Pound Forecast to Open Lower vs Euro on Monday as Leave Surge to Massive Lead Ahead of EUref

The British pound is in danger of slipping below a major support level against the euro at the start of the new week as the Leave group take a commanding lead over Remain in the latest UOB International polling series.

The pound to euro exchange rate is forecast to commence the new week in the red after a weekend poll confirms the Leave campaign is at a massive advantage just days ahead of the crucial EU vote.

An ORB International poll for the Independent shows a 10 point lead for Leave who command a 55% to 45% advantage over Remain.

"The online poll of 2052 respondes, conducted from June 8th to 9th, shows a swing to brexit with just 12 days of the campaign remaining," report ORB International.

The interesting thing is that over 80% of the respondents acknowledged there would be a risk to leaving, despite their apparent intention to do so.

There is clearly some underlying issue amongst the public with regards to the EU that the Remain campaign are not grasping.

Stock Market Sell-Off Undermines Sterling

The pound entered the weekend notably lower against most of its counterparts as it tracked a broad-based sell-off on global markets.

Stock markets are deep in the red as we head towards the London close with the FTSE 100 seen an eye-watering 1.85% lower on the day.

The declines accelerated as the American markets opened with the Dow taking a 1% plunge on the bell.

The British pound - a risk play - has fallen alongside. Sentiment towards sterling is negative at present and therefore it will react to bouts of broader investor negativity.

Note that the German DAX is over 2.3% lower, the pound vs euro rate has a history of tracking big moves in the DAX and today is no exception.

“Well, from a bad start to a worse lunchtime to a truly awful afternoon the global markets lost the plot this Friday, with the European indices plunging into the red in a way reminiscent of the grim scenes back in February,” says Connor Campbell, an analyst with Spreadex.

I have scoured my sources to find a reason for the declines. Unfortunately there is no one definitive source on which we can pin the blame.

Mike van Dulken, Head of Research at Accendo Markets, says the declines are derived from Asian bourses following their stateside peers south as negative bond yields become more prevalent, calling into question global monetary stimulus efforts while growth and inflation struggle to recover post-crisis.

“And with event-risk related to next week's Fed policy update and a too-close-to-call UK referendum on EU membership the week after, investors are continuing to temper their appetite for risk assets into the week-end. Apprehension likely stems from what bearing China data (Industrial Production, Retail Sales, Investment) will have on sentiment come Monday morning as well as a US dollar bounce hurting the commodity space, taking oil from its 2016 recovery highs,” says van Dulken.

There has also been some talk of the retreat in oil prices as being a source for the declines - the source of this being the rise in the dollar. But then you hear that the dollar is rising because stocks are falling, taking us back to square one!

Certainly, there is also the hanging uncertainty surrounding the EU referendum at the end of the month to also take into account.

Beware the Coiling Spring

With a mere 12 days until the UK heads to the polls some will find the resillience in the British pound as unexpected, but, we would continue to warn against complacency.

