British Pound Eyes Autumn of Explosive British Politics

Image (C) 10 Downing Street.

- Constitution will allow Johnson to oversee Brexit, even if confidence vote is lost

- Government of national unity mooted by remainers

- Sterling can absorb further risk premia say analysts

According to constitutional experts, UK Prime Minister Boris Johnson can deliver a 'no deal' Brexit by simply refusing to stand aside even in the event his Government is voted down in a no-confidence vote, making for a potentially explosive autumn in British politics that will surely keep the Pound under pressure.

Markets have for some time assumed that because a majority in Parliament was against a 'no deal' Brexit, it would ultimately be thwarted. However, Sterling has fallen of late as markets start to realise that the constitution will allow for a determined Prime Minister to deliver Brexit, if he so wished.

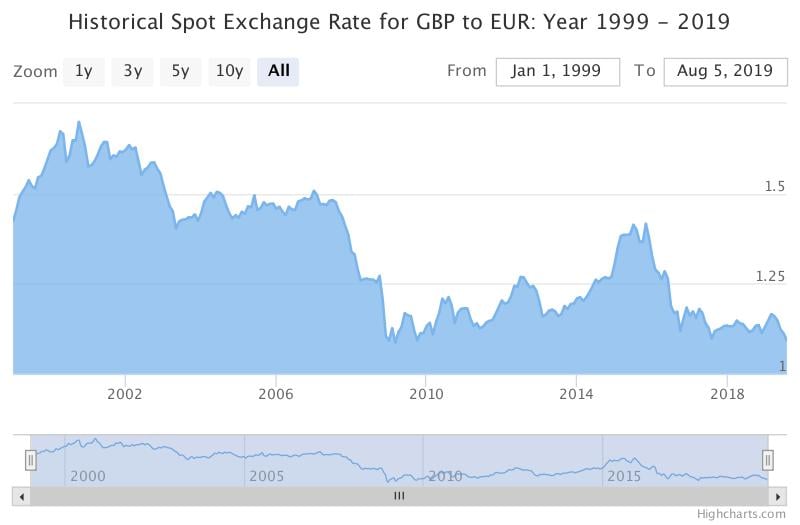

The Pound-to-Euro exchange rate is closing in on two-year lows, having been quoted at 1.0871 on Tuesday, while the Pound-to-Dollar exchange rate is quoted at 1.2184: the current month low is at 1.2079 and further declines to fresh multi-year lows remain possible.

"Politics should remain the key negative for Sterling in the months to come. There is more scope for risk premia to be built into the Pound while the Bank of England is unlikely to offer much help to the battered currency," says Petr Krpata, a foreign exchange strategist with ING Bank in London.

Expectations for a no-confidence vote in the Government are rising, with Labour Party leader Jeremy Corbyn saying on Monday that he will call the vote “at a point when we can win it” and it would be at an “appropriate very early time”.

The vote could be called in the first sessions of the new parliament, which starts on September 03.

Time is of the essence for those MPs determined to prevent a 'no deal' Brexit as the room for manoeuvre is diminishing, and financial markets are expressing their views on the matter via the substantial sell-off in Sterling witnessed since May.

Above: Sterling trades near historical lows against the Euro, despite the UK's superior growth and inflation rates. This reflects the premium demanded by traders for holding Sterling in light of perceived risks surrounding Brexit.

Expectations for a no-confidence vote come as it is reported EU officials are now accepting the UK will leave the EU without a deal.

According to The Telegraph's Camilla Tominey, Brussels believes that Britain will leave the EU without a deal after accepting that Boris Johnson "isn’t bluffing."

"Our working hypothesis is now no deal," an EU source told the Telegraph and that EU diplomats agreed at a meeting last week they could not rely on UK MPs to prevent a disorderly withdrawal.

EU officials are apparently aware that the new Johnson administration is fully committed to making a success of an EU exit on WTO terms.

Dominic Cummings - the special adviser to Johnson who has been mandated to deliver Brexit - appears to be a central driver behind the shift. Cummings told fellow government advisers last Friday that the UK would leave with or without a deal on October 31.

He said that "nothing will stand in the way of that".

In response to the reports, an EU Commission spokesman says:

"A no deal scenario is not our preferred outcome. We continue to believe an orderly withdrawal is the best outcome for all."

Further, the EU is said to "remain open to hold talks", the commission says, "but we won’t renegotiate the Withdrawal Agreement".

A number of Conservative MPs are expected to vote with the opposition to collapse the Government in the event that it becomes clear Parliament has run out of options to prevent a 'no deal' Brexit.

Should MPs, such as Dominic Grieve and Charles Clarke, vote against the Government it then falls to a majority of MPs to back the creation of a new Government within 14 days, or a General Election must be called.

"The decline in GBP would likely be swifter were it not for the idea that the threat of “no deal” will somehow be headed off by Parliament, either through procedural initiatives or a full-blown vote of no confidence that could trigger a general election and perhaps a second referendum. The rising chance of “no deal” is being offset by a rising probability of “no Brexit”, but only partially," says Daragh Maher, Head of FX Strategy at HSBC Securities in New York.

Reports suggest that one option that could be adopted by MPs determined to prevent a 'no deal' Brexit would be to get behind a Government of National Unity, with the single aim of asking the EU for another Brexit delay.

"MPs opposed to a no-deal Brexit have suggested a cross-party government could be formed with the sole purpose of requesting an extension to the UK’s departure from the EU, if Boris Johnson’s government loses a no-confidence vote this autumn," reports Sebastian Payne at the Financial Times.

However, according to constitutional experts, Johnson could simply refuse to resign in the event that he lost a no-confidence vote.

“In terms of a strict reading of the legislation, Boris is not required to resign. It is completely silent on all of this,” she said. “The onus is on the incumbent prime minister — they get to choose whether they resign. If they do not it is hard for a new government to be formed without dragging the Queen into politics," Catherine Haddon, a senior fellow at the Institute for Government think tank, told The Times.

“It would put huge pressure on the incumbent prime minister to resign. We would have a clash between a technical reading of the legislation and constitutional norms,” adds Haddon.

Therefore, it does appear that if Johnson is truly committed to a 'no deal' he can deliver it through sheer stubborness.

A UK Government spokesman yesterday confirmed:

“The UK will be leaving the European Union on October 31 whatever the circumstances, no ifs or buts. We must restore trust in our democracy and fulfil the repeated promises of parliament to the people by coming out of the EU on October 31. Politicians cannot choose which votes to respect. They promised to respect the referendum result. We must do so."

Expect further Sterling weakness as the 'no deal' Brexit premium is further written into the currency.

"The market is increasingly pricing in the risk of a disorderly Brexit. The danger is that - if the British and EU sides stick to their tough stance until the deadline at the end of October - the depreciation will intensify and the pain threshold for the British government will thus be tested," says Thu Lan Nguyen, an analyst with Commerzbank.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement