Turkish Lira Nears Record Lows but Could Make Comeback Soon

- Written by: James Skinner

- TRY nears lows, but may see recovery soon

- Aided by falling inflation, steady CBRT rate

- Real yields could draw speculative TRY bids

- PBoC swaps help CBRT fend off FX pressure

Above: File image of Governor of the CBRT, Şahap Kavcıoğlu. Image © TCMB

- GBP/TRY reference rates at publication:

- Spot: 12.14

- Bank transfers (indicative guide): 11.71-11.80

- Money transfer specialist rates (indicative): 12.03-12.057

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Turkish Lira was closing in on new lows against the Dollar on Thursday while ceding substantial ground to other currencies even after the Central Bank of the Republic of Turkey (CBRT) left its cash rate unchanged, although there’s a number of reasons for why a turnaround could be just around the corner.

Turkey’s Lira tumbled alongside many other emerging market currencies in the penultimate session of the week as the Dollar surged higher against almost all of its counterparts with only a handful of exceptions like the safe-haven Japanese Yen and the Brazilian Real.

This saw the USD/TRY rate closing in on early June’s record high located just above 8.72 even after the CBRT left its cash rate unchanged at 19%, in line with expectations, and maintained its commitment to keep the cash rate there “until the significant fall in the April Inflation Report’s forecast path is achieved.”

“Turkish inflation is unlikely to moderate continuously, especially against a background of rising oil price and double-digit lira depreciation this year. Even if the last inflation reading were to make some room to cut rates, we doubt that rate cuts can proceed beyond, say, 100-150bps before they will conflict with some aspect or another of monetary policy (such as the promise to hold the base rate higher than inflation rate),” says Tatha Ghose, an analyst at Commerzbank.

Turkey’s currency struck new record lows earlier this month after President Recep Tayip Erdogan fired Oguzhan Ozbas from the CBRT and its Monetary Policy Committee, the fourth exit of a bank official to be directed by Ankara since March, which appeared to incite market fears over the direction of the CBRT’s cash rate.

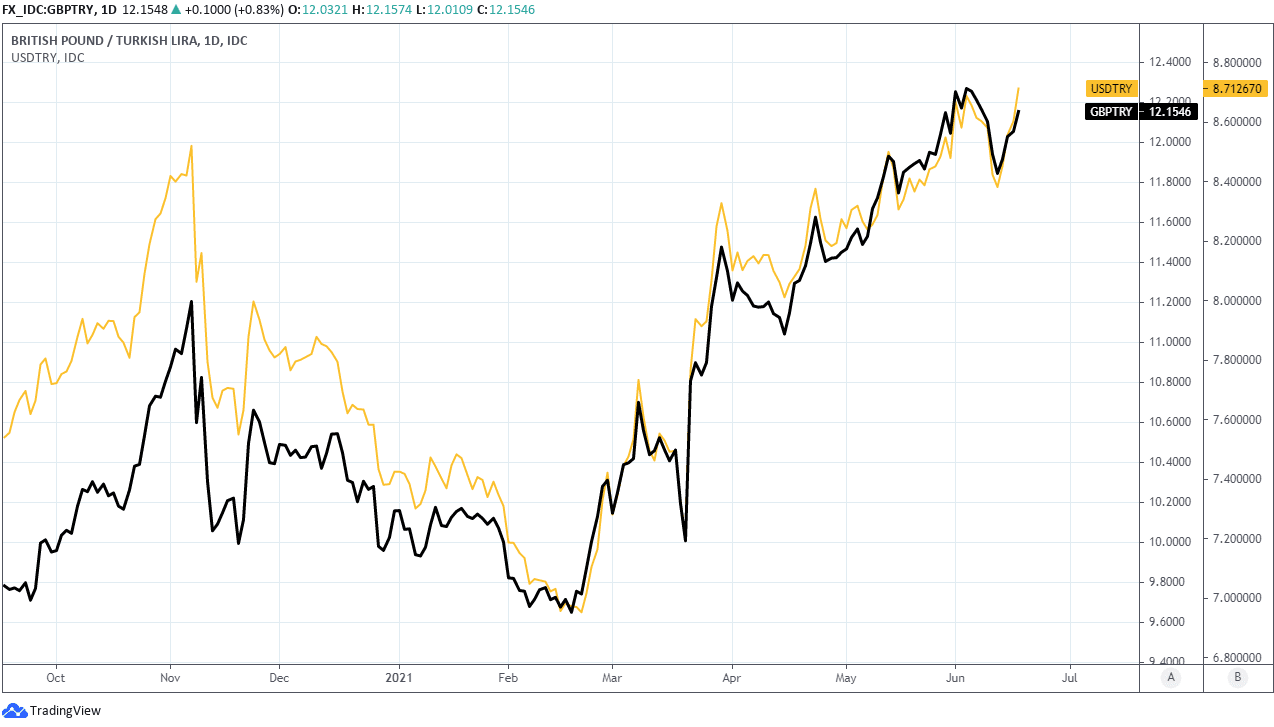

Above: Pound-to-Lira rate shown at daily intervals alongside USD/TRY.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Those fears may have been inflamed further in some parts during recent weeks after President Erdogan reiterated calls in domestic media for the bank to reduce its interest rate, although the CBRT reiterated its pledge on Thursday to keep the cash rate above the level of Turkish inflation.

