EUR/USD Week Ahead Forecast: Clash of the Central Banks

- Written by: Gary Howes

- EURUSD short-term outlook deteriorates

- ECB in focus on Thursday, look for pushback against cuts

- This could support the EUR

- But Fed update on Wedneday makes for a busy week

Photo by: Sanziana Perju / ECB.

The Euro to Dollar exchange rate is back under pressure and prone to further losses unless the European Central Bank can 'out hawk' the Federal Reserve in the coming week.

The U.S. Dollar rebounded last week and gained against all G10 currencies apart from the yen; the EUR has meanwhile weakened sharply in December, driven primarily by the recent dovish repricing of ECB policy expectations.

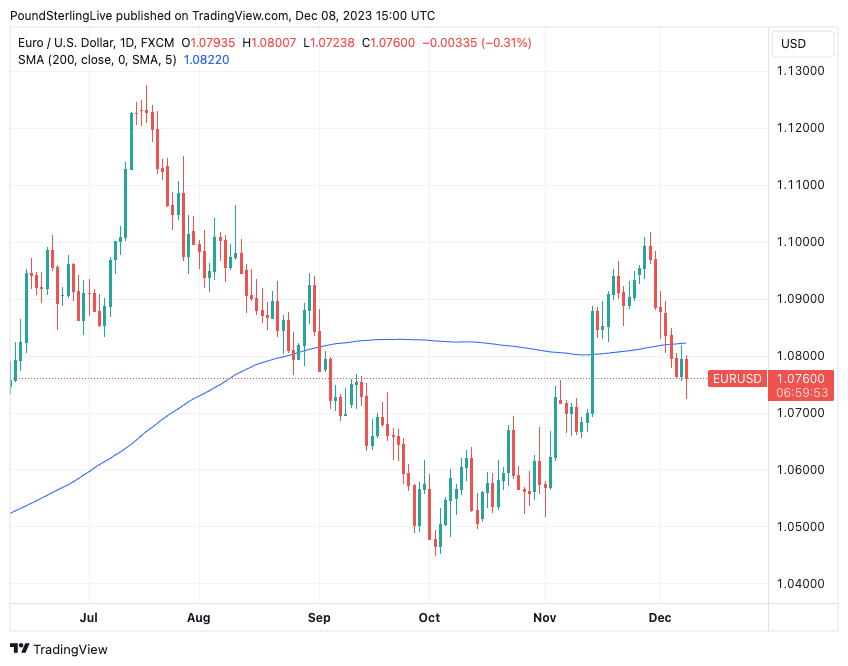

The result is EURUSD falling back into the middle of this year's trading range between 1.05000 and 1.1000.

In the process, the exchange rate has broken below the 200-day moving average, which could amount to a significant technical deterioration in the medium-term outlook:

Above: EURUSD at daily intervals with the 200 DMA annotated. Track EUR with your own custom rate alerts. Set Up Here.

This technical breakdown suggests the trend has shifted in favour of further downside, but we would not place a heap of weight on technical setups in a week packed with data events.

There is a decent chance the Euro stages a comeback over the coming days as the dovish repricing of European interest rate expectations reaches its limit and is prone to reverse, at least somewhat.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro has been a G10 laggard as markets moved to price in over 150bps cuts for next year, equating to an additional two rate cuts compared with pricing from just two weeks ago. Five interest rate cuts are expected from the ECB in 2024, with the first move seen in March.

For the Euro, how markets readjust following Thursday's ECB decision will determine price action. It is difficult to see how markets can get more aggressive on such pregnant pricing; can we seriously expect expectations to come forward ahead of March?

"We expect the ECB on hold next week. Communication and forecasts will suggest cuts are next, but not immediate. Risks of an April cut are up, but still not obvious. We stick to a first quarterly cut in June, faster moves in 2025," says Ruben Segura-Cayuela, Europe Economist at Bank of America.

The Euro could be better supported as markets cool their expectations regarding the ECB and rate cut expectations reverse.

Economists at Commerzbank say the ECB "will endeavour to limit market expectations of faster interest rate cuts," as inflation will only fall to the 2.0% target in 2025.

"Some reasons speak against rapid rate cuts," says Jörg Krämer, Chief Economist at Commerzbank. "The strong rise in wages continues to argue against a sustainable return of the inflation rate to the ECB's target in the near future."

U.S. Federal Reserve rate hike expectations have also come forward, and the Dollar could also benefit if the Fed pushes back against this development in its midweek policy decision and guidance update.

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

The highlight for the Dollar in the coming week is the Federal Reserve policy decision due midweek at 7PM GMT, where rates are expected to remain unchanged.

But the December meeting brings a fresh set of forecasts, which, combined with Chairman Jerome Powell's latest guidance, will move the markets.

"The appreciation of the USD over the last few days is likely to stay in place in view of the Fed meeting," says Dominic Schnider, a strategist at UBS.

"Investor expectations have shifted quite fast toward aggressive rate cuts next year, and the potential for disappointment—i.e., higher rates and renewed USD strength—should not be ignored," he adds.

Markets have brought forward expectations for Fed rate cuts to start around June, but these expectations were checked on Friday with an above-consensus U.S. labour market release.

A strong set of job and wage figures reminded markets the U.S. economy remains resilient and it is premature to expect rate cuts, which offered the Dollar a boost.

Track EUR with your own custom rate alerts. Set Up Here.

Ellie Henderson, an economist at Investec, says to keep an eye on the new projections for the Fed's interest rate levels.

She says the last time we received projections back in September (including the famous dot plot, which anonymously presents FOMC members' expectations on the path for rates) the median view on the committee was for the Fed funds target range to end this year at 5.50-5.75% i.e., one more hike.

"Considering the progress made on inflation and the slightly weaker economic data for the start of Q4 (such as retail sales), we do not expect this final hike of the year to occur. What will be of most interest though is the path thereafter, as markets and economists disagree over the potential pace of interest rate cuts next year," says Henderson.

Investec expects that the fears on the committee will be tilted towards the threat of an inflation resurgence rather than the fear of a deep downturn in the absence of faster rate reductions.

"As such, for the projections, we expect the FOMC to pencil in more rate cuts next year than was outlined in September but show restraint relative to market pricing," says Henderson.

From a currency market perspective, this would be supportive of the Dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes