Pound's Rally Against Euro Could Fade if Single Currency Steadies

- Written by: James Skinner

- GBP lifted by broad & large EUR losses

- Possible range potentially shifting higher

- Could span 1.1622-1.1801 in short-term

Image © Adobe Images

The Pound to Euro exchange rate shifted higher during the opening half of the week owing to large and widespread declines by the Euro, and the single currency is again likely to be instrumental in determining if Sterling ends the week back down around 1.1622 or further up near to the 1.18 handle.

Sterling rose throughout much of Wednesday in a third consecutive advance as the single currency itself plumbed the bottom of the major currency bucket for a second day running, helping lift GBP/EUR briefly above 1.17 along the way.

This was even after the cancellation of earlier planned strikes at a key Norwegian gas facility that had contributed to market concerns about the European economic outlook on Tuesday, and despite a Wednesday rebound for risky assets like stocks in Europe and elsewhere.

“In FX, recession fears are starting to take their toll more broadly on the pro-cyclical currencies, including the euro. And with the Fed showing no signs, as yet, of a pivot away from front-loaded tightening, the dollar has pushed to twenty-year highs. EUR/USD has broken to a new cycle low – now within two big figures of parity,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

Almost all major currencies have fallen heavily relative to a stronger Dollar this week but European currencies have been especially big fallers and none more so than the Euro, which is what the three day rally in GBP/EUR illustrates.

Above: Pound to Euro rate shown at 4-hour intervals alongside GBP/USD and EUR/USD.

Above: Pound to Euro rate shown at 4-hour intervals alongside GBP/USD and EUR/USD.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This is an especially important point because GBP/EUR tends to closely reflect the relative performance of Sterling and the Euro when each is measured against the U.S. Dollar, and new research from ING suggests there may be scope for EUR/USD to stabilise for a period.

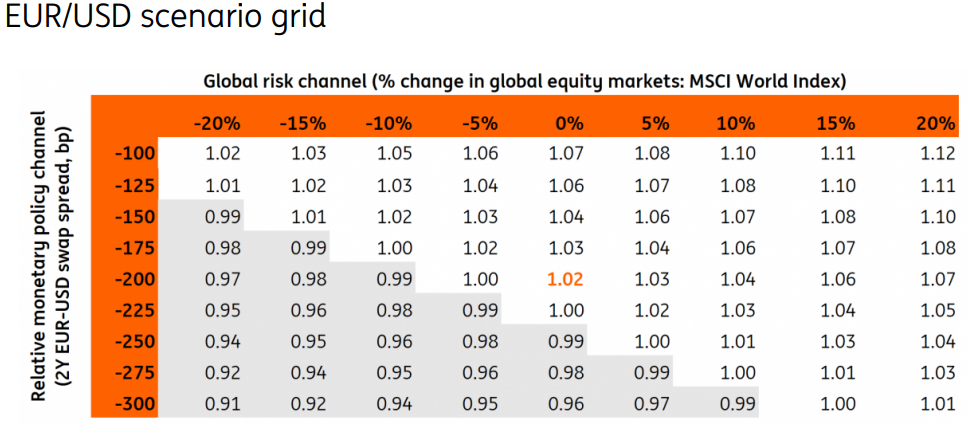

“A stabilisation in global risk sentiment would mean that EUR/USD should hold above parity, unless more ECB tightening is priced out of the swap curve (possibly due to a further deteriorating EZ growth outlook) while markets remain confident on the Fed’s policy pathh, ultimately causing a further widening (of at least 40-50bp) in the 2Y swap rate differential,” Turner and colleague Francesco Pesole wrote in a Wednesday research briefing.

ING’s short-term fair value model suggests that EUR/USD is likely to trade around the 1.02 handle if Wednesday’s tentative rebound in stock markets marks a short-term bottom for risk assets and if the spread or gap between European and U.S. bond yields remains reasonably steady.

This is important because any stabilisation or attempt at recovery by EUR/USD could have implications for other exchange rates including GBP/EUR, which would likely struggle to advance beyond Wednesday’s 1.17 level and may even risk unwinding some of its recent gains.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“Europe is suffering an enormous negative terms of trade shock from energy and as we have discussed over recent months, our own medium term fair value estimates of EUR/USD have fallen and suggest that, even at parity, EUR/USD is not extremely cheap,” Turner and Pesole cautioned on Wednesday.

GBP/EUR would likely fall back towards roughly the 1.1622 level if the worst of the Euro sell-off has run its course, according to the author’s own model, which uses currencies’ ever variable sensitivities to the direction of the Dollar and a process of cross-currency triangulation to estimate where non-Dollar exchange rates would likely trade as the U.S. currency itself rises and falls.

But if this week’s decline in EUR/USD marks the beginning of a more protracted period of weakness for the single currency - or otherwise greater susceptibility to strength in the U.S. Dollar - then in these circumstances the risk would be of GBP/EUR rising to around 1.1801 in the days ahead.

“No doubt the European Central Bank (ECB) will be quite concerned by the move – especially if it develops into a ‘sell the Eurozone’ mentality. Of note benchmark equity indices are off 11% in the Eurozone over the last month compared to 7% in the US,” Turner and Pesole said.

“Yet faced with the looming risk of recession – and the euro being a pro-cyclical currency – the ECB’s hands may be tied in its ability to threaten more aggressive rate hikes in defence of the euro. We will hear more on this issue from our Eurozone macro team shortly,” they added.

Above: Pound to Euro rate shown at daily intervals alongside GBP/USD and EUR/USD.