Pound-Euro Week Ahead Forecast: Holding 1.16 As BoE and UK Data Pose Upside Risks

- Written by: James Skinner

- GBP/EUR holding 1.16 in busy week for UK data.

- As BoE speeches, job, inflation & retail data loom.

- Wage & inflation surprises could see GBP/EUR rally.

- CNH sales ahead after PBoC lifts bank reserve ratios.

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1660

- Bank transfers (indicative guide): 1.1350-1.1430

- Money transfer specialist rates (indicative): 1.1550-1.1578

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Euro exchange rate entered the new week above 1.16, a level upon which its grip could solidify over the coming days if an action-packed UK economic calendar can be navigated without upset, although international factors will pose up and downside risks.

Sterling decisively rejected last Wednesday’s close below its 21 and 55-day moving-averages at 1.1610 and 1.1590 respectively when Thursday’s rally was followed on Friday by a small intraday gain, which lifted the Pound-to-Euro exchange rate above 1.1650 and enabled the British unit to claim third place in the rankings among major currencies for the week.

The Pound was still above those levels on Monday despite another Brexit psychodrama enduring into the new week with growing differences over exactly what was or wasn’t agreed between the two sides late last year.

“This could have a short-term negative effect on GBP,” says Petr Krpata, chief EMEA strategist for currencies and bonds at ING.

Tariffs on some UK exports have been spoken of by the EU side of late although it may be pertinent here that by month-end it will have been five full years since British governments and European institutions first began threatening each other with bodily injuries of various kinds.

Such injuries are yet to materialise however, after economic and political punches were pulled by either side wherever not pantomimed, and in a process that may have made Sterling slow if-not outright reluctant with its responses to the related rhetoric.

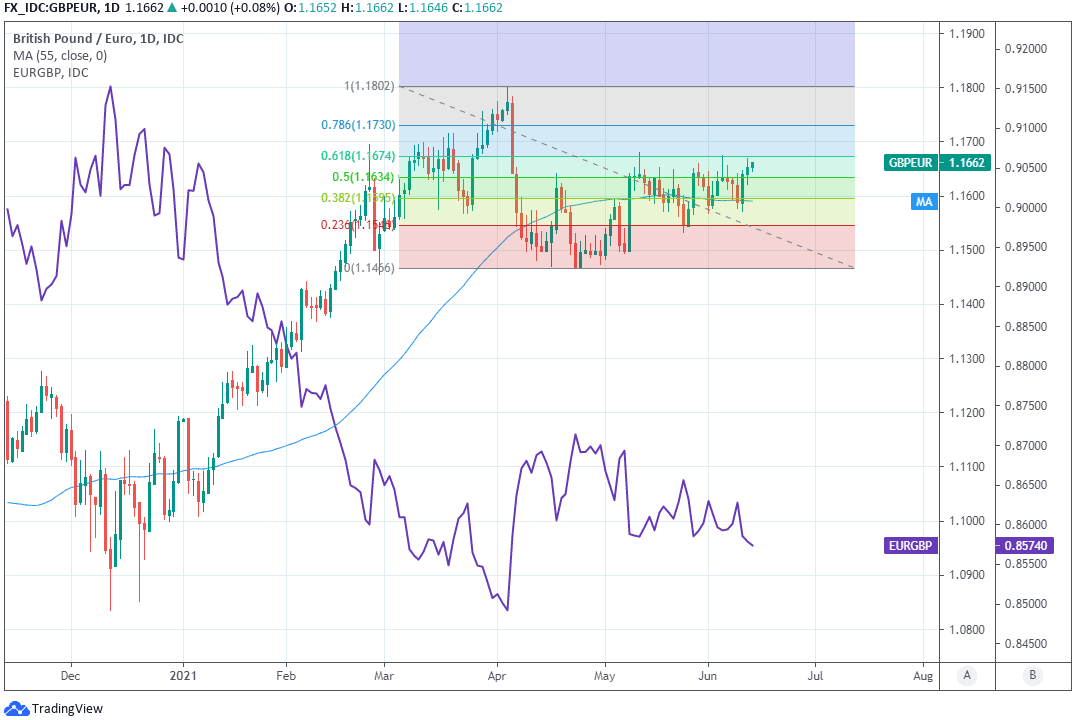

Above: GBP/EUR at daily intervals with 21 and 55-day averages, Fibonacci retracements of late March pullback and EUR/GBP.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

