Euro-Dollar: "Directionally, There is Only One Way" says Jefferies

- Written by: Gary Howes

Image © European Central Bank, reproduced under CC licensing

The European Central Bank (ECB) is unlikely to be supportive of the Euro when it meets on September 14 according to one analyst we follow who has assessed the foreign exchange landscape following the release of stubborn Eurozone inflation data.

Brad Bechtel, Global Head of FX at Jefferies LLC, says the combination of stubborn core and elevated headline inflation rates leaves the ECB unable to offer any Euro-supportive guidance when it meets mid-month.

"Directionally there is only one way for the EUR/USD from here," he says in a regular daily currency briefing following the release of Eurozone inflation figures.

Eurostat reported the Eurozone's inflation rose 0.6% month-on-month in August, a sharp increase on July's -0.1% and exceeding expectations for 0.4% growth.

"Inflation in the Eurozone continues to show signs of rebounding, or at least stabilizing at a high level," says Bechtel.

This week saw Germany post inflation a tenth higher than expected after the states' data there implied a two-tenths higher print, Spain also came in one-tenth higher than expected by markets.

France also saw inflation come in ahead of expectation at 1.0% m/m vs. 0.8% expected and 0.1% previously.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The August inflation data now informs the September 14 ECB policy decision, which current market pricing shows investors positioned for rates to be kept on hold with a 60-40 split, although a number of analysts we follow say another hike is likely.

"The hawkish hold narrative that the ECB had been angling for at the next meeting is likely slipping away a bit as these sorts of prints are going to put pressure on them to hike at the next meeting instead," says Bechtel.

The decision and guidance on future decisions will meanwhile prove a key moment for the Euro in the coming month. "In either scenario the EUR should underperform," says Bechtel.

"If they do a hawkish hold it won't be enough to fight back inflation and if they do end up hiking it will be at the expense of growth," he adds.

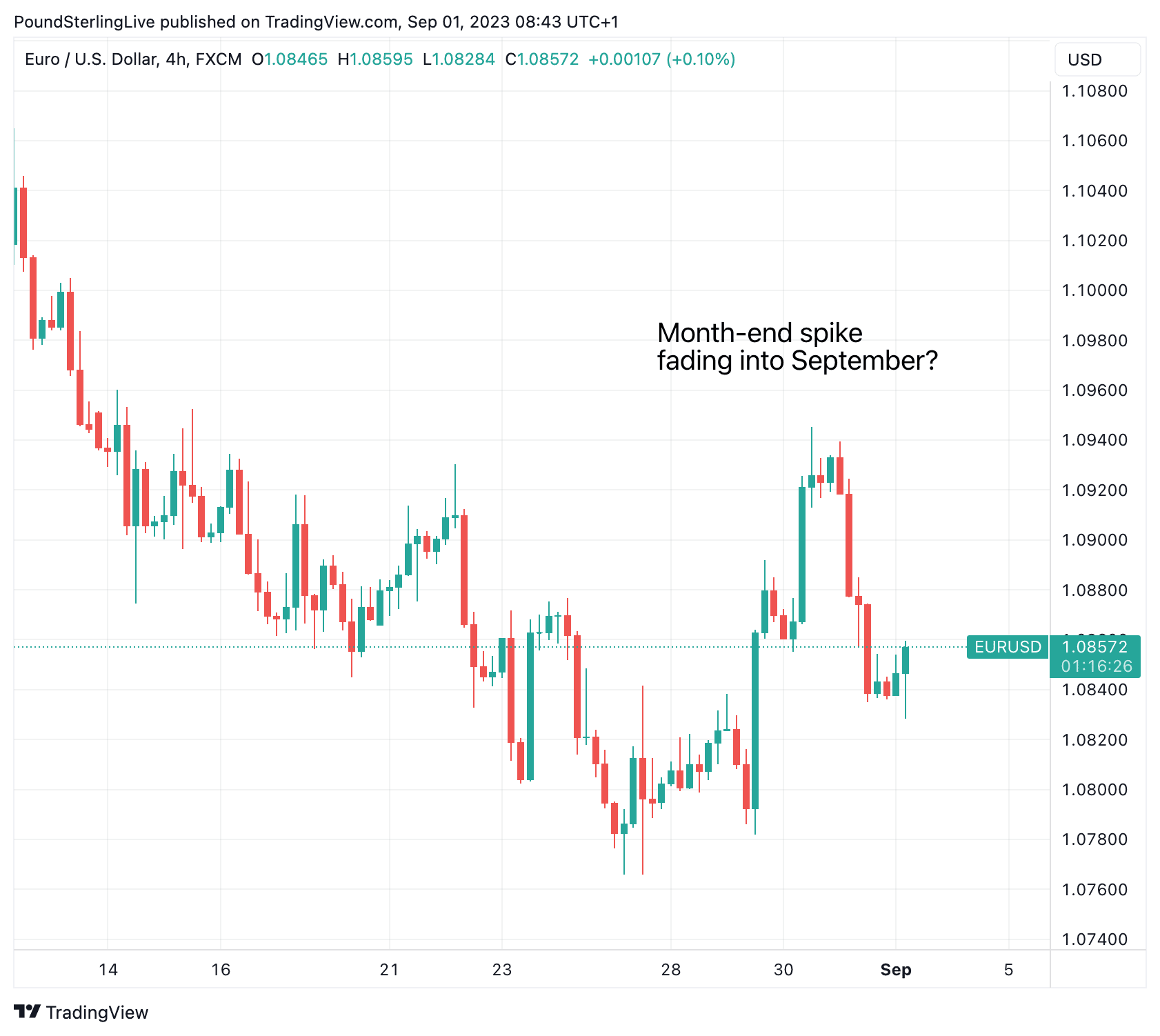

Above: EURUSD at four-hour intervals.

The Euro softened in the minutes following the release of Eurozone inflation data which showed core CPI inflation - a closely watched gauge at the ECB - fell to 5.3% year-on-year in August, down from 5.5% in July.

"Month-end flows are still out there as well, so the price action is not crystal clear, but I do think directionally there is only one way for the EUR/USD from here," says Bechtel.

But Jamie Dutta, Market Analyst at Vantage, says the falling core eurozone inflation print has seen markets move the dial more firmly towards an ECB pause at its September meeting.

"Traders had been reluctant to fully price in one last increase with the implied probability stuck around 50% over the last few weeks. These bets moved lower to roughly a one in three chance after the data, with the euro making new lows for the day," he explains.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes