EUR/USD Week Ahead Forecast: Pulling Back Before Another Leg Higher

- Written by: Gary Howes

Image © Adobe Images

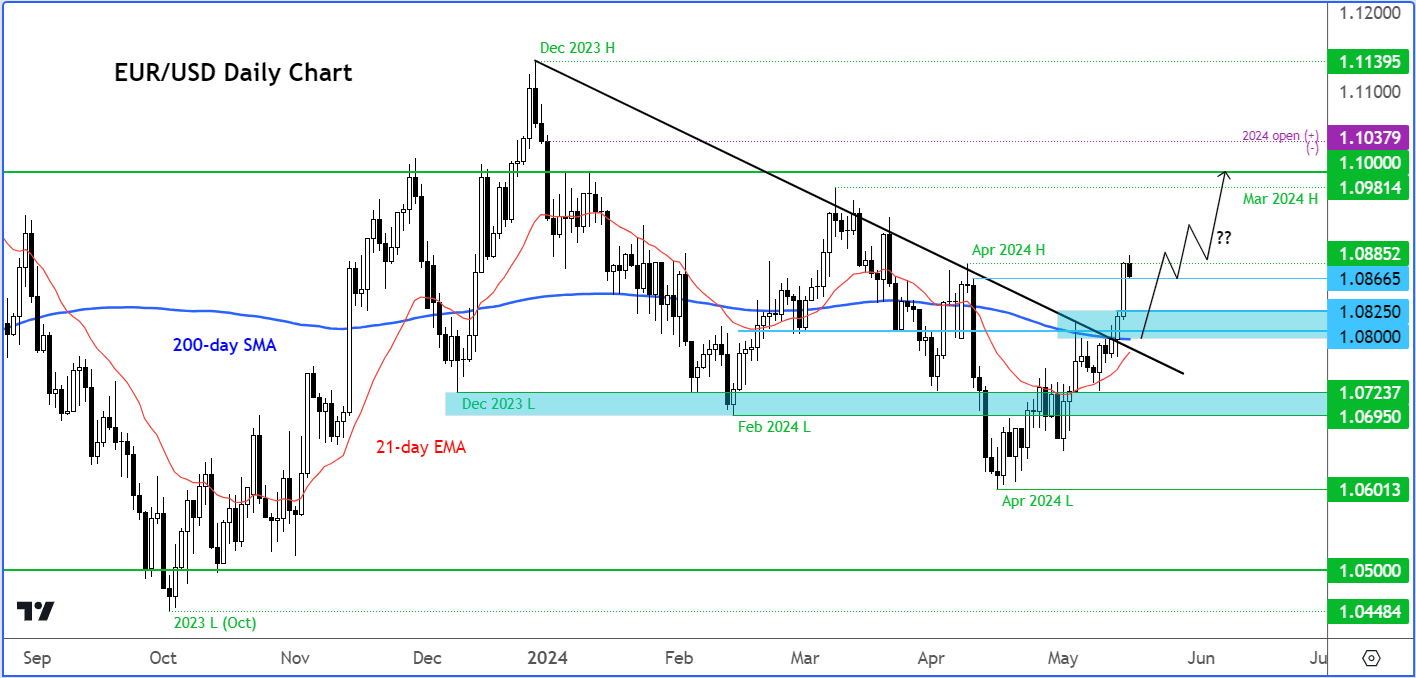

The Euro to Dollar exchange rate can fade lower from recent highs over the coming days before taking another leg higher.

The Euro completed a fifth weekly gain against the Dollar, spurred on by last week's softer-than-expected inflation print, which suggests the tide might be turning on the Dollar's 2024 rally.

A series of downside data surprises in late April and May have meant markets have once again started raising expectations for the number of Federal Reserve rate cuts that are likely in 2024, which suggests to us the Euro-Dollar lows for the year were reached in April.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The broader trend higher from April’s low remains intact and has the backing of a broadening alignment of bullish trend indicators across intraday, daily and weekly DMIs," says Shaun Osborne, Chief FX Strategist at Scotiabank.

The recovery is growing in confidence with the exchange rate crossing the crucial 200-day moving average. (Our Week Ahead Forecast rules state that an exchange rate is in an uptrend when above the 200 DMA).

Above: EUR/USD at daily intervals with the Bollinger bands and the 200 DMA illustrated.

The strong rally left the Euro looking somewhat overbought on some counts and a subsequent pullback from the 1.0894 high looks warranted. As the above chart shows, the exchange rate ran into the upper Bollinger band which signals an increasing likelihood of a pullback or consolidation.

"Minor losses from this week’s peak are extending a little," says Osborne, Chief FX Strategist at Scotiabank, "but the dip looks corrective, potentially ahead of another push higher."

