EUR/USD Week Ahead Forecast: "Could easily trade to 1.05"

- Written by: Gary Howes

- Waller shores up USD at start of week

- But position washout can run further

- Move to 1.05 possible says ING

Image © Adobe Images

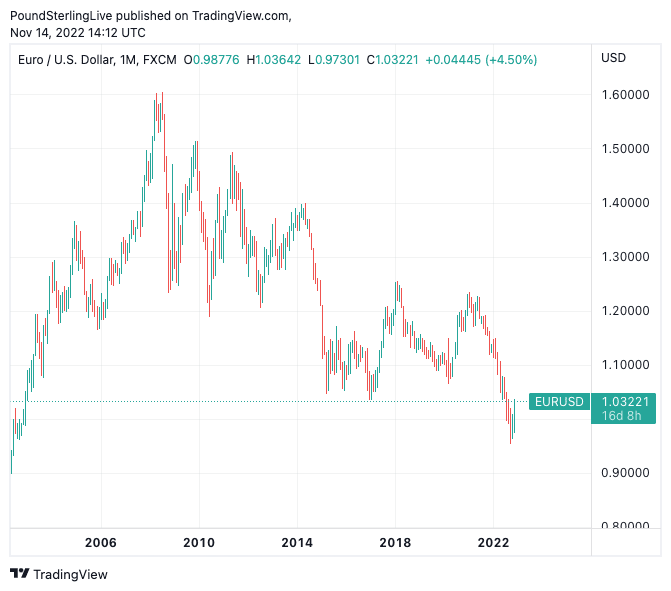

The Euro to Dollar exchange rate (EUR/USD) could extend its near-term recovery over this coming week say analysts, although many remain of a view the market is witnessing a technical position clear-out and not necessarily the start of a long-term rebound.

The Dollar was given a helping hand at the start of the new week, thanks in part to comments from Federal Reserve Governor Christopher Waller that the Fed was nowhere near ready to end its rate hiking cycle.

The Dollar index, a measure of broader dollar performance, fell by 4% last week as investors responded to an unexpected decline in U.S. inflation.

The data suggested the peak in U.S. inflation is at hand and therefore the Federal Reserve can consider slowing down the pace of hikes, with most investors now anticipating a downshift to 50 basis point hike in December.

But Waller said investors risk getting carried away with a belief the end of rate hikes is close.

"We're at a point we can start thinking maybe of going to a slower pace," Waller said at a conference in Australia, but "we're not softening... quit paying attention to the pace and start paying attention to where the endpoint is going to be. Until we get inflation down, that endpoint is still a ways out there."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The EUR/USD exchange rate rose 4.0% last week and is near those highs at the start of the new week at 1.0325, taking retail bank transfer rates back above parity for the first time in weeks to approximately 1.0040.

However, competitive payment specialists are offering well above parity in the region of 1.03, according to our data.

