EUR/USD Week Ahead Forecast: Lost Momentum

- Written by: Gary Howes

Image © Adobe Images

The Euro's rebound against the Dollar appears to have run its course and downside impulses are expected during the coming week, particularly if Wednesday's Federal Reserve decision proves hawkish.

The Euro to Dollar exchange rate's 0.60% loss last Thursday will prove a decisive move from a technical perspective; until this point, Euro-Dollar was in a short-term uptrend that promised an eventual test of the big 1.10 figure.

The selloff was big by daily standards, and it brought a decisive end to the short-term uptrend and raised the prospect of further losses.

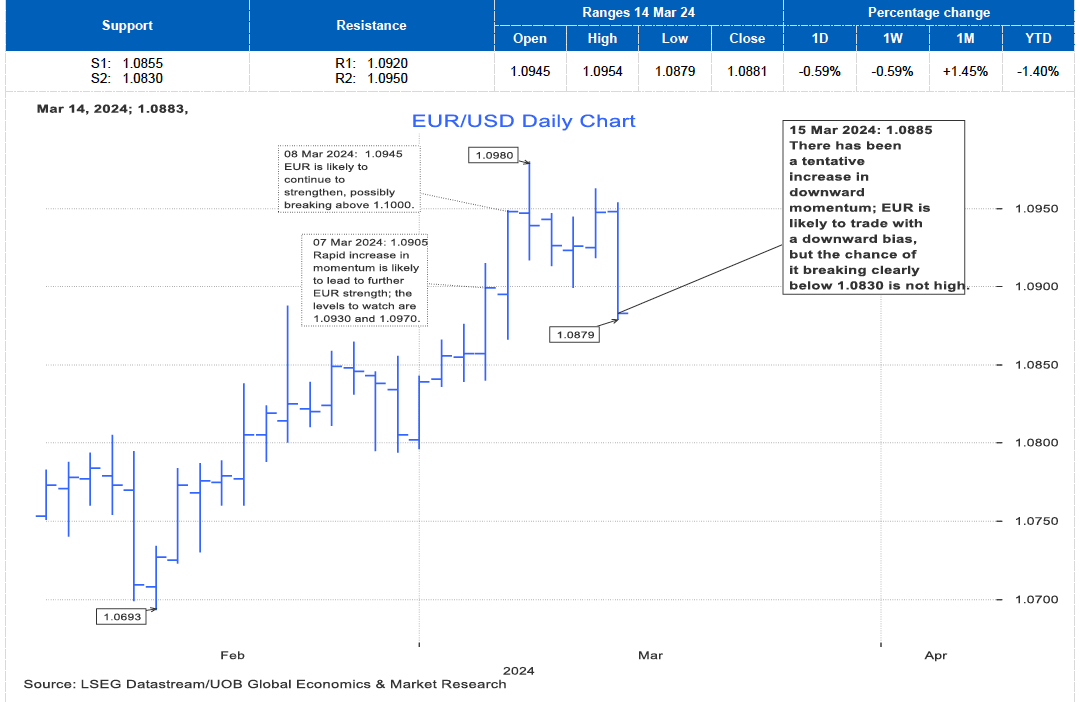

"The EUR strength from late last week (see annotations in the chart below) has ended. The price action has resulted in a tentative increase in downward momentum. For the next several days, as long as EUR stays below

1.0950, EUR is likely to trade with a downward bias. At this time, the chance of EUR breaking clearly below 1.0830 is not high," says Quek Ser Leang, Markets Strategist at UOB.

Image courtesy of UOB. Track EUR/USD with your own custom rate alerts. Set Up Here

According to the currency research team at Berenberg Bank, only "a close above 1.0970 would turn the sideways movement into an uptrend".

"However, until that happens, we are still in a correction of this year's downtrend, which has consolidated into a sideways trend," says Berenberg.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Key Risk of the Week: Federal Reserve Decision

With inflation and payroll data behind us, the next major event facing the Dollar is the March policy decision, due Wednesday at 18:00 GMT.

The Fed will keep interest rates unchanged and will likely reflect on the recent 'stickiness' in U.S. inflation and robust data outturns.

How strident the Fed sounds on the need to keep rates steady will be of interest and could pose upside risks to the Dollar.

Furthermore, upgrades to the Fed's new economic forecasts and interest rate projections (the dot plot chart) pose additional upside risks to the USD.

"The USD could have a better time of it. The median Fed dot for -75bp in 2024 cuts is flimsy, needing just two officials to back away. As it is, after two consecutive stronger CPIs, the March and April prints ahead of their June meeting must print decisively softer to give officials the confidence to ease," says a note from Westpac.

Image courtesy of Crédit Agricole.

"Key for the markets would be any indications that stickier US inflation, a more resilient real economy and easier financial conditions would be seen by the Fed officials as warranting a somewhat less aggressive easing from here. To the extent that this gives the USD rate appeal a boost, the currency could regain ground more broadly," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Eurozone PMIs

9:00 GMT on Thursday sees the release of Eurozone retail sales where markets expect a reading of 50.5 for services, confirming the sector is back in growth.

However, manufacturing is expected at 47 and the composite at 49.7.

The Euro has benefited from a run of better-than-expected readings of late, which suggests any undershoot in the figures would trigger the kind of disappointment that would prompt a decent EUR selloff.

"Next week, FX investors will focus on the preliminary Eurozone PMIs and the German ifo for March. With some positives related to the improving Eurozone outlook already in the price of the EUR, we think that the currency could be vulnerable to any potential downside surprises from the

data," says Marinov.

The German ifo release is due Friday at 9:00 GMT, with the market looking for the business climate component to increase to 86 from 85.5 and the current assessment to rise to 87.2 and 86.9.