Euro Supported by 'Hawkish' ECB Minutes

- Written by: Gary Howes

- GBP/EUR retreats from 1.20

- EUR buoyed by ECB rate hike expectations

- ECB minutes show increasingly hawkish tendencies

Image © European Central Bank, reproduced under CC licensing

The European Central Bank (ECB) is becoming increasingly restive on its monetary policy stance and looks keen to 'normalise' interest rates in the face of surging Eurozone inflation, which could offer the Euro support over coming weeks.

The Euro was bid after the release of the minutes to the ECB's March policy meeting on Thursday April 07 which showed increasing concerns that current ultra-low interest rates were inappropriate given the surge in inflation, which is expected to now average 5.1% in 2021.

"The just-released minutes of the European Central Bank's March meeting confirmed the official tone from the session and reflect many official statements since then: the ECB has become more hawkish," says Carsten Brzeski, Global Head of Macro at ING.

The rule of thumb in foreign exchange markets is that a currency finds buying interest when its central bank turns more 'hawkish', i.e. is looking to push interest rates higher sooner, or faster, than was previously expected.

The Euro rose against all its major peers in the wake of the development with Euro-Pound peaking at 0.8363, ensuring the Pound to Euro exchange rate retreated further below 1.20 and confirming price action to be stubbornly fixed below this watershed marker. (Set yourself a rate alert here.)

Looking ahead, there is ample scope for the Euro to find further support from this channel given the ECB remains one of the most 'dovish' of central banks, steadfastly maintaining its key lending rate below 0% at -0.5%.

"To the extent that the strategy props up European rates while keeping peripheral risks in check, the withdrawal of monetary stimulus should ultimately support the EUR," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

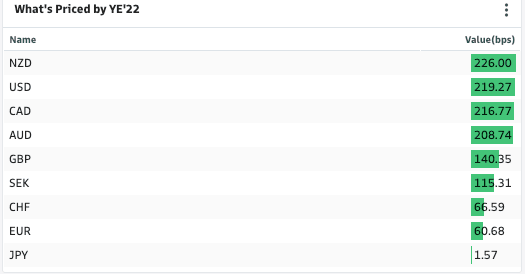

Above: The market sees little movement at the ECB, Bank of Japan and Swiss National Bank relative to other G10 central banks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound and Dollar have over recent months themselves found support from central bank rate rises and expectations for further hikes, but analysts say there is a strong likelihood that expectations are now too aggressive.

Should expectations for Federal Reserve and Bank of England hikes ease but expectations for ECB hikes increase the Euro would appreciate in value against these two currencies.

"The chances of earlier rate hikes have risen," says economist Jan von Gerich at Nordea Markets. "The pressure to do something on the exceptionally easy monetary policy stance is growing."

The minutes showed the ECB show the near-term outlook for the Eurozone economy has deteriorated, largely as a result of the Ukraine war and energy supply constraints, but they still expect a gradual rebound in activity during the second half of the year.

Arguments made against raising interest rates imminently rest largely with a view that inflation will fall back below the 2.0% target by 2024 as the effects of sky-high energy bills fall away, but there are concerns that this is too a benign assumption.

"High spot inflation now, especially driven by energy and food prices, should not make the central bank tighten policy. However, the constant underestimation of inflation over the past two years is a burden on the credibility of the ECB, especially as the ECB staff forecasts have adamantly insisted inflation would be close to the 2% target at the end of the forecast horizon," says von Gerich.

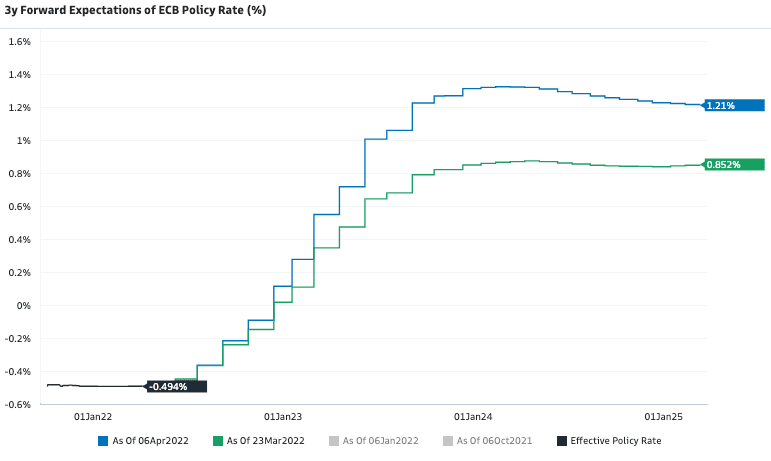

Above: Expectations for ECB rate hikes have risen over the course of the past two weeks. Image courtesy of Goldman Sachs.

"Not for the first time, there appear to be several critical voices as to the technical assumptions of the forecasts, particularly the use of energy future prices at the current juncture," says Brzeski.

Like other central banks it appears members of the Governing Council - who formulate policy decisions at the ECB - are concerned inflation anchors itself above 2.0% on a more permanent basis.

This would therefore require rates to be lifted sooner rather than later, they argue.

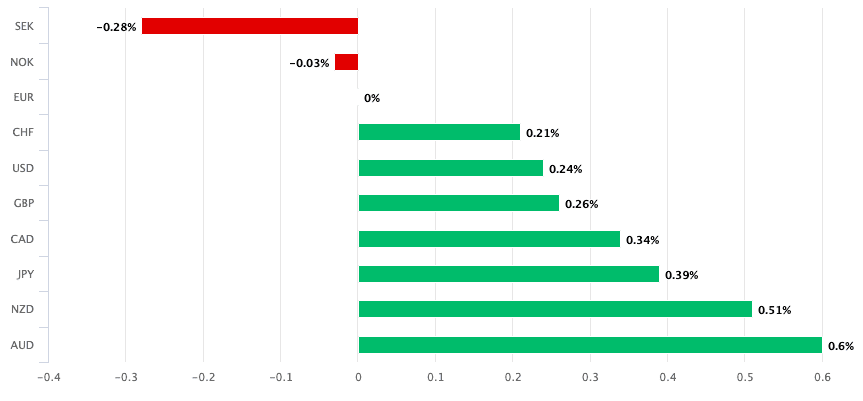

Following the release of the minutes there was a notable bid for the Euro, with the single currency rising nearly a quarter of a percent against the Pound and Dollar.

Indeed, gains came across the majority of G10 peers:

Above: EUR performance on April 07

"Probably the most important message from the minutes is the paragraph that many members believed that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation," says Brzeski.

The paragraph in question reads:

"Doubts were expressed about the convergence of inflation to 1.9% as expected in the baseline staff projection for 2024, the last year of the projection horizon. The question was raised as to how one could expect such a fast mean reversion in inflation, faster than in the previous projection round, after the current huge shocks to inflation. It appeared puzzling that inflation projections would still fall somewhat short of the 2% target in 2024 despite consecutive upside surprises in inflation outcomes, a persistently positive output gap for most of the projection horizon and the latest increases in longer-term inflation expectations."

Brzeski says this is a clear signal that the announced policy normalisation at the March meeting might not be sufficient.

The minutes reveal some members argued in favour of a firm end to the net asset purchase programme in the summer, forming a necessary first step to a rate hike.

Brzeski says the ECB will seek to make a clear distinction between policy normalisation and monetary policy tightening, explaining normalisation would include an end to net asset purchases and bringing the deposit rate back to zero.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Tightening would be the start of a longer rate hike cycle, bringing rates close to, or even above, neutral levels (wherever these levels might be). Normalisation seems to be acceptable for both hawks and doves; there are only different views regarding the timing. Tightening is definitely not yet an option for the doves, nor for all hawks," he says.

Von Gerich says finds it "quite telling" that not even the ECB hawks have called for more than to take the deposit rate to zero by the end of the year.

Bundesbank President Nagel, for example, suggested interest rates could rise soon, but even he said that the ECB will take the next decisions in June.

As such there should thus be no great rush to take further decisions at next week's meeting, but the market is pricing in higher rates for coming months, and this is what ultimately matters for Euro exchange rates.

"Nevertheless, given that the ECB has surprised hawkishly in each of the past few meetings, we see a risk that the central bank will make a decision to end net purchases by the end of June already at next week’s meeting, or at least give strong indications that it is tilted in that direction," says von Gerich.

Any such hawkish pivot at next week's meeting could offer the Euro further support, but of course much will depend on the general investment atmosphere concerning the war in Ukraine.