Pound / Euro Week Ahead Forecast: Stalling and Sprawling if Euro Stops Falling

- Written by: James Skinner

- GBP/EUR stalling & at risk of falling in short-term

- If PBoC aids EUR & JPY to fend off RMB strength

- EUR/USD, BoE & ECB speeches all key for GBP

Image © Adobe Images

The Pound to Euro exchange rate rallied back to within arm’s reach of post-referendum highs last week but could be seen stalling and then sprawling this week if the People’s Bank of China (PBoC) comes to the aid of the European single currency in a bid to fend of unwanted strength in the Renminbi.

Sterling entered the holiday-shortened week comfortably above 1.20 after trading briefly above 1.21 handle during pre-holiday trade following a mixed bag of economic figures from the UK and a sudden 80 point rally last Wednesday.

While official data revealed last week that unemployment fell back to its pre-pandemic low of 3.8% in February, it also showed economic growth was slower than many economists had anticipated in the same month and confirmed that inflation surged further to an annualised 7% during March.

“In terms of the macro outlook, the key factor will prove to be retail sales and flash PMIs on Friday. A slide in retail sales volumes will support our view of excessive UK rate expectations. Sliding consumer confidence and political risk will challenge [short term interest rate] pricing and GBP valuations,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

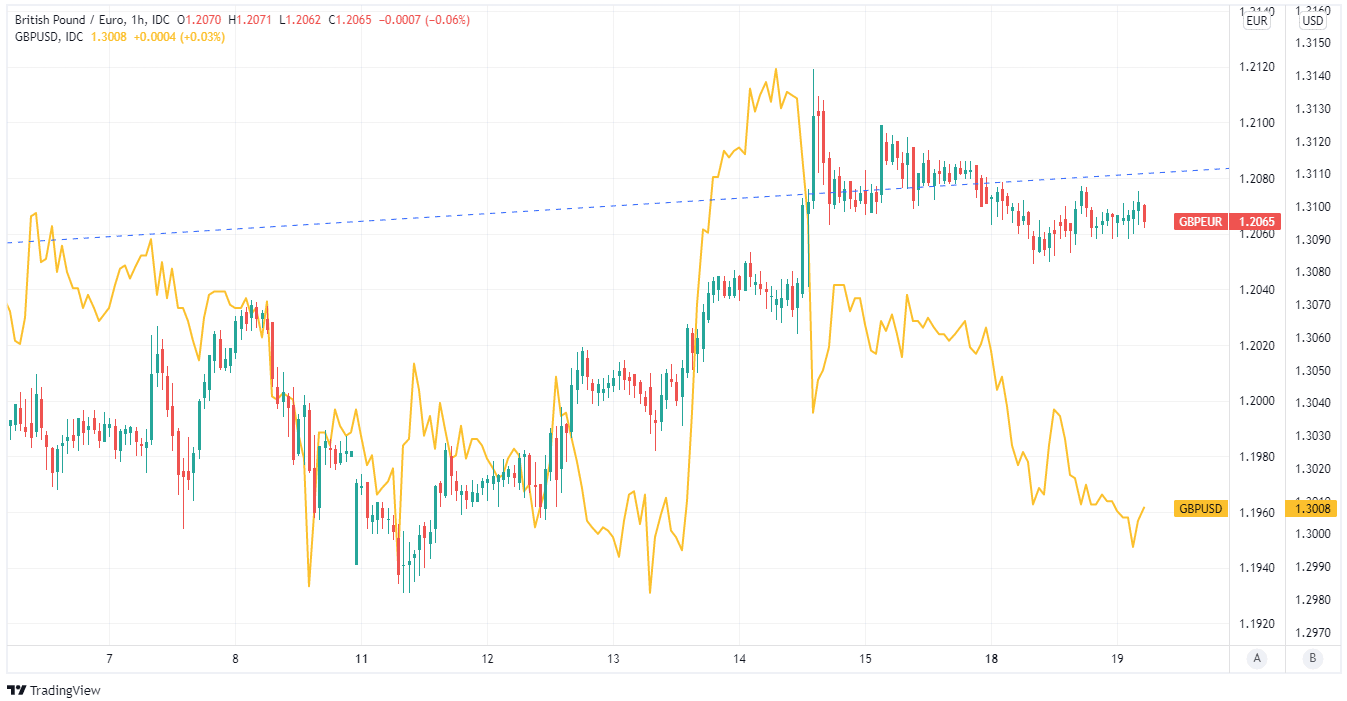

Above: Pound to Euro rate shown hourly intervals and alongside GBP/USD.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“We view the slide in EUR/GBP [rally in GBP/EUR] as potentially overdone in view of a greater risk of UK rates strip repricing. We would look for a EUR/GBP bounce to keep GBP/USD pressured, and this comes as we continue to look for a slide towards the current year-to-date low at 1.2974,” CIBC’s Stretch and colleagues said in a Monday market commentary. (Set your FX rate alert here).

The Pound overlooked last Wednesday’s inflation data and possibly because it would not necessarily be enough to persuade the increasingly cautious Bank of England (BoE) to continue raising its interest rate during the months ahead.

It wasn’t until late last Wednesday and toward the end of the London trading session when Sterling and the Euro rallied sharply in price moves that came along with a strong indication that they may have originated from Beijing.

To the extent that the recent rally originated from the PBoC itself, it would be an indication of an increasing desire in Beijing to fend off any further strength in the managed-floating Renminbi; likely by supporting the Euro, other currencies in Europe and possibly also the Japanese Yen.

Above: 2022 weightings of foreign currencies in the China Foreign Exchange Trade System (CFETS) index.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"CNY/JPY has shifted 19.9% over the past year. For now, China is running enormous trade surpluses regardless due to booming exports, which is about to subsidise further, and slumping imports,” says Michael Every, a global macro strategist at Rabobank.

"However, the tail risks for just how far CNY would drop if that trade position shifted, either due to global downturn or geopolitics, is worth considering," Every also wrote in a Monday market commentary.

While the Japanese Yen has fallen further than the Euro, it has only a little over half of the same weighting in the trade-weighted Renminbi index as the Euro, which fell by -12% against the Renminbi in the last 12 months.

This contributed a 2.2% uplift to a rising trade-weighted Renminbi index that has frequently been a source of consternation for policymakers in Beijing during the Chinese currency’s almost two-year rally, which may now have elicited direct intervention from the PBoC.

As far as this is the correct interpretation, and to the extent that any intervention would be focused on the Euro and Yen, any such action would likely be enough to stall - if not begin to reverse - the rally in the Pound to Euro exchange rate during the week ahead.

Above: Pound to Euro rate shown weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of medium-term technical support for Sterling, and shown alongside EUR/USD and EUR/CNH.

Above: Pound to Euro rate shown weekly intervals with Fibonacci retracements of 2020 recovery indicating possible areas of medium-term technical support for Sterling, and shown alongside EUR/USD and EUR/CNH.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

With developments relating to the Euro and other currencies aside, the week ahead is devoid of major appointments for the Pound to Euro exchange rate until Thursday when BoE Governor Andrew Bailey and European Central Bank President Christine Lagarde are scheduled to speak publicly.

Governor Bailey speaks at the Peterson Institute for International Economics’ Macro Week 2022 event on Thursday while President Lagarde will participate in Debate on the Global Economy at the Spring Meetings of the International Monetary Fund and World Bank Group shortly after.

President Lagarde then addresses Macro Week 2022 on Friday just before Governor Bailey delivers a speech about “Inflation Dynamics in a Fragile Global Economy” at the IMF and World Bank.

All of these events are highly important for Sterling and the Euro, and especially in the context of recently mounting uncertainty about the extent to which the BoE would be likely to meet market expectations for Bank Rate to rise from 0.75% to 2% or more this year.