Odds-on That Euro-Dollar Goes Lower in Wake of Fed: TD Securities Strategists

- Written by: Gary Howes

Image © Adobe Images

TD Securities has laid out its strategy scenario for the Euro to Dollar exchange rate (EURUSD) heading into the midweek Federal Reserve policy decision.

The market is prepared for the Fed to forgo a rate hike - a conviction that has increased in light of Tuesday's below-consensus U.S. inflation reading - however, TD Securities expects a final hike to be the outcome.

"This week's decision is likely to come down to the wire, but we maintain our long-held view that the Fed will tighten rates by a final 25bp in June to a range of 5.25%-5.50%. If the Fed decides to 'skip' the June meeting, we expect the decision to be accompanied by communication that leans hawkish, signalling a likely hike in July," says Oscar Munoz, Chief U.S. Macro Strategist at TD Securities.

TD Securities attaches a 55% possibility the Fed hikes again, while they also expect Chair Jerome Powell to reiterate that the Fed remains data dependent and that economic data since the May FOMC meeting have not shown convincing signs of slowing.

"He will also make clear that inflation risks remain elevated," says Munoz.

What does this mean for Euro-Dollar?

Munoz's colleague, Mark McCormick who heads G10 Strategy at TD Securities, says their base case scenario envisages about -0.10% downside in Euro-Dollar.

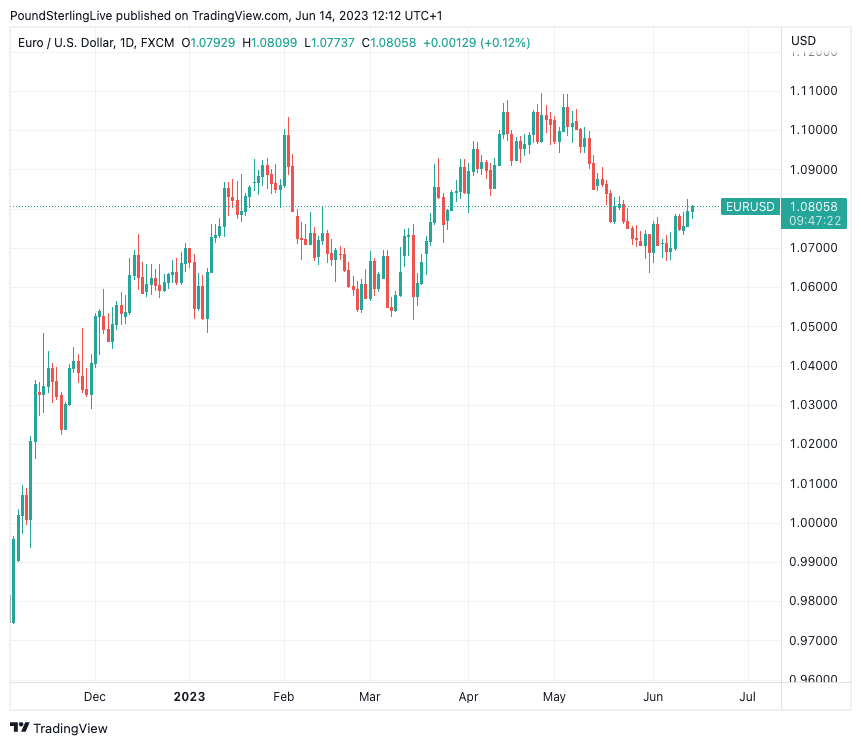

Above: EURUSD at daily intervals showing the Euro is trying to recapture its uptrend.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

But this downside grows to -0.20% in the event the Fed delivers a 25bp rate hike but also commits to additional rate increases.

Such a 'hawkish' outcome has odds of just 5% attached by TD Securities who reckon the Fed would need to justify the move by arguing labour-market conditions, consumer spending, and underlying inflation remain elevated.

The odds of the Fed leaving rates unchanged are meanwhile set at 40% by TD Securities.

Here, "the Fed skips a rate increase but signals that further hikes are possible," says Munoz.

"While economic activity indicators have yet to suggest the Fed is on a clear path to 2% inflation, they can afford to gather more data given the accumulation of rate increases and as the risks to the outlook have become more two-sided," he adds.

McCormick reckons under such an outcome the Euro-Dollar exchange rate could rally in the region of 0.60%.

Looking beyond the near-term post-Fed reactions, the broader picture for the Dollar outlook is clear says the analyst:

"Whether the Fed hikes in June or July (or skips both) the USD is focused on the near completion of the tightening campaign, skewing the risks towards a USD pullback in H2."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes