EUR/USD Exchange Rate: The Rain Returns

The euro exchange rate complex has broken lower out of the narrow holding pattern in place since the last ECB meeting; have the rains come again for the single currency?

EUR/USD has broken out of its post-ECB December meeting sideways range and is moving lower again, on the back of some disappointing data on Tuesday.

The lower-than-expected 0.2% CPI reading for December resurected fears of further visitations of deflation and the European Central Bank resorting to more quantitative easing in an effort to hit target, and was the fundamental catalyst for the breakdown in EUR/USD.

The outlook for the dollar side of the pair meanwhile remains relatively unchanged, with the its relentless rise becoming a problem and leading some analysts fearing a ‘too-strong’ dollar backfiring on economic growth and scaring the Fed back into accommodative mode.

The next big release for the EUR/USD in the near-term is Non-Farm Payrolls on Friday, as it will start to shape expectations of when the Fed will make its next interest rate rise – or not - and thus increase or decrease the value of the dollar.

There may also be some volatility in the interim on Wednesday from Non-Manufacturing ISM and ADP Employment Change.

Euro v Dollar Technical Forecast

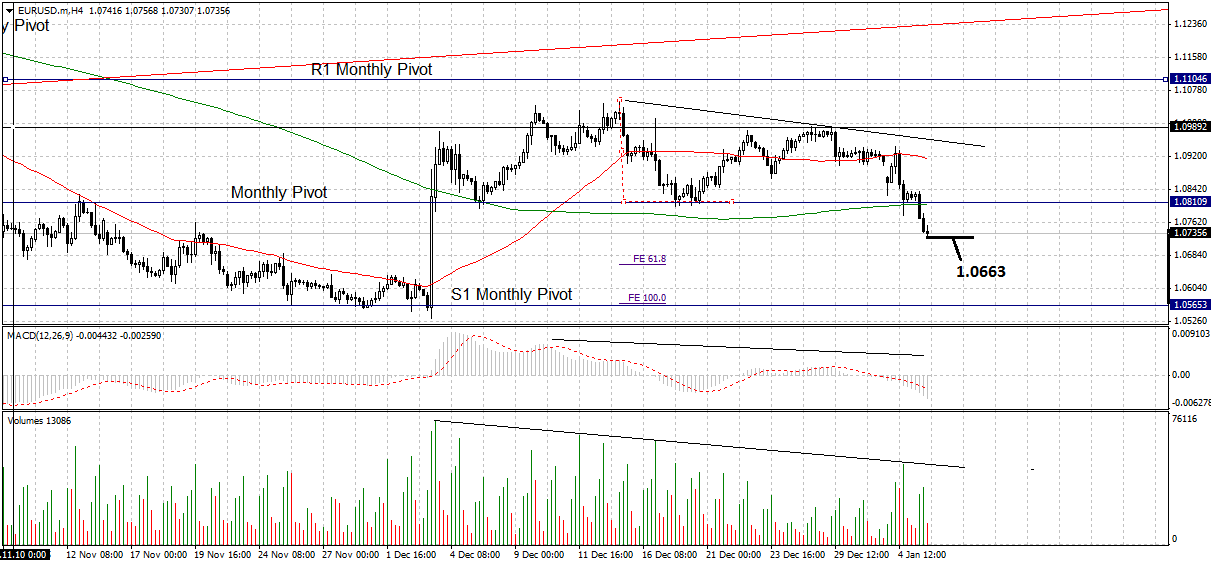

From a technical point of view, the EUR/USD exchange rate has now slowed its initial spurt lower following the release, but a lack of nearby support means it will probably continue lower, with the 61.8% Fibonacci extrapolation of the width of the range providing the first – and least risky - downside target at 1.0663 – followed by the target at the 100% extrapolation, at 1.0570, where support from the S1 Monthly Pivot is also situated.

Falling volume and momentum as measured by MACD further reinforces the bearish picture.

Draghi’s Measures’ on Inflation Inadequate

In a note following this morning's inflation miss, Alex Lydall, Senior Sales Trader at Phoenix Partners, highlighted how the data showed Draghi’s move to lower the deposit rate at the December meeting and increase the length of the QE programme, had failed to translate into increased demand in the real economy so far:

“Despite relatively aggressive policy measures last month at his press conference, notably cutting the deposit rate and extending Quantitative Easing, inflation woes are not easing for Draghi.”

Whilst previously analysts could explain-away sluggish inflation as due to continued falling oil prices, in the case of December there was a reduced impact compared to earlier in 2015, which made the lack of price growth even more concerning:

“Furthermore, the notable explanation of downward pressure from energy prices across the globe is easing off, seeing a substantial drop in consecutive months from September through to November. Taking this lessening effect of energy prices into consideration, Draghi will be hopeful of an uplift in the short term to avoid further pressure to extend monetary policy measures in early 2016.”

Steadily Improving Fundamental Picture for 2016

Recently analysts had looked favourably on the prospects of the euro going into 2016, and although it was never going to be one of the ‘stars’ of the currency constellation, small improvements in the region’s economy were beginning to add up to an overall much improved outlook.

A recent note from the National Bank of Canada proves the point, and argues the opposite view to those who say the ECB’s policies have had no impact:

“There are encouraging signs that the European Central Bank’s aggressive policies are starting to bear fruit.

“Credit channels in the Eurozone are slowly being unblocked as evidenced by improving household credit and business loans, the latter even managing to grow on a year-on-year basis for the first time since 2012.

“So, unless inflation disappoints, the ECB may want to adopt a wait and see approach.

The common currency could slip over the near term on unfavourable yields, but we remain of the view it will recover later in the year particularly if the USD gives back some of its outsized gains of the past couple of years.”