Euro Outlook: Fresh Gas Price Falls, Flow Dynamics Underpin Positive EUR/USD Story says Deutsche Bank

- Written by: Gary Howes

- Deutsche Bank holds positive EUR/USD view for 2023

- As gas market dynamics continue to improve

- TTF gas prices hit fresh 17-month low

- Supportive capital inflows seen accelerating

Image © Adobe Images

The Euro has come under pressure against the Dollar of late, but falling gas prices and supportive capital flows will see it higher over the coming months says Deutsche Bank.

"Underlying flow dynamics are turning dramatically more positive for the euro this year," says the German bank in a new currency research briefing.

Natural gas market developments are seen to be particularly supportive of the Euro, thanks to an ongoing decline in prices.

"Prices have continued making fresh lows in recent days which will reduce Europe's energy bill," says George Saravelos, a strategist at Deutsche Bank in London.

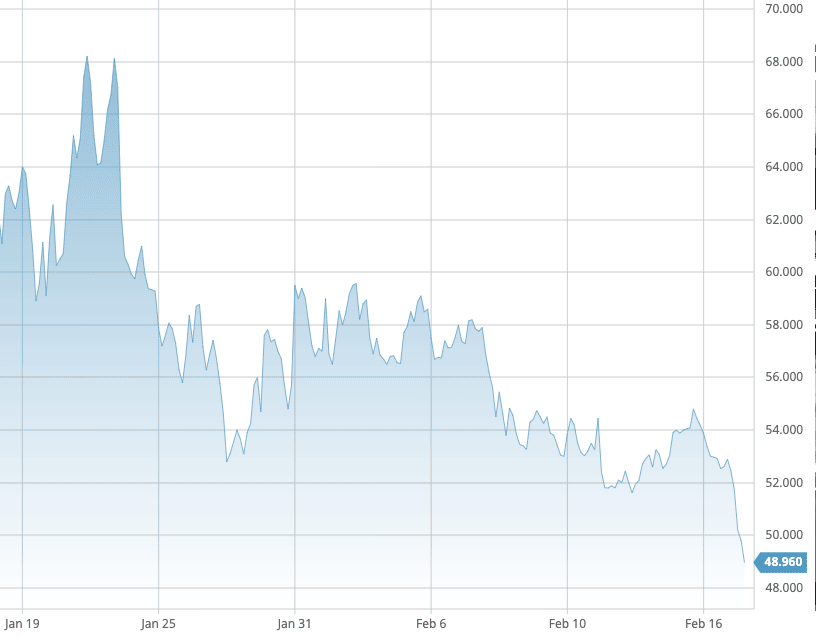

Wholesale natural gas prices in Europe dropped to their lowest level in 17 months on Friday to €49.80/Mwh amidst increased wind electricity production, relatively warm temperatures and steady imports.

Above: TTF gas contract prices for March, source: Barchart.

However, the falls are not registered in the Euro to Dollar exchange rate (EUR/USD) which continues to extend a recent pullback from highs just above 1.10.

At the time of writing EUR/USD spot is quoting at 1.0630 as a broader comeback in the Dollar - associated with a recent spate of stronger-than-expected U.S. data - works through global currency markets.

But Saravelos says dips in the Euro against the Dollar should be bought as the energy crisis of 2022 fades.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Deutsche Bank estimates that on current trends, gas storage could be refilled by the summer.

"After that, Europe won't need to buy more gas until winter. In all, we estimate Europe's import bill could more than halve this year, implying 100bn-150bn less EUR selling from natural gas alone," says Saravelos.

But Robin Brooks, Chief Economist at the IIF and former Chief FX Strategist at Goldman Sachs, says the Euro has further to fall as the Eurozone remains in the grip of an energy crisis.

"The Euro has resumed its fall to parity. This fixes one of the bigger mispricings in global markets. Euro should never have risen the way it did. Markets wrongly priced a mild winter and absence of energy shortages as a sign that Europe's energy shock is over. The shock is ongoing," says Brooks.

Above: The pullback in EUR/USD is justified says Brooks. But Saravelos says dips should be bought. Consider setting a free FX rate alert here to better time your payment requirements.

However, it is the return of investor capital into the Eurozone that is of the most consequence to the EUR/USD outlook, according to Deutsche Bank strategists.

Researchers find the era of negative interest rates at the European Central Bank prompted investors to embark on a huge divestment programme of domestic yield in favour of foreign assets over the last decade.

Most of the capital was sent to the U.S.

"With European yields now turning higher, these outflows have stopped. Compared to just a few months ago, we observe a net EUR 800bn shift in portfolio flows in favour of the euro," says Saravelos.

Deutsche Bank expects a structural interest rate differential widening in favour of Europe this year, which would in turn benefit Euro exchange rates.

"Flow dynamics are turning dramatically more positive for the euro this year. This remains one of the structural underpinnings of our bullish EUR/USD view," says Saravelos.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes