Pound to Euro Rate Poised Below 2024 Peak as Barnier Faces "Moment of Truth"

- Written by: Gary Howes

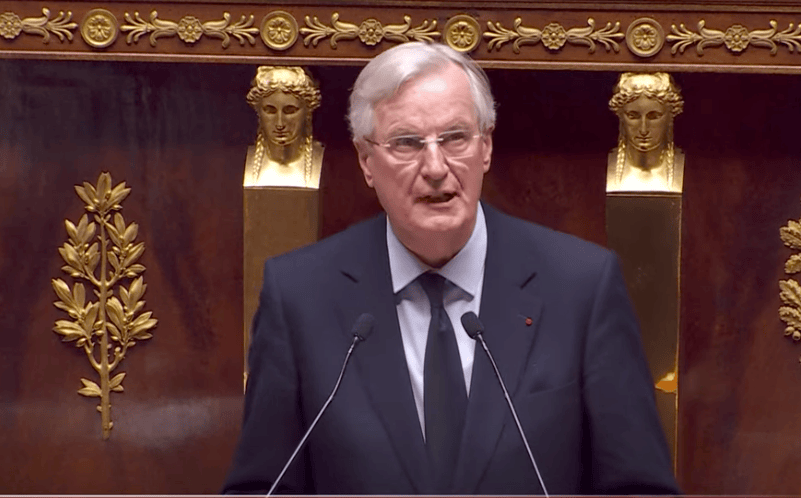

Above: France's Prime Minister Michel Barnier Monday used an executive power to force through a social security budget bill without a vote in parliament, exposing his government to a no-confidence challenge from the opposition. "It is now up to you... to decide if our country should have a financial law that is responsible, indispensable and useful for our fellow French citizens, or if we are to enter into unchartered territory," Barnier said. Source: France 24.

Pound Sterling trades near 2024 highs against the Euro as market attention turns to French political instability.

The shaky French government headed by Michel Barnier faces a no-confidence vote on Wednesday, which looks set to bring it down and inject fresh instability into Europe's second-largest economy.

The Euro was under pressure amidst rising French government bond yields after Barnier said his country faces "a moment of truth".

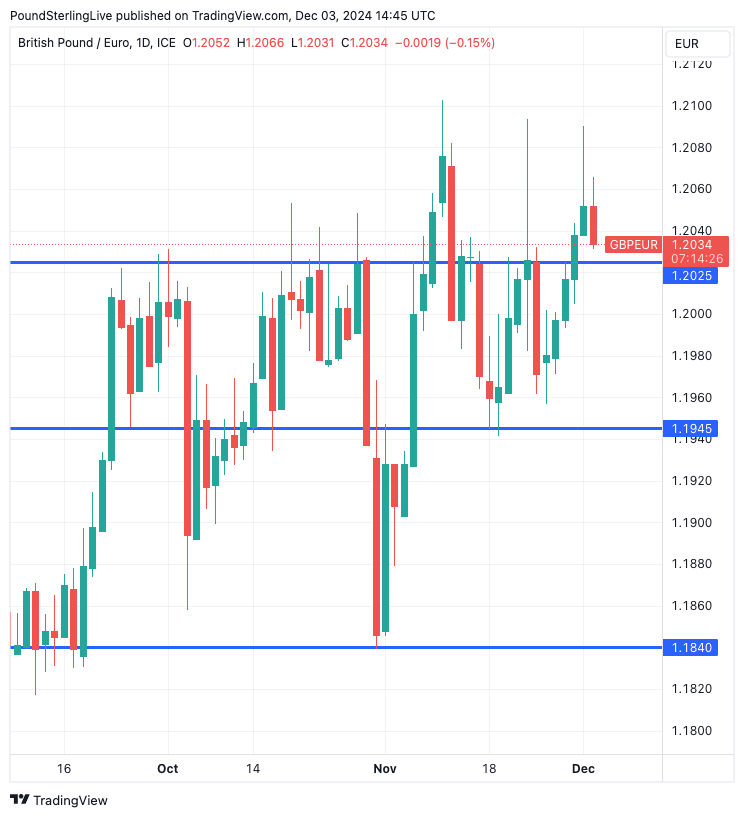

The Pound to Euro exchange rate rose to a high of 1.2090 on Monday and is at 1.2060 on Tuesday; the 2024 high is at 1.2103, reached on November 11.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Marine Le Pen's National Rally (RN) party filed a motion of no confidence in the government on Monday alongside a bloc of leftist parties.

If the left and RN joined forces, Barnier's government wouldn't be able to survive a no-confidence vote.

The move comes after Barnier failed to secure RN's support to get his budget through parliament, which prompted him to utilise a piece of legislature to force the budget through without a vote.

This drew the ire of RN and the leftist bloc. Barnier told lawmakers that bringing the government down would trigger a "storm" in financial markets.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"The combination of France’s political crisis and the ECB’s easing trajectory creates “a perfect storm” for the euro," says Nigel Green, CEO of deVere Group. "Investors face a dual-pronged challenge: tackling the immediate fallout from French instability and adjusting to a looser monetary environment. The result is likely to be heightened volatility and downward pressure on the currency."

France's debt is spiralling and is expected to reach 7% of GDP next year, well above what the EU allows. In response, French debt costs have shot higher as investors seek extra compensation for holding it.

"It's hard to find any positives on the EU in the upcoming year with the political mess, de-industrialization, elevated energy prices and just general lack of solutions or leadership there," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

France's political uncertainty and burgeoning debt are definite headwinds for the Euro, but it is worth noting that the crisis is contained to France and does not impact other nations.

Despite the French crisis, the GBP/EUR is still contained below November highs.

This is not a Eurozone debt crisis like the one of the early 2010s, and as long as that remains the case, the Euro will stay weak but likely avoid a major collapse in value.

"The French-German yield spread, which is where investors have expressed their concerns over French fiscal sustainability, is also down a touch on Tuesday at 85bps. This is still close to the highest level since 2012, but it suggests that the market is not willing to push French bonds to breaking point at this stage," says Kathleen Brooks, research director at XTB.

Ultimately, the Euro is backed by the European Central Bank (ECB), which stands ready to back any government that falls into crisis. TS Lombard analyst Davide Oneglia says France extracts an "exorbitant privilege" from being a member of the Eurozone.

"The ECB has come a long way since the GFC: now it has the tools (TPI), the template (UK Gilt crisis) and the motive (protect repo markets) to stem a market rout," he says.

This Euro 'backstop' means that France will ultimately avoid a run on its debt by nervous investors because they know the ECB is in the wings to provide a backstop and underwrite their exposure.

"It’s important to remember firstly that French borrowing costs, at around 2.9% for 10-year government bonds, are still well below levels that would signify a crisis and also far below the equivalent UK rate of 4.2%," says Lindsay James, investment strategist at Quilter Investors.

However, the ECB backstop means French politicians on the left and right can avoid having to make harsh decisions that will be unpopular with the electorate, as they know the ECB won't let their debt run amok.

The risk, though, is that France becomes trapped in a prolonged period of paralysis and ever-rising debts that, at some point, someday, will need to be dealt with.

If Barnier loses Wednesday's vote, President Emmanuel Macron will appoint a caretaker government with limited powers.

This will govern France until July 2025, which is when fresh legislative elections can be held.

Should markets take the view that the caretaker government can keep France ticking over, then anxieties will recede, potentially allowing the Euro to recoup recent losses, keeping GBP/EUR capped below November highs.