To the extent that the above is the case, the week ahead would likely be dominated by an action-packed UK economic calendar and the implications of each data point for the recovery from last year’s collapse.

“The emergence of the delta variant has caused a sharp rise in Covid infections in recent weeks and the lifting of remaining restrictions could be delayed. But we think the impact of a delay on GDP growth would be limited, provided it is short and that restrictions are not reimposed on retail and hospitality,” says Andrew Goodwin, chief UK economist at Oxford Economics.

This week’s calendar includes two speeches from Bank of England (BoE) Governor Andrew Bailey with the first being an address to the Association of Treasurers at 14:00 on Monday and the second being a speech about “the future growth of UK-based financial services” aat an online forum hosted by TheCityUK due on Tuesday at 13:15.

Sterling will likely listen closely for clues on whether Governor Bailey shares the increasingly optimistic views recently articulated by some Monetary Policy Committee (MPC) members, with the latest coming from the BoE’s outgoing chief economist Andy Haldane in early June.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Haldane said that “pretty punchy” price pressures could see the UK economy overshooting the BoE’s 2% inflation target for longer than was anticipated at last month’s MPC meeting, potentially necessitating an earlier rethink of the bank’s crisis-fighting quantitative easing and interest rate policy settings than is currently expected by investors.

“After a decade of slow growth and weak inflation, it is tempting to believe that credit and inflation excesses are gone for good. But as a robust recovery is underway, inflation pressures are rising and the housing market is showing early signs of overheating,” says Holger Schmieding, chief economist at Berenberg.

“We see a rising chance that the BoE could surprise markets by ending its asset purchases in August – instead of December as planned and as we still project – before preparing markets for the first hike in August 2022,” Schmieding adds.

Schmieding flags the possibility of a policy surprise that could only have positive implications for the Pound-to-Euro rate and one which might become more likely this week if the wage growth measure in the April employment report and inflation figures for May confirm that both BoE as well as private sector economists are right to be viewing inflation risks as shifting further to the upside.

Above: Pound-to-Euro exchange rate at weekly intervals with 21-week average and Fibonacci retracements of 2020 collapse.

Employment figures for April are due out at 07:00 on Tuesday and consensus is looking for them to reveal an almost unheard of 4.9% annualised increase in the average wage packet, alongside a fall in the unemployment rate from 4.8% to 4.7%.

These are followed by inflation data for May at 07:00 on Wednesday and economists are expecting on average that this will show the main consumer price index inflation rate rising from 1.5% to 1.8%, and the core inflation rate rising from 1.3% to 1.5%.

Faster-than-expected inflation and rising cost pressures in the private sector would simply encourage speculation about BoE interest rate rises that come sooner than has so-far been anticipated by investors, many of whom have recently wagered that the bank would be unlikely to change its current monetary policy settings before 2023.

That would be positive for Sterling although the Pound-to-Euro exchange rate might also see any upside impulse curtailed if the Euro itself, which has a quiet week ahead of it in terms of Eurozone economic data, turns out to be a beneficiary of an early June decision by the Peoples’ Bank of China (PBoC) to raise the foreign exchange reserve ratio requirement of domestic lenders.

The decision is due to be implemented from Monday 14 June and was effectively an instruction for Chinese banks to buy foreign currencies in an amount that analysts estimate could be worth around $20 billion when measured in U.S. Dollar terms, while the single currency could be a notable beneficiary as the Eurozone currently duals with the U.S. economy for the largest share of international trade with China.