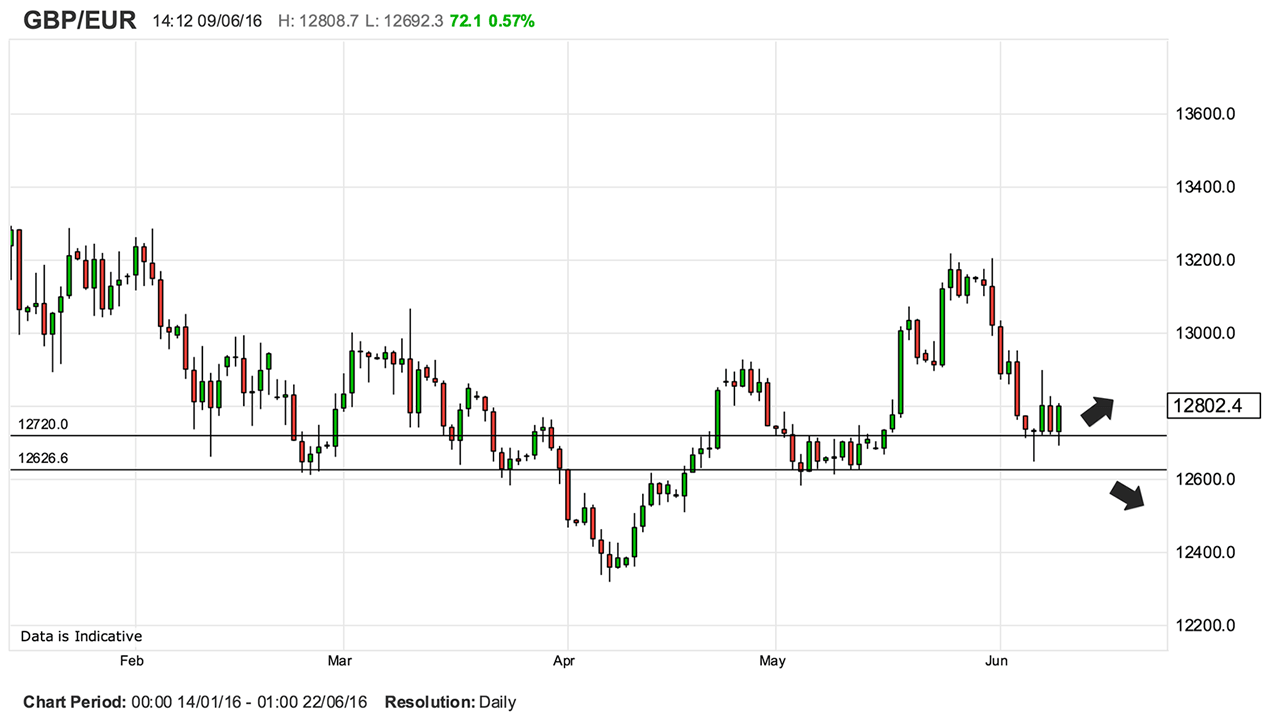

Sterling rose off a low at 1.2648 recorded earlier in the week to hit 1.2793 on Friday.

present and those with immediate payment decisions should be aware that any weakness towards 1.2720 GBP/EUR appears to pique the interest of buyers.

Where sterling ends this week will be instructive as to whether support will hold.

With no major news flow coming out of the referendum debate, and polls essentially split at 50/50, markets are left gazing at the charts and making decisions accordingly and that is why we are quite confident in reading a small upside bias in the pair at present.

However, with the EU referendum now 12 days away volatility in the underlying options market remains at levels not seen the financial crisis. Tensions are bubbling under the surace and will continue to do so, but they are yet to really be reflected in the spot market.

The spot market is what those readers with impending international payments are familiar with. (For the latest retail rates that are available please see here - a spread is extracted from spot by your provider and the size is at their discretion - remember you can get up to 5% more FX by quoting with an independent specialist).

Those with impending euro payments will note the exchange rate has failed to fall below the 1.2720 level for some time now confirming it is a solid point of support that has been in place for much of 2016.

There is clearly a good deal of buying interest here.

Even if it were to give way over coming days we would suggest the sell-off won’t really gain traction as there remains even more buying interest at 1.2626.

Only when this level gives way would we expect the year’s lows at 1.2319 to come into view again.

Could we now be entering a two week period of consolidation ahead of the vote? If so this coiling spring will give an explosive move once released by the vote outcome.

“We are still trapped between intra-day support in the 1.2878 region and 1.2642-1.2594 support,” notes Robin Wilkin, a technical strategist at Lloyds Bank.

Like us though, the number that Wilkin is really interested in is that support at 1.2626 as he believes a move below here would suggest the recovery from the low at 1.2319 to 1.3141 was “merely been another correction phase” and risks a re-test of the 1.2195 region.

A decline through 1.2878 would alleviate downside risks and should see a gradual shift back towards initial support around 1.3071.

Analysts at Standard Chartered agree that pound sterling will remain well supported by the zones we have identified and reported on in this report.

Standard Chartered say they remain bearish on the euro as the GBP/EUR sits above the technical support at 1.2626.

“We believe a breach of 1.2626 is needed to signal more significant upside,” say Standard Chartered in a brief to clients.

Pound Fundamantally Undervalued Against the Euro

One question that we are regularly asked is what will happen to the pound after the EU referendum.

We have noted here that the reaction function of GBP/EUR could differ to that of GBP/USD owing to questions of how far each pair has deviated from what is deemed fair value.

For instance, the gap between the GBP/EUR and interest rate differentials is large, courtesy of Brexit fears. Therefore the move to close the gap when the vote passes will likely be a big one.

According to BNP Paribas' medium-term CLEER™ model EURGBP should be trading around 0.71 rather than its current level of 0.78.

In GBP/EUR terms, the rate should be at 1.4084 at present - pretty much where it was before markets got wind of the risks posed by an EU exit.

"GBP undervaluation also appears strongly linked to the uncertainty surrounding the UK’s referendum," says Steven Saywell at BNP Paribas, "the GBP appears cheap versus its current macroeconomic fundamentals, likely due to the elevated level of political risk."

If we link the 'coiling spring' reflected in the charts with the consensus view that sterling is undervalued, then we could be in for a big move towards the 1.40s in the event of a Remain vote on June 23rd.

With regards to Brexit, it is not even worth trying to pick a target - those who say parity in GBP/EUR could occur could well be on the money.

Get Ready to Sell the Euro: Hantec's Perry

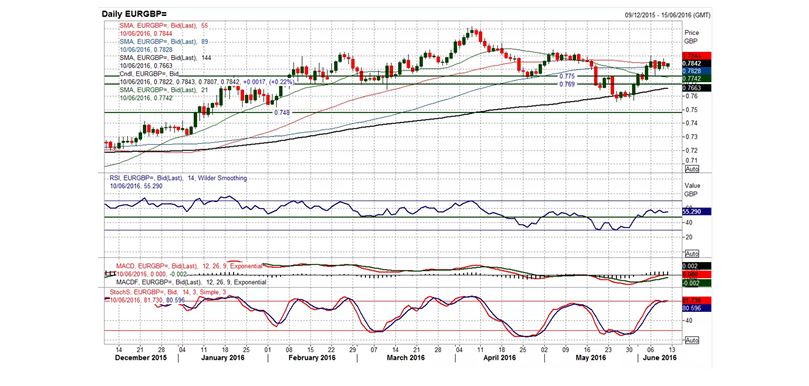

Having studied the euro/pound sterling charts, analyst Richard Perry at Hantec Markets says the euro is failing to convince him that it can establish a sustainable uptrend.

"The technical outlook will still not turn decisively against sterling until a close above the right hand shoulder high of the old top pattern at £0.7945. Ultimately, I see this recent rally on Euro/Sterling will prove to be another chance to sell," says Perry.

The caveat however is that sterling strength would have to be triggered by the UK voting to remain in Europe.

Nevertheless, "the technicals are rolling over again and suggest that the recent rally is running out of steam now," says Perry. "the RSI is failing below 60 having put consistent pressure on 30 (which suggests a bear market rally), whilst the Stochastics are crossing lower again in a similar fashion to the May sell signal."

Perry has spoken previously about the old long term key pivot at £0.7750 and this caught the reaction low on Tuesday, but I expect this will come under further pressure in the coming days.

This week’s rally high at £0.7905 is resistance and could easily now look to form another lower high under £0.7945.

"However, the £0.7750 pivot is key to the outlook near to medium term now as it protects a deeper move lower back towards initially the old neckline at £0.7690 but also possibly the May lows again at £0.7560," says Perry.