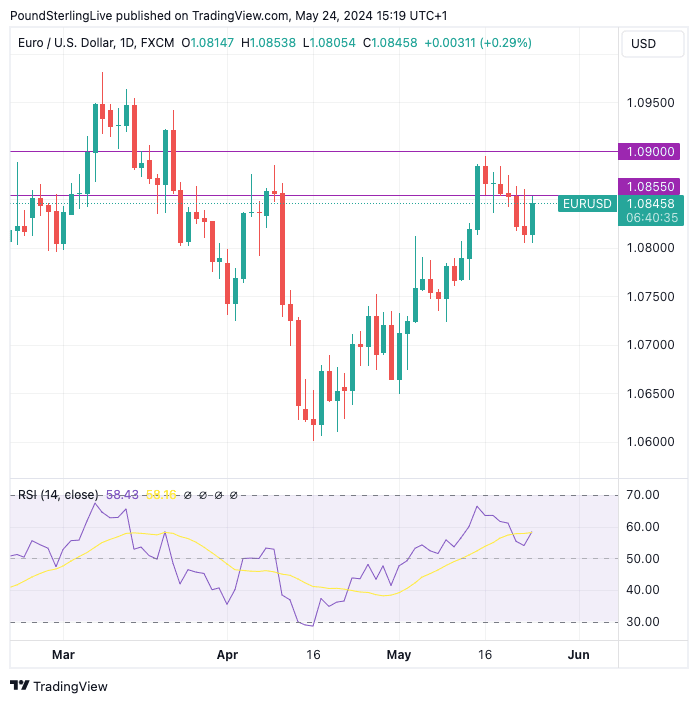

EUR/USD Week Ahead Forecast: Still Bullish, Inflation a Potential Stumbling Block

Image © Adobe Images

The Euro to Dollar exchange rate is forecast to maintain a constructive feel in the week commencing May 24. However, inflation measures from both the Eurozone and the U.S. will make for volatile trading at the end of the week.

The Euro registered its first weekly decline in six weeks against the Dollar last week, but this is a minor blemish on what is a bullish setup.

Euro-Dollar is in a short-term uptrend and last Friday's strong rejection in the low-1.08s maintains the constructive feel that can extend in the coming days.

"A solid-looking rebound in spot from the low 1.08 area has delivered a bullish reversal (outside range session) on the 6-hour chart, which suggests additional scope for EUR gains to the 1.0855/60 zone. EUR progress above here should allow for additional progress back to the 1.09 zone. Support is 1.0800/10," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Above: EUR/USD at daily intervals with potential upside targets indicated. Track EUR/USD with your own custom rate alerts. Set Up Here

Turning to the events that could shape price action in the coming days, Germany releases inflation figures on Wednesday, which can often provide a steer as to where the final Eurozone print - due Friday - is headed.

German headline CPI is expected at 2.8% year-on-year and the Eurozone equivalent at 2.5%. The rule of thumb is that an undershoot is supportive of ECB interest rate cuts, which can weigh on the Euro. The opposite stands for an overshoot in the numbers.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

However, Thomas Flury, Strategist at UBS, says the data's impact will probably be short-lived. He says even a stronger-than-expected print would not change the ECB’s strong commitment to a June cut.

"In fact, an upside surprise would weigh on the euro, as a mix of high inflation and lower rates is negative. An undershoot, however, would support the euro even further, as low inflation and lower rates typically lead to a relief rally for the currency," says Flurry.

Such a market reaction would be the opposite of what the playbook demands, making for an interesting week ahead.

The Dollar will take guidance from Thursday's U.S. GDP number, with the market looking for a reading of 1.5% annualised in the first quarter.

A stronger-than-forecast print can boost the Dollar as it would support a view the Fed is in no rush to cut interest rates.

Arguably more important than the headline GDP print would be the bit of the report detailing personal consumption, as this is an effective measure of inflation at the personal level.

The market expects personal consumption to read at 2.1% y/y in the first quarter.

Friday brings the release of the PCE deflator measure of inflation, which many economists fondly point out is the Federal Reserve's favoured measure.

A strong beat of expectations (2.8% year-on-year) could propel the Dollar into the weekend and upend Euro-Dollar's rally back towards 1.09, making it the main short-term risk to consider.