“The policy rate will continue to be determined at a level above inflation to maintain a strong disinflationary effect until strong indicators point to a permanent fall in inflation and the medium-term 5 percent target is reached,” says Sahap Kavcioglu, Governor of the CBRT.

That policy prevents the country’s interest rates from turning negative in real terms and could foster confidence among investors if sustained, although it need not be a hardship either given that Turkish inflation is declining and in the process enhancing what is now already a ‘real yield’ offered to investors.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Next up for the lira is June’s inflation data, released on July 5th, which should show the impacts of returning consumer demand and last month’s fuel tax hike. The data will be key in determining whether Turkey’s disinflationary channel has truly formed and comes just a week before the CBRT’s next meeting on July 14th,” says Simon Harvey, a senior market analyst at Monex Europe.

Turkish inflation fell to 16.5% from 17.14% in May while core inflation - which is generally seen by central bankers as a more reliable gauge of domestically generated price pressures - fell to 16.99% from 17.77% while both of these metrics could further decline in the months ahead for at least two reasons.

This is because the nascent increase in Dollar exchange rates has already served to reign in many commodity prices in what is a disinflationary development.

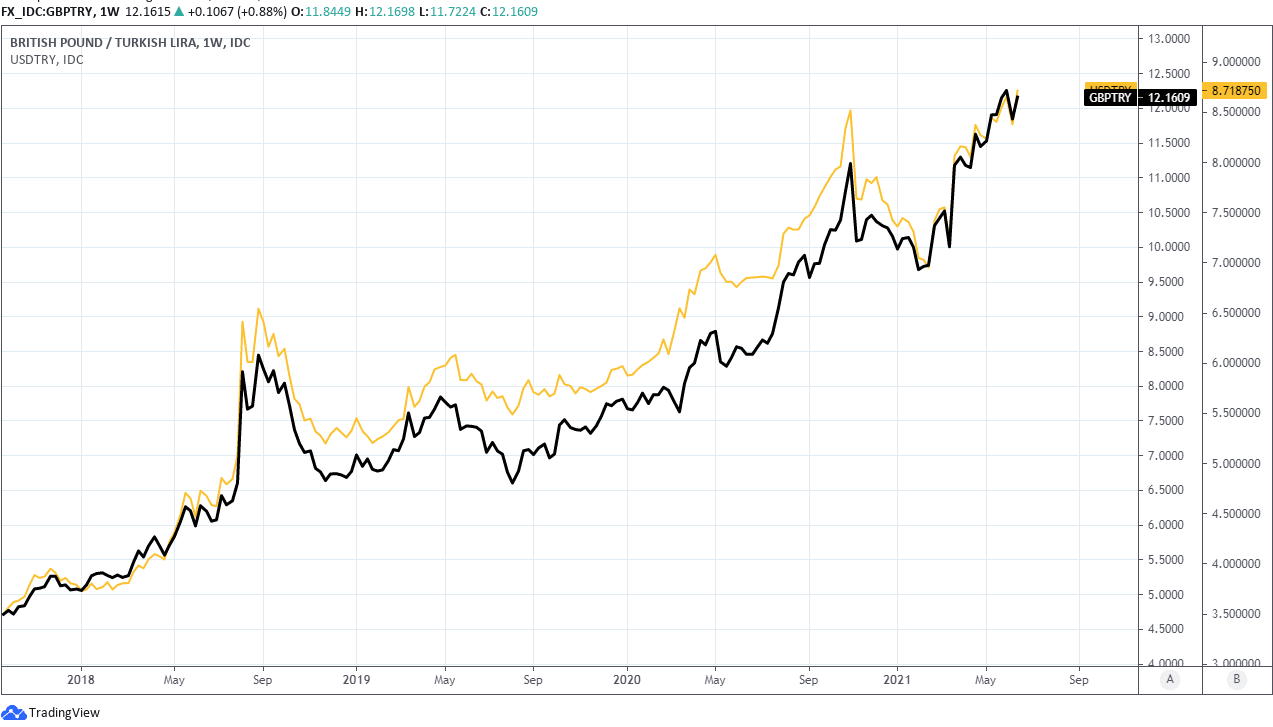

Above: Pound-to-Lira rate shown at weekly intervals alongside USD/TRY.

The Dollar appreciation is on the other hand an inflationary development but one which could be countered if-not more than offset by Turkish foreign exchange assets that were recently afforded a substantial boost through a enhanced currency swap agreement with the Peoples’ Bank of China (PBoC).

The PBoC and CBRT agreed just this week to quadruple an earlier May 2019 agreement, raising it in value by 35.1 billion Lira to a total of 46 billion Lira, which is equivalent to an increase from $1.29bn in 2019 to $5.4bn in 2021.

While the swap is intended to facilitate bilateral trade between the two countries, it also has a secondary purpose which is “to support financial stability of the two countries” and this could mean it’s able to be deployed for the purpose of defending the Lira or otherwise reducing Turkish inflation.

Doing so would not only promote Turkish financial stability, but also help the PBoC itself to attain its own objective of keeping the overall trade-weighted Renminbi “basically stable,” given the Lira is included within the China Foreign Exchange Trade System basket of currencies.

Some of those other currencies have recently depreciated and in the process placed upward pressure on the overall trade-weighted Renminbi.

“The increased amount has been recorded in CBRT accounts as of 15 June 2021. The core objectives of the agreement are to facilitate bilateral trade in respective local currencies and to support financial stability of the two countries,” the CBRT announcement says.