Pound Sterling to Underperform Euro as Year-end Rate Cut at Bank of England Looms

- Written by: Gary Howes

- Bets for Bank Rate cut grow

- ECB tipped to cut at slower pace

- Which should pressure GBP/EUR

Image © Adobe Stock

Investors are betting the Bank of England will have cut interest rates by the time the year is out, according to new data, something analysts say could undermine the British Pound.

Expectations for a 2023 rate cut in the UK rose after survey data released on Tuesday revealed the UK economy likely entered recession in January following a contraction in the services and manufacturing sectors.

In response, and for the first time since August, money market pricing shows a 25 basis point rate cut is now fully priced in by year-end.

In tandem with these developments, the Pound came under pressure, confirming Bank of England interest rate expectations are exerting a pull on the currency with the first monetary policy decision coming into view on February 02, where investors anticipate a 50bp hike.

Money markets show investors are still expecting Bank Rate to peak at around 4.5% in the summer as the Bank seeks to get a hold of still-elevated inflation.

But as the below shows rate cuts will commence after a short 'hold'.

Above: Money market pricing shows markets have quite recently started to price a steeper pace of Bank Rate cuts of late (blue line).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

A poll of economists by Reuters meanwhile shows the Bank of England is expected to lift Bank Rate by 50 basis points on Feb. 2 to 4.00% and then add another 25bp in March before pausing, suggesting an undershoot on market expectations.

Should markets revise expectations lower over the coming days - and align with the views of economists - the Pound could come under further pressure.

"The Bank of England renders its first policy decision of the year on Feb 2. when it's all but certain to raise rates to 4% from 3.50%. But mounting economic headwinds could mean that rates top out below recent forecasts of around 4.50%," says Joe Manimbo, Senior FX Analyst at Convera.

"The developments have increased the risk of a less hawkish outcome from the BoE next week. The biggest surprise would be if the BoE now delivered a smaller 25bps hike. It poses downside risks for the pound in the week ahead," says Lee Hardman, Senior Currency Analyst at MUFG.

Further rate hikes are likely as UK inflation data revealed last week that prices jumped 10.5% in December from a year earlier, while core prices rose 6.3% year-on-year.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The inflation figures combined with labour market data showing elevated wage pressures boosted market expectations for another 50bp rate hike and two subsequent 25bp hikes, underpinning the Pound.

But these expectations unravelled somewhat on Tuesday when UK Services PMI for January read at 48, well below the 49.7 economists had forecast and below the 49.9 printed previously.

A reading below 50 indicates the UK economy's largest and most important sector had contracted and points to a soft start to the year.

The Composite PMI - which gives an indication of the broader economy's performance - read at 47.8, down on December's 49 and below analyst forecasts for 49.1.

The data resulted in a reevaluation of the outlook for UK rates, prompting a rise in bets for a rate cut later in the year.

The Pound fell half a percent against the Euro on the day and two-thirds of a percent against the Dollar.

According to analysts at Investec, the prospect of rate cuts from the Bank of England will be keenly felt by the Pound to Euro exchange rate.

"We are cautious about further gains over 2023, especially against EUR: markets are pricing in about as many rate cuts in the UK by the end of this year as in the EU20, but we see the MPC going further and faster than the ECB Governing Council once, eventually, rate cuts come back onto the agenda," says Philip Shaw, an economist at Investec.

MUFG's Hardman also sees the Euro as holding the advantage, "yields spread developments point towards a retest of recent highs for EUR/GBP at just below the 0.8900-level."

EUR/GBP equates to a GBP/EUR exchange rate of 1.1236.

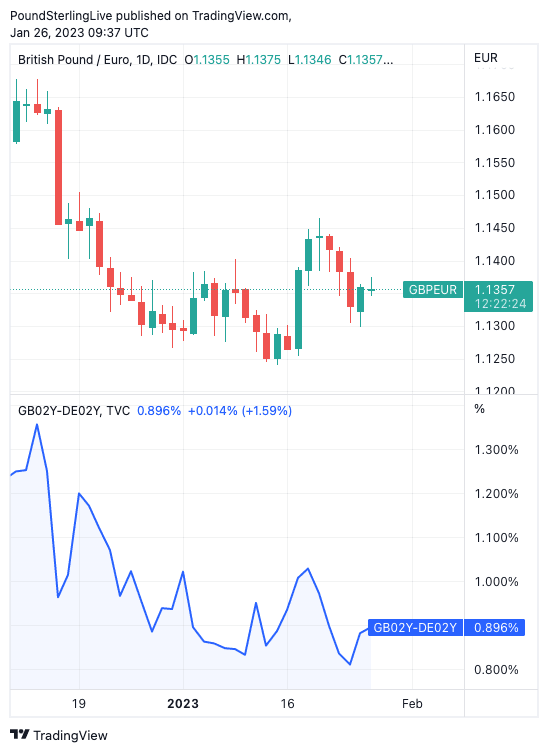

Above: The difference between UK and German bond yields of a two-year duration has narrowed as ECB rate hike bets ramp higher (bottom panel). This is seen to be dragging on GBP/EUR (top panel). Consider setting a free FX rate alert here to better time your payment requirements.

The European Central Bank (ECB) caught the attention of investors in December when it signalled at least two further 50bp hikes were likely in early 2022, wrongfooting those who had expected a slowdown from the central bank.

Meanwhile, the ECB's 'hawkish' stance was reinforced on several occasions in January when members of the Governing Council - including President Lagarde - said the plans had not changed.

ECB 'hawkishness' when contrasted to Bank of England 'dovishness' is one reason Investec has recently lowered its forecasts for the Pound-Euro exchange rate to 1.11 for the end of 2023; they expect no change by the end of 2024.

PMI data from the Eurozone this week suggested the region's economy had grown and economists say the region might avoid recession altogether, confirming an economic divergence with the UK that favours Euro strength against Sterling.

"We think it will take a lot more than a new prime minister, a few positive datapoints, and a 50bps hike to get international investors to warm to sterling. So, notwithstanding its recent recovery, we maintain our Least Preferred recommendation on the pound," says Dean Turner, Chief Eurozone and UK Economist at UBS Global Wealth Management.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes