Euro to Dollar Week Ahead Forecast: 1.0665

- Written by: Gary Howes

Image © Adobe Images

Rewind to this time last week and things were looking up for the Euro to Dollar exchange rate (EUR/USD). Now, we are forecasting further losses in the coming days.

EUR/USD had broken above the 200-day moving average (DMA) last Monday, which was to form a solid support layer that would underpin an extension of a recovery that had been building in intensity since October 23.

But, then the U.S. election results came in, showing a clear win for Donald Trump and his Republican party, in a 'red sweep' that analysts say unambiguously supports the USD's outlook.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro is particularly prone to a new Trump agenda that would involve a blanket 20% hike in global import tariffs. The Eurozone's economy is one that relies heavily on the export of goods, meaning Trump's protectionist agenda is particularly challenging.

Trump wants to go further with tariffs on China (60%). However, China is another important market for the Eurozone's high-quality exports, meaning the bloc's economy is exposed in this direction too.

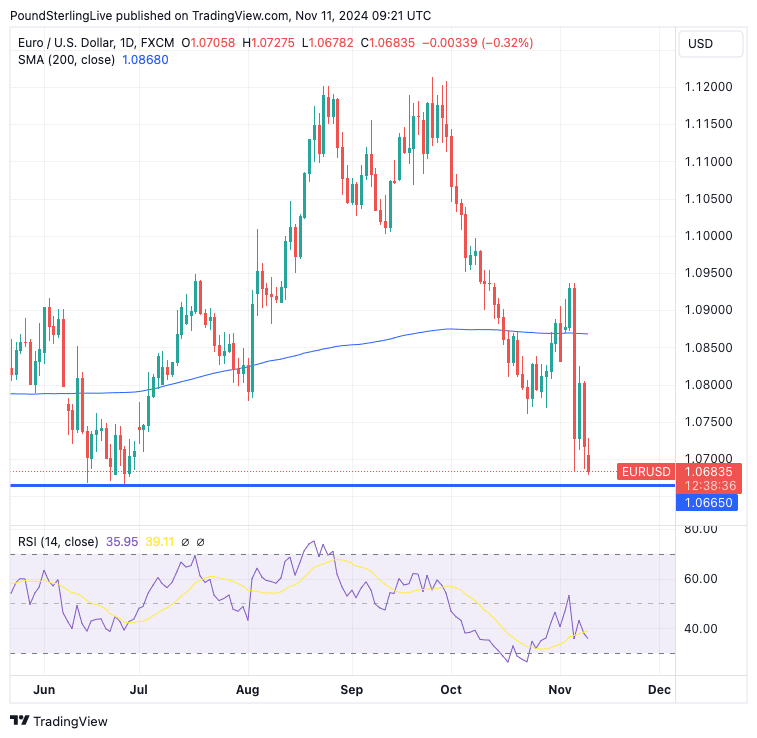

Euro-Dollar sliced through the 200 DMA on Wednesday (the blue line in the below chart), in a signal that the outlook has undergone a sudden swing in favour of USD strength.

The exchange rate's next objective is the June lows at 1.0665, where some residual support might be located.

There is a chance the 'Trump trade' is paused as markets await details from Trump. We know Trump is a negotiator at heart, and there is strategic strength in creating uncertainty; as he judges, this strengthens his hand in negotiations.

If Trump is open to negotiating with China and the EU, the worst-case scenario might not occur.

This can allow the Euro to rally in relief.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

If the market waits until January to make a decision, the Euro-Dollar can consolidate around 1.0665 and even rebound to the 200 DMA at 1.0868.

However, there is still some time before Trump enters the White House, and we think this means the balance of probabilities favours further Euro-Dollar weakness.

"President Trump’s pro‑growth policies can attract capital that boosts the USD. The fast money has already shifted capital. But long-term investors will take time to reallocate their portfolios. Therefore, there is more upside to the USD in our view," says Kristina Clifton, Senior Currency Strategist at Commonwealth Bank.

The main event on the USD's calendar is the release of inflation data, due Wednesday.

Here, the expectation is for a reading of 0.2% month-on-month and 2.6% year-on-year. Anything more and we could see the USD catch a bid.

However, there has been a significant repricing away from Federal Reserve rate cuts during October as investors prepare for U.S. economic outperformance, with the market now seeing a limited number of cuts forthcoming in 2025.

We think delivering a material reduction in rates would take a significant upside surprise for the USD. This is because a large part of the reduction in rate cut bets has already taken place, and it is difficult to see too much by way of USD upside in response.

Instead, the bigger reaction could follow a softer-than-forecast outcome, given there is now more space for markets to rebuild rate cut bets.

So, while the technical indicators advocate for downside in EUR/USD, some relief might come in the form of the midweek inflation print.