British Pound Vulnerable to Testing 2018 Lows vs. Euro

Image © Thomas Otto, Adobe Stock

- Euro struggles on disappointing data

- But political risks seen as key driver of GBP/EUR rate

- "Market capable of testing" recent downside soon

The Pound edged higher to close at 1.13 against the Euro ahead of UK Prime Minister Theresa May's journey to Brussels to finalise the Brexit Withdrawal Agreement struck between the UK and EU.

We are told that any strength seen in Sterling is likely to be short-lived with analysts saying the currency faces fundamental challenges while technical studies point to the potential for further moves lower.

Ahead of the signing of the deal with EU leaders Sunday, May will be meeting with European Commission officials Saturday to iron out some outstanding issues; Spain's opposition to the deal's current wording on Gibraltar being the most important.

The British Pound recovered some lost ground against the Euro ahead of the Sunday meeting of EU leaders in the wake of news the UK and the European Commissions had agreed a text on the Political Declaration on future trade negotiations with markets betting enough concessions had been made to give the Brexit Withdrawal Agreement a shot of getting through the UK's deeply divided parliament.

The hope is that this Declaration will detail enough to give sceptical UK lawmakers the reassurances they need to approve the Withdrawal deal in parliament.

"The Pound’s initial reaction to the leaked details was surprisingly positive – against the Euro, Sterling rose by almost 1% in a few minutes," says James Smith, an economist with ING Bank N.V. "But will the Declaration really be a game changer for the parliamentary vote? Looking beyond the warm and cooperative tone of the document, there are a few reasons to be cautious."

In the wake of the news the Pound-to-Euro exchange rate raced to a high at 1.1304, from the solid support level the exchange rate encountered down at 1.1180.

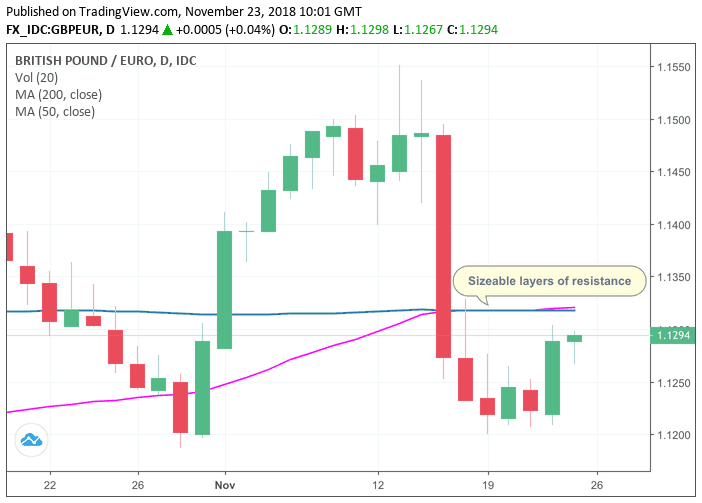

Looking at the charts to determine where the exchange rate might go next, we can see the market has rallied back towards the 55 day moving average at 1.1316 and the 200 day moving average at 1.1319.

This layering of technical resistance could well provide a roadblock to any further upside.

Those watching the news headlines will of course argue that the Pound's rally failed because traders realised that the details of the Political Declaration simply don't go far enough to trigger the required sea-change in opinion amongst opponents of Theresa May's Brexit plans to ensure they are ratified.

Of particular interest is a determination set out in the Political Declaration to avoid having to ever use the highly contentious backstop plan that effectively traps the U.K. under EU customs law. The two sides agreed that other available options - technology included - should be utilised to avoid the backstop being used.

"Given all the concerns about the Irish backstop, the prime minister's challenge now is to convince lawmakers that it will never be needed - and at face value, the declaration contains some statements that might help her cause," says Smith.

However, the Declaration is legally binding; therefore the concessions here might come to naught while the backstop is legally binding as it is contained in the Withdrawal Agreement which is in effect a treaty.

"In reality, the EU has been very sceptical in the past about the practical and political ramifications such a system might have. And despite these reassurances, the fact that the Irish backstop will form a legally-binding part of the overall deal hasn't changed," says Smith. "We therefore still suspect many Brexiteers, along with the DUP, will feel inclined to reject the agreement when it is voted in parliament."

The fear of a 'no deal' Brexit taking place in March 2019 therefore remains elevated and is enough to temper enthusiasm towards hold Sterling, and according to some will ensure GBP/EUR heads towards the bottom of recent ranges.

"Greater uncertainty around the outcome of the U.K. Parliamentary vote has raised the probability of a no deal. We now put this at roughly 50% and investors are increasingly discounting this outcome," says Liam Peach at Capital Economics.

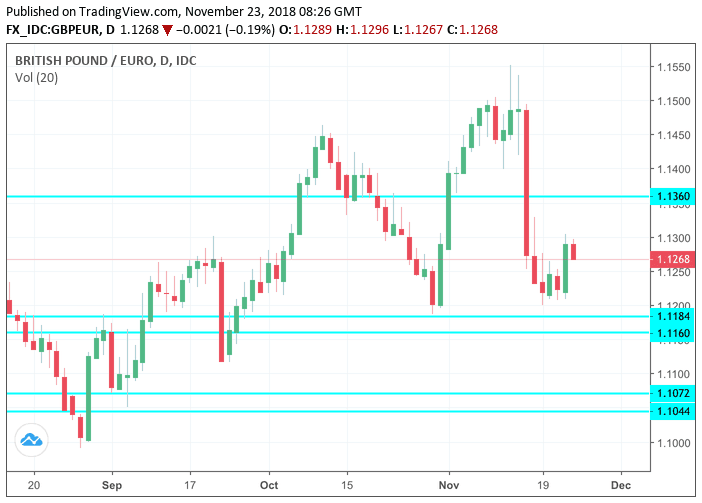

Technical analyst Karen Jones at Commerzbank says that while the GBP/EUR exchange rate remains under 1.1360, "the market will remain capable of retesting" the downside.

Should the market go below the July low at 1.1184, 1.1160 comes into view, followed by the early August and September lows at 1.1072 and 1.1044.

"However given that we are currently pretty much mid-range – we have no strong bias," says Jones, offering some comfort for those watching the market that cannot afford a major breakdown in value.

We can meanwhile report that consensus estimates for GBP/EUR have been raised for the 3, 6 and 12 month timelines. We recommend downloading the November exchange rate forecast report from Horizon Currency to see where over 50 of the world's leading investment banks and financial institutions are expecting GBP/EUR to trade through 2019.

Euro Struggles Amidst Slowing Economic Growth Data

The Euro's outlook has meanwhile soured somewhat after November's IHS Markit PMI surveys showed the single currency bloc's economy softening even further in the final-quarter, casting a shadow over the European Central Bank (ECB) policy outlook.

The Eurozone manufacturing PMI fell from 52.0 to 51.5 in November when markets had looked for it to remain unchanged, while the services PMI declined from 53.7 to 53.1 when economists had penciled in only a minor fall to 53.6.

This led the Eurozone composite PMI down from 53.1 in October to 52.4 in November, marking a 47-month low, as business activity grew at its weakest pace for more than four years.

The Euro was seen broadly lower on the data with the EUR/GBP exchange rate fading down to 0.8843 and the EUR/USD declining half a percent to 1.1340.

Softness in both French and German manufacturing sectors led the decline in the overall index for November, with falling exports and declining new order growth driving the downturn.

"The rise in factory output was the weakest since the recovery in production began in July 2013. Production growth came to a near-standstill in response to second successive monthly falls in factory orders and exports," says IHS Markit, compilers of the report.

Weakening global demand amid high levels of uncertainty about the economic outlook was responsible for the fall in export orders, although the so-called trade war and sluggish car sales were also cited as headwinds.

"When all is said and done, a PMI headline if 52.4 is not catastrophic, but it does suggest that the growth in the Eurozone is slowing faster than markets, and the ECB, expect. Mr. Draghi recently held on to his view that risks remain “broadly balanced,” but these data suggest that the president will have to change his tune next month," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here