EUR/USD Rate has Peaked for Now say Analysts, But One Italian Lender Looks for More

- Written by: Gary Howes

- EUR rally has reached limits near-term

- Soc Gen says EZ growth expectations peaked

- Danske Bank says all the good news is in

- Most see gains resuming later in 2023

- But Intesa Sanpaolo says near-term gains likely

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) has peaked for now, unless the Eurozone's energy crisis can be truly considered solved, says a leading foreign exchange analyst.

Kit Juckes, who is Global Head of Foreign Exchange Strategy at Société Généale says the Euro's recovery has been driven to a great degree by relief that the Eurozone has passed the peak of its energy crisis.

The easing of the energy crisis has allowed the Euro to rally alongside improved economic growth expectations, but although the crisis era has passed energy security remains an issue says the analyst.

"The euro may consolidate unless European confidence improves. And the key to that may be the extent to which consumers and economies are confident that the energy crisis is behind us," says Juckes in a recent currency review and outlook note.

"Economic agents will not easily ignore Europe's dependency on imported (and in particular Russian) energy," he adds.

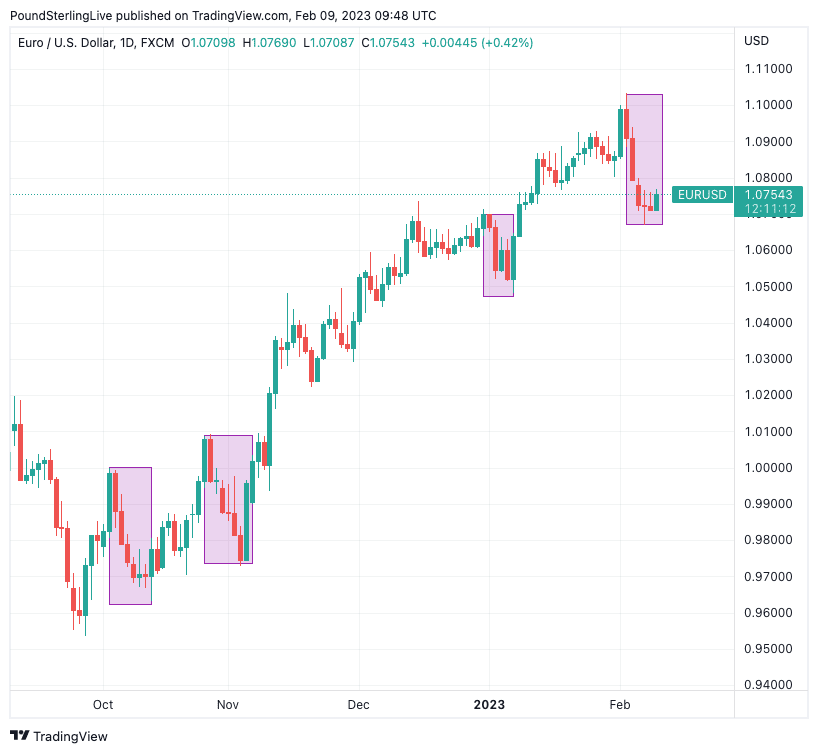

Above: The chart compares the current pullback with three other significant reversals in the current cycle.

EUR/USD rallied to a high of 1.1030 on February 02, the culmination of a four-month rally from lows at 0.9535.

The subsequent retreat back to 1.0750 leads a number of foreign analysts to question whether the rally is now due a pause in the short-term.

"Just about everything that could go right for the EUR has happened the past month. We think the EUR rally has started to lose steam," says Jens Nærvig Pedersen, an analyst at Danske Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Scandinavian lender and investment bank says the drop in the value of the Euro since last week is therefore "well grounded" and it looks for more to come.

"While improving expectations helped the euro, the currency has done far better than they might suggest," says Juckes.

The retreat in the single currency leaves EUR/USD spot at 1.0760 at the time of writing, taking bank payment rates to approximately 1.0380, cash and holiday rates at competitive providers to approximately 1.0660 and transfer rates at competitive providers to around 1.0730.

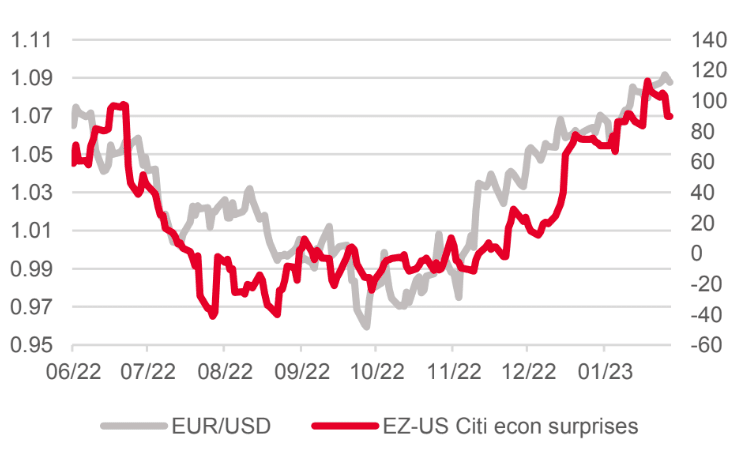

For rates to lift materially higher Société Générale says Eurozone economic data must start surprising to the upside again.

Above: "Have relative economic surprises turned less euro-friendly" - Société Générale.

"It may have peaked, now that European growth expectations have made a big adjustment upwards," says Juckes.

Société Générale says it retains an end-2023 EUR/USD forecast for 1.12. "If markets are persuaded, rightly on wrongly, that the energy crisis is solved and won't return, EUR/USD could trade back to 1.20, based on where we think bond yield differentials are heading," says Juckes.

But Asmara Jamaleh, an economist at Intesa Sanpaolo in Milan, reckons the Euro should be higher against the Dollar.

"Relative monetary policy between the ECB and the Federal Reserve matters, and is currently favouring an extension higher in the Euro," he says in a recent note.

The Dollar jumped against the Euro on Friday after a stronger-than-expected job report prompted investors to fully expect a further cumulated increase worth 50bp from the Federal Reserve.

However, comments from Fed Chairman Jerome Powell said on Tuesday night that it was too soon to react to the jobs report, prompting market expectations to ease back again.

This has put a lid on the EUR/USD decline in the near term. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Jamaleh expects the European Central Bank to deliver more by way of interest rates than the Fed over the course of 2023, and this is supportive of the Euro.

"The actual size of the ultimate misalignment between the ECB and the Fed will be important, as it will condition the levels of the EUR/USD exchange rate," says Jamaleh.

The Fed is meanwhile expected by markets to begin cutting rates later in 2023, but the ECB won't owing to a more stubborn inflation profile in the Eurozone.

This would further assist Euro upside says Jamaleh.

"We have kept unchanged our forecasts for the exchange rate, in the near term as well, at EUR/USD 1.10-1.12 on a 1m-3m horizon," says Jamaleh.

On a six-month horizon, the forecast rises to 1.14 and 1.15 in twelve months.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes