Euro Forecast to Reach Parity Against Dollar

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) could be on course to hit the 1:1 marker, according to an increasing number of analysts. Others say such talk is overblown.

"The sell-side researchers are upgrading the USD across the board. The EUR/USD calls are getting the most attention, with many calling for a move to parity for EUR/USD," says W. Brad Bechtel, Global Head of FX at Jefferies.

EUR/USD entered a downtrend in October, with the selloff intensifying following the unexpectedly strong showing of Donald Trump and the Republicans in the November 05 vote.

Trump wants to raise tariffs on U.S. imports, which will hit exporter economies such as the Eurozone. At the same time, Germany's ruling coalition has collapsed, and Europe's largest economy now faces a winter of political uncertainty ahead of a February election.

"If Donald Trump follows through on his threat to impose a high sector-specific tariff on European cars, German firms could suffer a big reduction in exports, deepening the crisis in the sector and adding another headwind to economic growth. That would be additional to any hit from a “universal” tariff," says Andrew Kenningham, Chief Europe Economist at Capital Economics.

"In sum, if the Trump agenda is implemented in full force and quickly without a countervailing policy response from Europe or China, we could see EUR/USD drop through parity to 0.95 cents or even below," says George Saravelos, Global co-Head of FX Research at Deutsche Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Trump said he wants to place a 10% global import tariff on all imports to the U.S., with a 60% tariff reserved for China.

The U.S. is the Eurozone's main export market for manufactured goods, while any economic hit to China from tariffs will also impact another crucial market.

"The euro has suffered more than most in the wake of Trump’s victory and we doubt that will let up anytime soon. Given our view that tariffs will be imposed next year and the ECB will ease by more than investors expect, we forecast the euro to slide to parity against the greenback by the end of 2025," says James Reilly, Senior Markets Economist at Capital Economics.

Deutsche Bank says that for EUR/USD to go below parity, a number of negative scenarios must play out in Europe and China, in addition to a strong set of USD-supportive developments.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

EUR/USD at 0.95 "would be an overshoot that takes the real trade-weighted dollar to record highs, exceeding the Volcker period. A more balanced approach to the various scenarios would suggest a EUR/USD drop to 1.00 that matches the dollar's historical record highs but does not exceed it," explains Saravelos.

Trump has far more experience going into his second term and is keen to hit the ground running, meaning he will be fast to deliver on his agenda.

It appears euro exchange rates came under pressure on Monday as Trump announced a series of 'hawkish' appointments to top positions, with analysts saying he is filling his top team with people who share his view on China and global trade.

This means he was not bluffing with his 'hawkish' trade agenda.

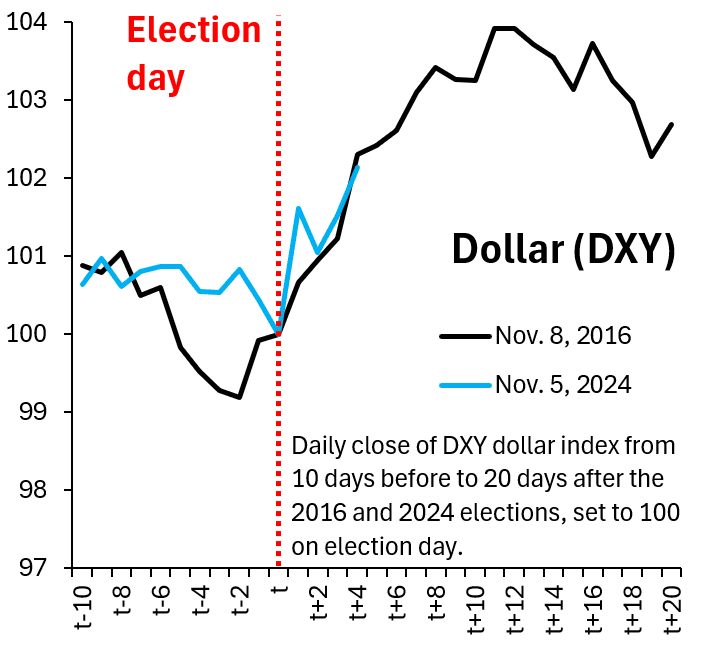

"The Dollar is rising almost exactly in line with what it did after the 2016 election. This is - so far - a conventional Dollar move driven by expectations of fiscal easing, the impact on growth and thus rate differentials. If tariffs come, this Dollar rise will get MUCH bigger," says Robin Brooks, Senior Fellow at Brookings Institute and previously the Chief Economist at the IIF and Chief FX Strategist at Goldman Sachs.

However, other analysts are not convinced and say it is too soon to talk about parity in the Euro-Dollar.

"EUR/USD parity? Not so fast," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Crédit Agricole acknowledges that Trump’s victory and the growing chances for a ‘red sweep’ in the U.S. Congress have added to the downside risks to their current EUR/USD forecasts.

However, there are reasons why this might not happen. These include the fact that markets have already made significant adjustments to the outlook of relative interest rate policy in the Eurozone and the U.S.

"Investors have pared back some of their Fed easing bets while pricing in very aggressive ECB rate cuts ahead, which suggests that many negatives are in the price of EUR/USD," says Marinov.

Furthermore, Marinov explains that U.S. tariffs could add to headwinds for growth but also fuel imported inflation in the Eurozone if EUR weakens further and the EU retaliates against the U.S., which could slow down the ECB easing cycle.

A potential boost to the Eurozone, according to Crédit Agricole, could come if Trump succeeds in his stated aim of ending the Ukraine war.

"All of these considerations would argue for more muted EUR/USD losses from here," says Marinov.