Pound Euro Exchange Rate Suffers as German Confidence Shows Signs of Improvement

- Written by: Gary Howes

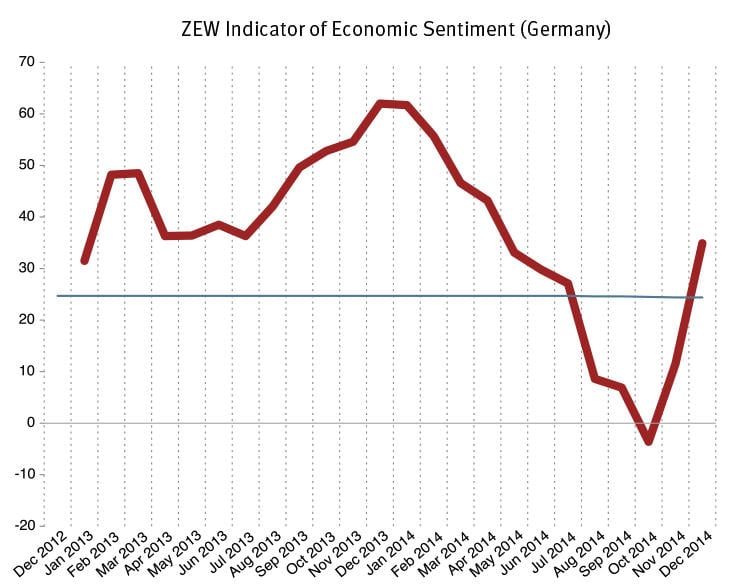

Above: German business confidence has started to grow, underpinning a EUR recovery.

The British pound to euro exchange rate (GBP/EUR) has taken a knock lower in the early half of the week thanks to signs that traders may be over-estimating just how poor the Eurozone economy is.

Sterling fell sharply against the shared currency on Tuesday the 16th of December when it was shown that confidence continues to improve in Germany – the Eurozone’s single most important economy.

If the European Central Bank (ECB) believes that it does not need to take further aggressive measures to stimulate the economy then the euro exchange rate complex faces some significant buying pressure.

For now though, markets are betting that some form of aggressive quantitative easing will be announced in 2015.

German Business Confidence Sends Euro Rates Higher

The pound succumbed to a stronger euro on news that the ZEW Indicator of Economic Sentiment for Germany gains 23.4 points in December 2014.

This is the second consecutive increase, the index now stands at 34.9 points (long-term average: 24.4 points), the highest reading since May 2014.

"Confidence in the German economy seems to be slowly returning among the financial market experts surveyed by ZEW. This increase is related to favourable economic conditions such as the weak euro and the low crude oil price. The recently published German export figures already show a positive trend. However, we should be aware that the current optimism is fuelled by factors that might change even over the short term", says ZEW President Professor Clemens Fuest.

Sideways Trend in Euro Pound Rate Forecast to Continue

So what does the current strength in the euro mean for the EUR/GBP’s outlook?

As the below illustration shows, the euro pound has been caught in a sideways motion for some time now – we see little suggestion that a break of this range will transpire for some time yet – a scenario that provides welcome certainty to holiday makers and corporates alike.

Momentum has favoured the euro since early December and the obvious termination point for the positive run appears to be the upper end of the range located at 0.8020.

Any turn-around that favours the pound sterling will likely prompt a decline back towards support located at 0.7780.

Turning the equation around to GBP/EUR any recovery in sterling will likely be met by the barrier at 1.28.

Euro Predicted to Drift Higher in the Near-Term

According to Piet Lammens at KBC Markets there is little to suggest sentiment towards the UK will change significantly anytime soon:

“On Monday, the UK data weren’t that bad, with strong UK CBI orders, but the direct impact on sterling was limited.

“The overall ‘bid’ for the dollar pushed cable from the mid 1.57 area to the low 1.56 area.

“In this move, cable clearly underperformed EUR/USD, sending EUR/GBP higher towards the 0.7970 area.

“We didn’t see much eco news to support the move. M&A deals and rumours from different UK based firms/investment funds probably played a role. Still the technical picture for cable and EUR/GBP hasn’t changed in a profound way.”