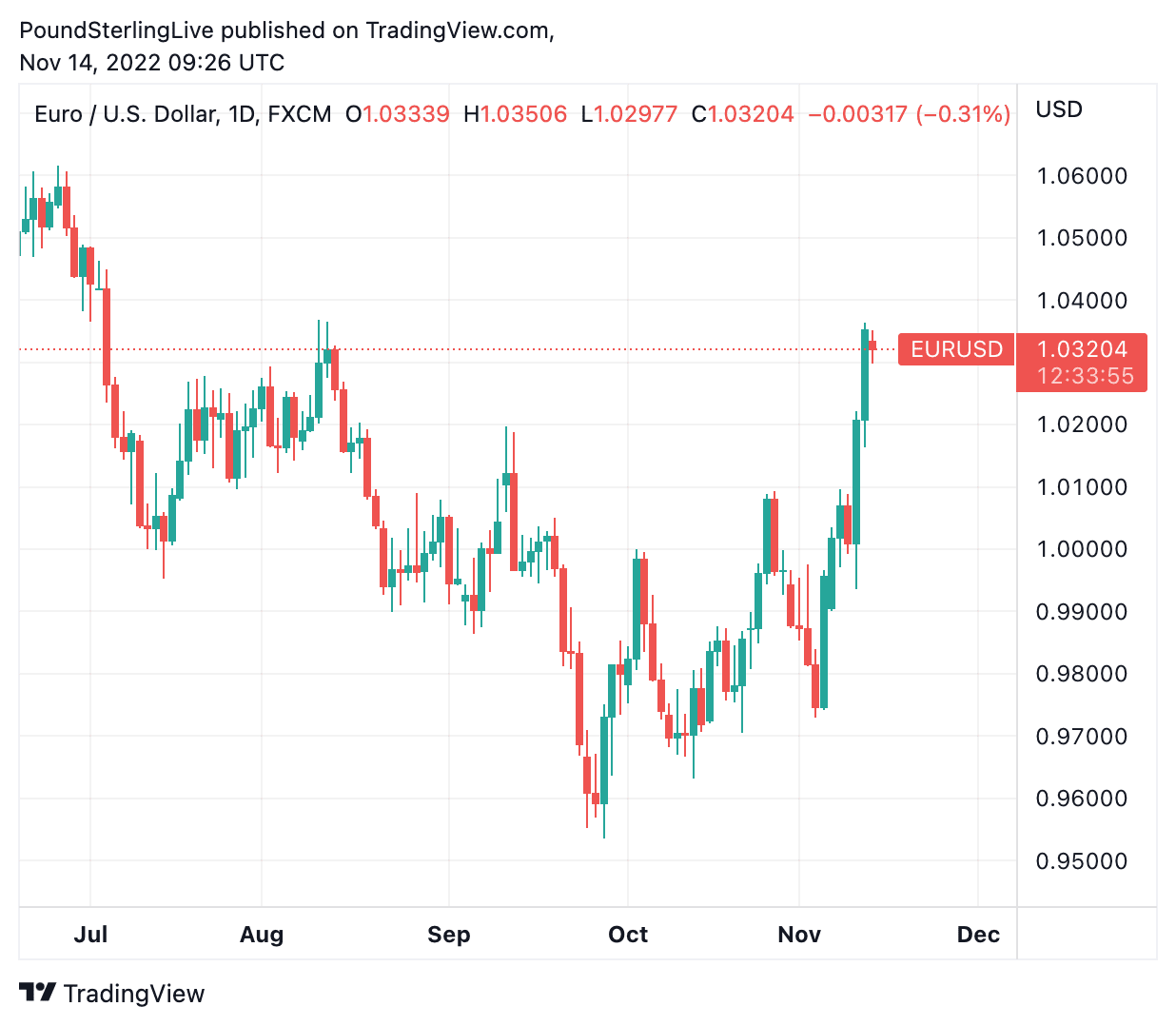

"The severity of the EUR/USD correction has caught out many (including ourselves)," says Chris Turner, Global Head of Markets for ING Bank. "This largely looks like a function of position adjustment."

Above: EUR/USD daily. To better time your payment requirements, consider setting a free FX rate alert here.

The Euro was boosted on Monday after Eurozone industrial production rose 0.9% month-on-month for September and 4.9% year-on-year.

The figures are much better than the expected +0.1% m/m and 2.8% y/y, suggesting the bloc's fall into recession could be delayed.

"In absolute terms, the Eurozone recession may not be as deep as feared a few months ago, despite high energy costs and a sharp rise in the ECB rate," says Alex Kuptsikevich, FxPro's senior market analyst.

"We note that commodity prices have fallen significantly in recent months. A relatively strong economy by the start of the extreme hike cycle forms more room for an ECB rate hike, which is suitable for the euro," he adds.

FXPro expects the EUR/USD will likely face a few obstacles for the upside up to the area of 1.0400-1.0430, where the 200-day MA and the support of the pair in May-June are concentrated.

"Here, the pair could face local profit-taking, and there will be a fierce tug-of-war between the dollar bulls and the bears in the markets," he adds.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

A risk for those hoping for a stronger Euro is that the recent rally proves to be largely technical in nature and the Dollar starts to strengthen as investors heed the warnings of the Fed that it is by no means done with its interest rate hiking cycle.

"Further declines in the short term cannot be ruled out as markets unwind the long USD positions. But, let's be clear, one data point does not signify a pivot or a change in Fed policy," says Thanim Islam, Market Strategist at Equals Money.

Waller emphasised that while the inflation data was welcome, it was still a single reading.

"The very difficult question is whether this short EUR/USD squeeze has run its course near 1.0365 or needs to trade higher still," says ING's Turner.

Markets have been heavily invested in the 'long' Dollar trade for a number of months now, an understandably popular position in a climate of falling stocks and accelerated Federal Reserve rate hikes.

And a further clearing out of this significant build-up of bets could continue over the coming days, according to Turner.

The ING analyst says given the depth, conviction, and one-sided nature of long dollar positioning, we all need to be careful about prematurely calling an end to this correction.

"Indeed, EUR/USD could easily trade to 1.05 were conditions/data to fall into place," says Turner. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: EUR/USD at monthly intervals, showing the historically low levels.

The data docket in both the U.S. and Eurozone is light this week and EUR/USD is likely to take its guidance from global conditions and technical adjustments.

We look out for further comments from Federal Reserve speakers and would imagine they follow the same line as Weller in warning that the Fed is not done.

Fed speakers include Brainard (16:30 GMT) and Williams (23:30) on Monday.

Cook speaks on Tuesday (14:00), Williams (14:50) and Waller (19:35) are both out on Wednesday.

Thursday sees Bullard (13:00), Bowman (14:15), Mester (14:40) and Jefferson (15:40).

The Fed speakers are likely to present a sobering counterpoint to the euphoric post-CPI moves seen last week and could therefore see the Dollar better supported.

"Sustained demand in the face of high prices gives firms little incentive to cut prices, particularly in the service sector, which will help to keep inflation elevated through the first half of 2023," says Jay H. Bryson, Chief Economist at Wells Fargo.

"While goods inflation is seeing meaningful relief, improvement in services will be slower-going," adds Bryson. "Inflation's descent is still poised to be painfully slow with some bumps along the way".

Wells Fargo expects the Dollar to remain supported well into 2023 and says it will only be in the second half of the year that a more sustained depreciation materialises.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes