EUR/USD 5-Day Forecast: "Ample Room" for Upside Correction

- Written by: Gary Howes

- EURUSD upside correction can extend

- Gains to 1.0675/1.0725 possible

- U.S. employment data and Fed Chair speech in focus

Image © Adobe Images

The Euro to Dollar exchange rate (EURUSD) could rebound over the coming days according to analysts who see scope for a further unwinding of recently oversold conditions, but this week's busy U.S. data and event calendar must show a clear weakening in activity if any gains are to be sustained.

The Dollar remains dominant on a multi-week timeframe as markets respond to signs of ongoing U.S. economic outperformance relative to that of the Eurozone, which has shored up the advantage of U.S. bond yields over their Eurozone counterparts.

The fundamentals are further backed up by the recent 'risk off' tone to markets as investors feared for global economic growth amidst surging long-term bond yields across the developed markets.

The extent to which these overarching themes continue to play out over the coming days will impact the direction of Euro-Dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

But, the pair was left deeply oversold last week and subsequent profit-taking and a rebalancing in the market could extend over the coming days, favouring a further recovery in the Euro.

EURUSD short-term technicals are bullish says Shaun Osborne, FX Strategist at Scotiabank in a recent analysis of the pair: "two solid up days (so far) for the EUR barely makes a dent in the sustained sell-off seen since July’s peak but EUR is oversold and there is ample room for a correction—at least—in recent losses."

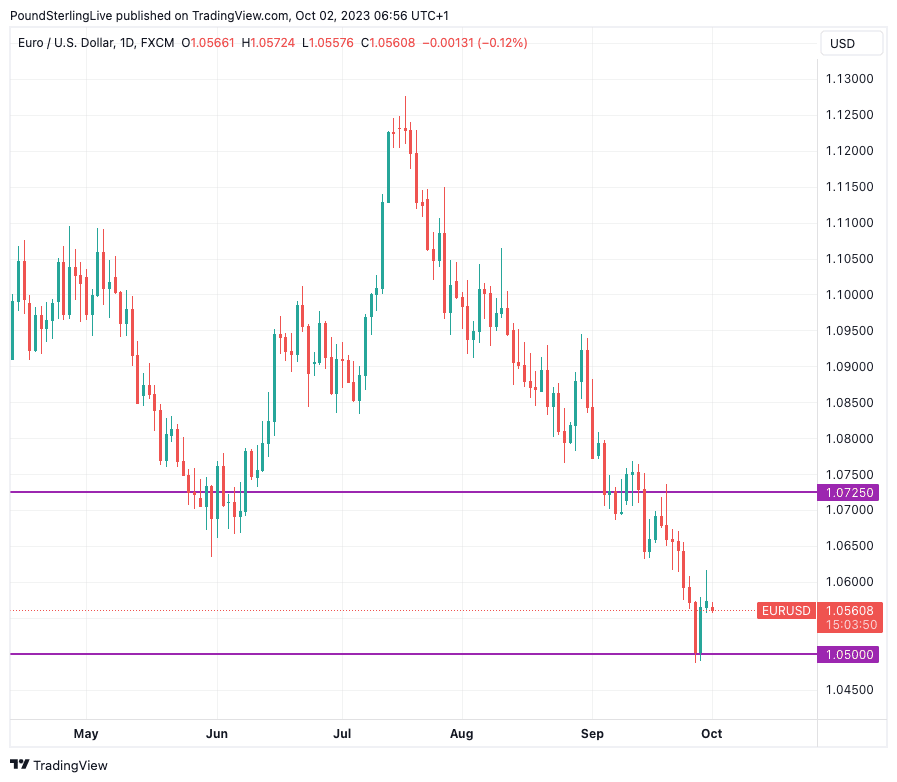

Osborne says the weekly candle pattern reflects a potential “hammer” signal which will support the impression of a low developing around the previous week's test of the 1.05 area.

"Gains might extend to 1.0675/1.0725. Support is 1.0575/00," he adds.

Above: EUR/USD daily chart with potential resistance and support levels, as identified by Scotiabank's Osborne.

The Eurozone's data and event calendar is light this week and the focus for markets is firmly on the U.S. where a slew of data releases are in focus.

The U.S. ISM Manufacturing PMI is due Monday at 15:00 BST, markets are looking for a reading of 47.8 for September, from 47.6 previously.

"Upcoming US data, like the ISM manufacturing and nonfarm payrolls, are unlikely to stall current USD momentum, in our view. The releases are likely to be robust and help keep the dollar well-bid," says Dominic Schnider, a Strategist at UBS.

Federal Reserve Chair Jerome Powell is then scheduled to speak at 16:00 BST, in what could amount to the most pivotal event of the week, provided he touches on monetary policy.

Recall that it was Powell's message that U.S. rates would remain elevated for an extended period of time that prompted the market to sell U.S. Treasuries, in turn jacking up their yield in what amounted to a market-negative event.

"Markets digest the message from the Fed of a possible last hike and only two interest rate cuts next year, and we have seen financial conditions continue to tighten," says DNB's Østnor.

For the Dollar, the rising yields proved supportive. Does Powell say something that cements the message from the September 20 policy update, or does he strike a more 'dovish' tone in light of the recent move in yields?

If the latter, then the Dollar can retreat further.

Tuesday sees the release of JOLTs job openings at 15:00 BST, which should give an indication as to how the labour market is evolving. We actually saw last month's release prompt a market reaction so we will be watching the August release.

The ISM non-manufacturing PMI is due for release at 15:00 BST where a figure of 54 is expected, which would be consistent with an ongoing and robust expansion of the U.S. economy.

Such an outcome would not be a surprise in itself given the U.S. outperformance theme is now well understood, therefore the bigger market reactions would lie with an undershoot.

The week ends with the all-important release of U.S. non-farm payrolls that tend to give the final word on how the jobs market is evolving.

The headline is expected to print at 150K and a beat would prove supportive of the Dollar as it would likely shore up U.S. yields as markets bet the Fed has little choice but to go with another rate hike in November.

But an undershoot would see such expectations ease, potentially resulting in Dollar weakness ahead of the weekend.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes