GBP/EUR Week Ahead Forecast: Upside Limited as BoE Speeches Eyed

- Written by: James Skinner

- GBP/EUR headed for period of consolidation

- With 1.1342 to 1.1432 range likely short-term

- BoE speeches, UK jobs & GDP data in focus

Image © Adobe Images

The Pound to Euro rate has reversed much of its recent losses but could be likely to consolidate its recovery this week as investors digest important UK economic data and speeches from Bank of England (BoE) policymakers.

Sterling extended its recovery from late September lows against the Euro early on last week, helped by a corrective setback for the U.S. Dollar and a buoyant performance from risky assets like stocks and some commodities, which saw GBP/EUR trading briefly back above 1.15 by last Tuesday.

However, Dollar exchange rates were not kept at bay for long and their eventual rebound saw appetite for risky assets dissipate over the second half of last week, leading the Pound to Euro pair to retreat back below the 1.14 handle ahead of the Friday close.

"The outlook for BoE policy will also come under greater market focus in the week ahead. A number of MPC members are scheduled to speak," says Lee Hardman, a currency analyst at MUFG.

"At the same time, the release of the latest monthly UK GDP report for August and labour market report will shed more light on how the UK economy is holding up to the cost of living shock, The tight labour market keeps pressure on the BoE to keep raising rates into more restrictive territory," Hardman said on Friday.

Above: Pound to Euro rate shown at 2-hour intervals with Fibonacci retracements of late September recovery indicating possible areas of technical support for Sterling while shown alongside U.S. Dollar Index and Dollar-Renminbi rate. Click the image for closer inspection.

Above: Pound to Euro rate shown at 2-hour intervals with Fibonacci retracements of late September recovery indicating possible areas of technical support for Sterling while shown alongside U.S. Dollar Index and Dollar-Renminbi rate. Click the image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

While there are multiple pieces of economic data due out of the UK this week and each could have an impact on Sterling, the reopening of financial markets in China following the Golden Week holiday and any impact on the direction of the U.S. Dollar complex will also be an important influence on GBP/EUR.

GBP/EUR has tended to struggle recently during periods of strength in the U.S. Dollar and the latter would be likely to benefit this week if renewed pressure on the Renminbi leads USD/CNH to rise again after China's markets reopen following the latest holiday, with adverse implications for Sterling.

"USDCNH could continue to track the broad dollar move, but a sharp move higher to new highs is unlikely as spot stability could be PBoC’s focus ahead of the political event," says Jayati Bharadwaj, an FX and emerging market macro strategist at Barclays.

Much likely depends on the Renminbi and correlated currencies like the Pound, however, on whether local authorities continue with their earlier efforts to stabilise the currency in the lead-up to the 20th National Congress of the Chinese Communist Party (CCP) on October 16.

These efforts were initially reported to have begun ahead of last week's holiday and were followed by a four-day correction lower from the U.S. Dollar, which likely aided the recent recovery in the Pound to Euro rate too.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of 2022 decline indicating possible areas of technical resistance for Sterling while shown alongside U.S. Dollar Index and Dollar-Renminbi rate. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, most important for the Pound will be UK economic data and speeches from Bank of England policymakers due over the course of the week.

"We think the recent weakness in employment growth plus increasing signs of weakness on the activity front will halt the decline in unemployment, with the ILO rate forecast to hold steady at 3.6% in the three months to August," says Andrew Goodwin, chief UK economist at Oxford Economics.

"There are grounds to expect a rebound in construction output, given the unexpected weakness of July's outturn, but otherwise our expectations are set low, with GDP expected to have risen by just 0.1% m/m in August," Goodwin wrote in a Friday look at the week ahead.

Tuesday's employment figures and Wednesday's release of GDP data for August are the economic highlights of the week but are interspersed with a number of public appearances from members of the Bank of England (BoE) Monetary Policy Committee.

"This week’s GDP and labour market data look set to confirm that the economic recovery ground to a halt over the summer. We think that GDP rose by just 0.1% month-to-month in August, resulting in a fall in the three-month-on-three-month growth rate to -0.1%, from zero in July," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

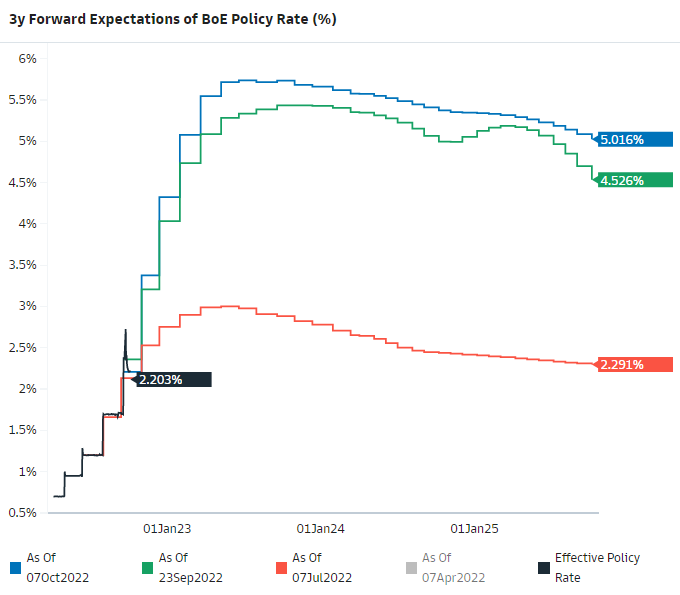

Above: Changes in market-implied measure of investor expectations for BoE Bank Rate. Source: Goldman Sachs Marquee.

Above: Changes in market-implied measure of investor expectations for BoE Bank Rate. Source: Goldman Sachs Marquee.

"Meanwhile, the main interest in this week’s labour market report will be whether the singlemonth measure of employment fell for a third consecutive month in August," Tombs wrote in a Monday look at the week ahead.

This week's speeches and remarks from BoE rate setters include a Tuesday appearance by Governor Andrew Bailey at the Institute of International Finance Annual Membership Meeting in Washington and a Wednesday address by chief economist Huw Pill to the Scottish Council for Development and Industry.

These are likely to be of most interest to the market and perhaps more so than the economic data after the market fallout over the new government's budget, which was widely criticised in late September and early October.

Market-implied measures of expectations for Bank Rate have since risen sharply to imply a high probability of it rising from 2.25% currently to more than 5% by the early months of the new year in what would likely be a very damaging policy outcome for the UK economy.

The Pound to Euro rate would likely be sensitive to any remarks about that from BoE officials this week, although the author's model suggests Sterling is likely to spend much of its time trading between roughly 1.1342 and 1.1432.

The model uses individual currencies' sensitivities to the U.S. Dollar and a process of cross-currency triangulation to estimate where non-Dollar exchange rates would be likely to trade as the Dollar itself rises and falls.