So, the overall setup is one of potential weakness in the coming days, but the bigger picture remains one of recovery that could take the market back to 1.10. "Minor dips to the 1.08 area can be expected, but they should remain well-supported," says Osborne.

Image courtesy of Forex.com.

The main event for the Euro this week is Thursday's preliminary PMI numbers for May, which should confirm the recovery continues. Markets look for Germany's composite PMI to print at 43.5, any improvement on this could underpin the Euro. The main number to watch with regard to the pan-Eurozone release is the composite PMI, which is expected to read at 52, up from 51.7 in April.

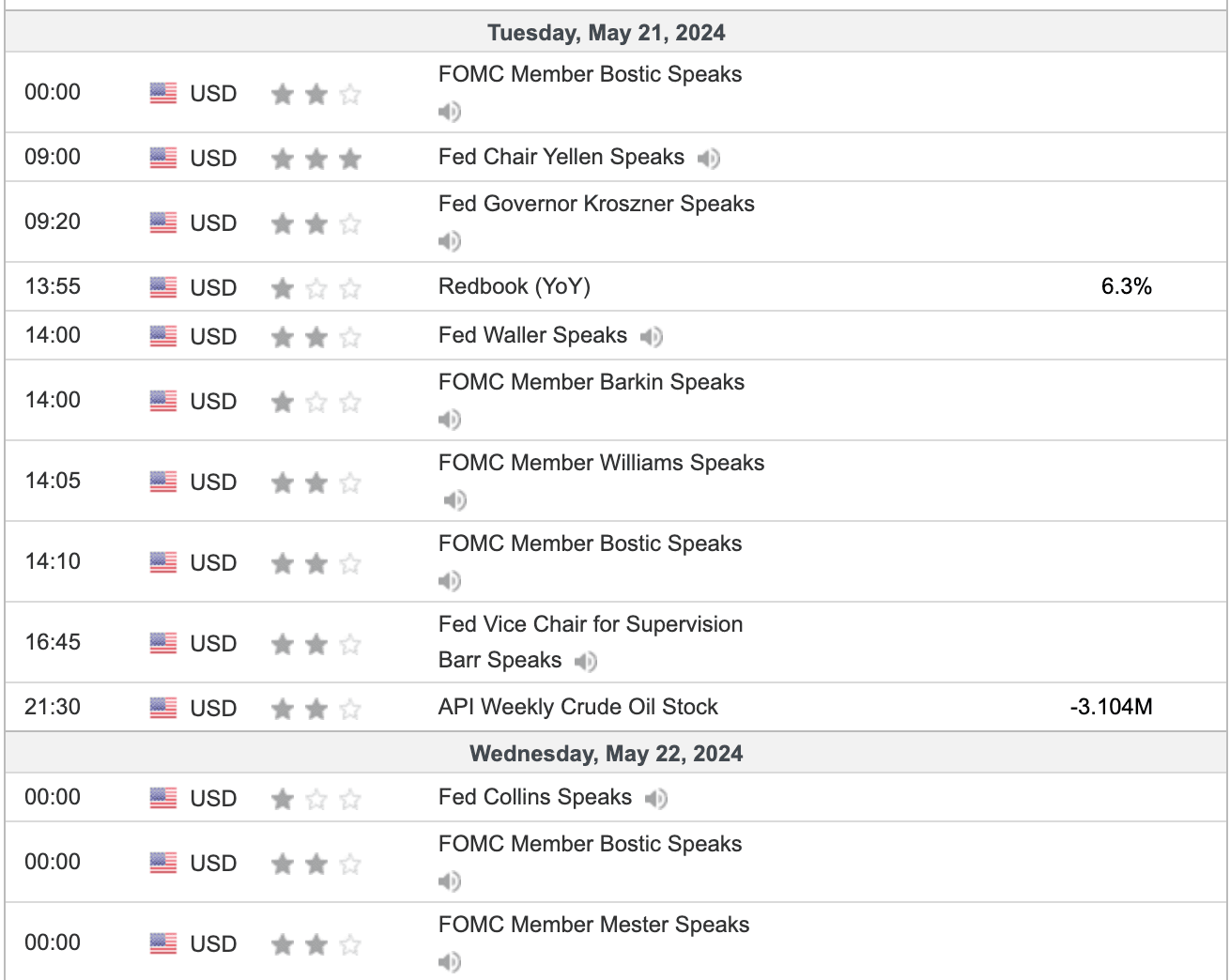

There are no major headline data releases due from the U.S. next week, however, there will be an unusually packed calendar of Federal Reserve speakers.

A look at the below shows the rump of the Fed speak will fall on Tuesday and Wednesday:

We expect the overall message to be one of caution when considering a recent slowdown in U.S. data, with most unwilling to say they support imminent rate cuts. Any impact on the Dollar won't last.