cycle remaining resilient to the Brexit shock, the upside risks to Sterling are building,” says Sharma.

Sting in the Tail and then Bre-exhaustion

But the road ahead will remain bumpy for Sterling for some time yet.

Sharma warns that the triggering of Article 50 is likely to crystalise Brexit risks, and the EU response is unlikely to suggests a smooth transition to divorce.

This could result in a near-term blip lower and Bank of America do concede that many political hurdles lay ahead for GBP in the years ahead.

And this is the sting in the tail - Sharma believes the GBP will push back towards the bottom end of its trading range and, further, before that long-awaited recovery transpires.

And it appears the Bank of England is also not yet ready to fire the starting gun on a stronger Pound.

At their February Inflation Report the Bank sent Sterling lower having failed to communicate an interest rate rise is likely over coming months.

This suggests markets could be finally turning back to watching fundamentals and not simply playing the Pound as a political currency.

However, "we doubt that the markets will be in a perpetual state of panic over every Brexit-related headline," says Sharma. "Markets will likely settle into a steady state once the intensity of initial post A50 headlines fade."

This is not the first time we have heard that Brexit might start losing its downward pull. Last week we reported that BNP Paribas were prepared for a GBP rally as the Brexit story risked becoming repetitive and markets had already priced in the worst that the event had to give.

This should allow investors to re-focus on the fundamental GBP backdrop, but it’s not just the UK that matters for the Pound’s outlook argues Sharma:

“It should not be forgotten that GBP is essentially a global trade currency by virtue of its large current account deficit. Consensus projections for G20 look for growth to accelerate to 3% y/y from 2.4% in 2016. The fortunes of the global economy are just as important for GBP as the domestic economy.”

Patience is required then, Sharma reckons H2 2017 could set the stage for a recovery in GBP.