GBP/EUR Week Ahead Forecast: Recovery Faces Inflation Test

- Written by: Gary Howes

Image credit: Luke Hayter. Sourced: Flickr. Licensed under CC 2.0 conditions.

Pound Sterling risks a setback against the Euro if the midweek release of UK inflation undershoots expectations and Eurozone PMI figures better those from the UK on Thursday, as some analysts expect.

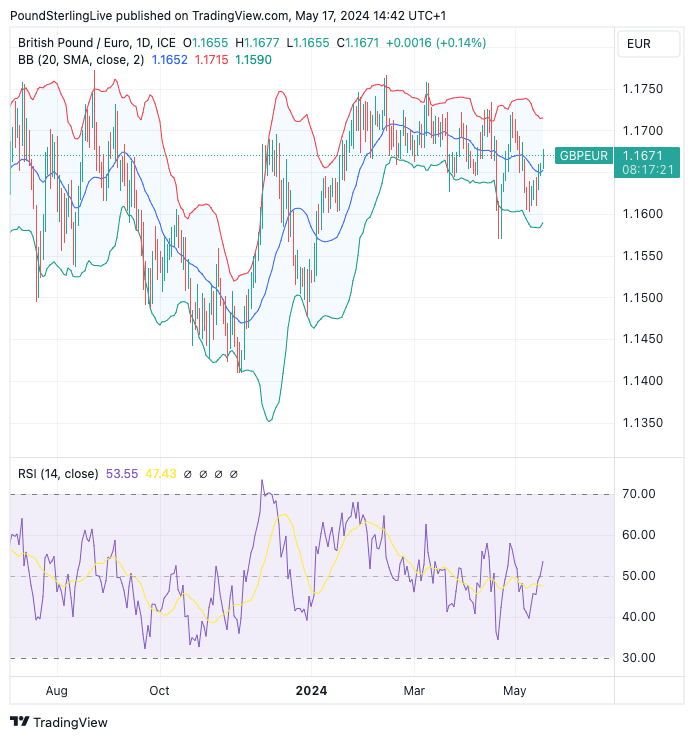

The Pound to Euro exchange rate has trended higher over recent days, comfortably returning to the middle of the 2024 range. The pair is still down for the month of May, but last week's comeback improves the technical picture, and we would not be surprised to see a retest of 1.17 in the coming days.

Those watching this exchange rate should not expect significant movement ahead of Wednesday's release of UK inflation data. In fact, we wouldn't be surprised to see Pound-Euro slip in the first half of the week as investors lower exposure ahead of the release.

Above: GBP/EUR at daily intervals showing Bollinger bands and the RSI momentum indicator which is pointed higher (lower pane). Track GBP/EUR with your own custom rate alerts. Set Up Here

We won't dwell too heavily on the technical charts as any analysis will ultimately be upended by what will be one of the most important single data prints of recent years. The outcome could pull the trigger on the start of an interest rate-cutting cycle at the Bank of England next month (GBP-negative) or send a stern message to rate-setters that the battle against inflation has not yet been won (GBP-positive).

The market looks for CPI inflation to fall to 2.1% year-on-year in April from 3.1% in March, the core inflation rate is expected to fall to 3.7% from 4.2%. Any deviation from these expectations can influence the currency, with the Pound gaining on upside surprises and falling on any undershoot.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Also, keep in mind that it could well be the services component of the inflation basket that generates the biggest market reaction, as the Bank of England has been at pains to point out that this is their main area of focus. This was highlighted by Ben Broadbent, the Bank's deputy governor, who said on May 09 that he will look more closely at services inflation than wages in the short term.

There is no estimate for the services number, but we would expect any downside progress from last month's 6.0% to bolster expectations for a June interest rate cut. "We see services CPI coming in at a strong 5.4%," says Sanjay Raja, an economist at Barclays.

Analysts at TD Securities look for services to edge down to 5.6%, highlighting the divergent expectations in the analyst community. The market's verdict on the actual outcome will be made apparent by the Pound's reaction. "As it stands, markets are fully priced in for a summer rate cut by the BoE, thus it is a question of when that first cut takes place with the June meeting priced at 54%," says Justin McQueen, market analyst at Reuters.

The Pound can weaken if markets move to fully price a June cut following the data.

The main event for the Euro this week is Thursday's preliminary PMI numbers for May, which should confirm the recovery continues. Markets look for Germany's composite PMI to print at 43.5, any improvement on this could underpin the Euro. The main number to watch with regards to the pan-Eurozone release is the composite PMI, which is expected to read at 52, up from 51.7 in April.

"On the other hand, we see softness in the UK PMIs, with the services index likely declining half a point to 54.5 and the manufacturing index edging down to 49.0," says TD Securities.

Such a divergent outcome would, all else equal, weigh on the Pound to Euro exchange rate.

The week ends with UK retail sales data for April, where economists look for a decline of 0.2% month-on-month as poor weather weighs. Anything more severe could also pressure Pound Sterling.