Market Selloff Crimps Pound Sterling Ahead of Bank of England

- Written by: Gary Howes

Image © Adobe Images

The British Pound was lower against the Euro and Dollar ahead of a key Bank of England and European Central Bank interest rate meeting as global equity markets registered declines.

The move lower in stocks comes in the wake of an overnight decision by the Federal Reserve to raise interest rates to the highest level in years.

The initial market reaction to the Fed was one of defiance as investors bet interest rates would not rise to the levels the Fed is projecting. Stocks went higher and the Dollar was relatively unchanged.

However, fast-forward and there is a clear 'bearish' flavour to proceedings on Thursday.

The Pound to Euro exchange rate was lower by a quarter of a percent at 1.16 in London trade, the Pound to Dollar exchange rate was lower by 0.85% at 1.2315.

The declines in Sterling come amidst a fall in European equity indices where the FTSE 100 is lower by three-quarters of a percent and Germany's DAX is lower by a percent.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

U.S. futures are lower by similar levels, suggesting they will open in the red.

The developments confirm Pound exchange rates to be highly sensitive to global sentiment and the moves could therefore overshadow the response to the BoE and ECB.

"The world's reserve currency has climbed broadly this morning after policymakers reinforced US rates to peak higher and for rates to stay higher for longer than markets expect, whilst inflation is set to remain sticky and the economy to weaken next year," says George Vessey, an analyst at Western Union Business Solutions.

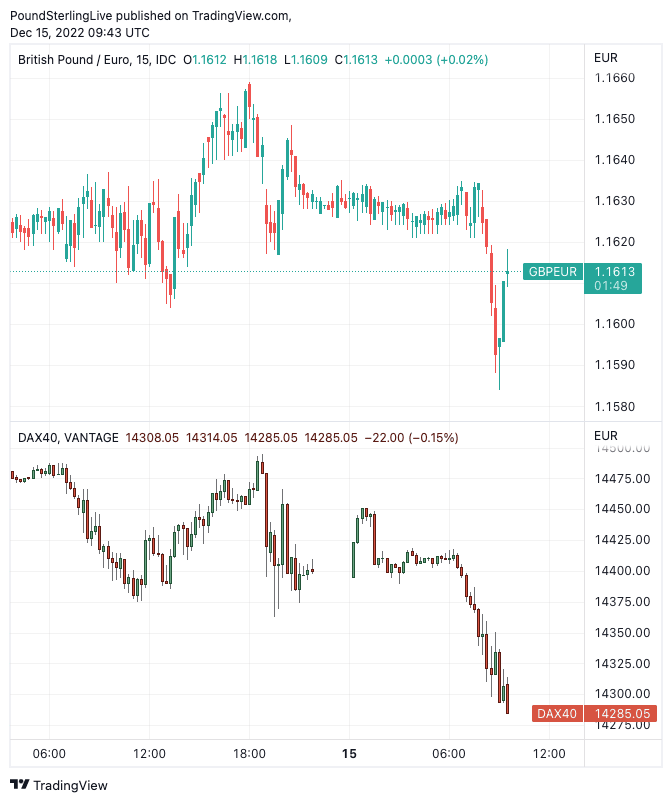

Above: GBP/EUR (top) and Germany's DAX40. The chart points to a correlation between GBP and broader equity market sentiment. However, expect ongoing volatility through both the ECB and BoE decisions. Consider setting a free FX rate alert here to better time your payment requirements.

The Federal Reserve raised its projections for the peak in the Federal Funds rate to 5.1%, up from 4.6% previously.

They also upgraded 2023 inflation forecasts which send a clear message that the time to ease back on raising interest rates has not arrived.

This defies current market expectations that show investors are actually positioned for interest rate cuts in late 2023.

The falling stocks and rising Dollar could therefore be a delayed reaction to the Fed's messaging by a belligerent market.

"The Fed is not yet convinced that inflation is on a sustained downward path. Overall, and contrary to the hopes of many observers, Jay Powell did not open up room for any dovishness and seems to value the painful lessons the Fed learned during the 1970s and 1980s. Small wonder the markets’ initial reaction is one of disappointment," says Christian Scherrmann, U.S. Economist at DWS.

Short-term calls on the Pound, Dollar and Euro will prove difficult as volatility is likely to be elevated over the coming hours as numerous central bank decisions are digested by markets.

But heading through the early stages of 2023 market moves will depend on whether the market's bet for rate cuts towards the end of 2023 can be sustained.

If the market is forced to throw in the towel and align with the Fed's thinking - that rates will remain elevated for longer - then the Dollar can find its feet and stocks will likely succumb to losses.

This would put the British Pound back on the defensive against both the Euro and Dollar in the first quarter of the coming year.

"Renewed optimism in global markets – in large part tied to hopes for a Fed 'pivot' – pushed the US dollar down against most major currencies last month. But with a global recession on the horizon, we continue to think that the dollar rally will resume as 'safe-haven' demand intensifies in the coming months," says Jonas Goltermann, Senior Markets Economist at Capital Economics.

"With still-sticky inflation drivers, we do not envisage a clear "pivot" from the Fed and the dollar index may well remain elevated for an extended period into 2023 on flight to safety flows when economic slowdowns or recessions materialise," says Jessie Guo, Senior Economist at Swiss Re.

Bank of England: What to Expect

- 50bp rate hike

- Push back against market pricing for the peak in Bank Rate

- This will be interpreted as 'dovish'

- Typically this would result in GBP weakness

- But some analysts now argue this could be supportive

European Central Bank: What to Expect

- 50bp hike

- But, 75bp is not out of the question

- Meaning there is the chance of a decent upside move in EUR

- Talk of balance sheet reduction could also prove hawkish

- "Only a 75bp hike or the explicit announcement that QT will start at a specific date in early 2023 will be able to drive a large EUR reaction" - ING.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes