Dollar-Yen: Potential 1-2% Further Downside Before Move Completes

- Written by: Gary Howes

Image © Adobe Images

There is the potential for a further slide in the value of the U.S. Dollar against the Yen before the retracement is complete and another run higher begins.

This is according to a leading investment bank currency strategist, observing the Dollar to Yen exchange rate's ongoing pullback from recent highs.

"I am estimating we have are likely to drop below 145.00 and perhaps take a look towards the 200dma but not actually achieve it, before this move is over," says W. Brad Bechtel, an analyst at Jefferies, the investment banking and capital markets firm.

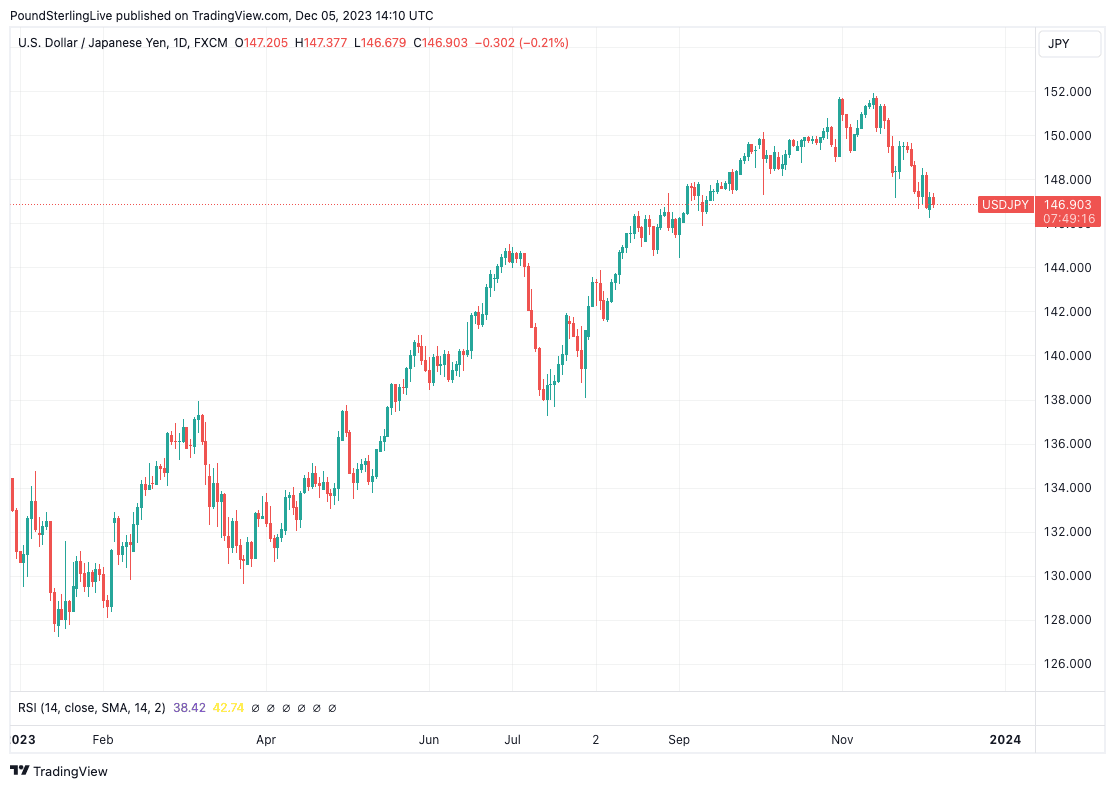

The Dollar-Yen peaked at 151.90 on November 13 as 2023's surge - built on a broad-based selloff in the Yen - extended above the key 150 markets.

The move marked a formidable 16% advance for Dollar-Yen in 2023, and according to Bechtel, the recent pullback to today's 146.97 is not yet evidence that this rally is complete.

Above: USDJPY at daily intervals showing the three notable pullbacks in the broader trend. Track JPY with your own custom rate alerts. Set Up

Bechtel observes that USD/JPY has pulled back to the tune of 5 or 6% twice this year: once in March and again in July. (One heading into a quarter end and once just after a quarter end).

"In the current move, which commenced just after the September quarter end we have dropped around 4% so far," says Bechtel. "If history repeats or rhymes, that would imply a further 1 or 2% downside before the move completes."

He says the pullback would likely coincide with a basing in U.S. yields as well.

"If that is true that would pull us below 145.00 vs. 147.00 trading. The 200dma lurks down around 142.20. So I am estimating we have are likely to drop below 145.00 and perhaps take a look towards the 200dma but not actually achieve it, before this move is over," says Bechtel.

From here, another march towards the highs could then commence.

The strategist says many are getting bulled up on the idea that we are about to see a big JPY rally in 2024.

But, "I would argue that the bulk of the move is basically over. Perhaps worth chasing for another percent or two, but I wouldn't bet the farm on some big structural bull market for JPY in 2024," says Bechtel.