Expect Dollar "Surge" to Continue "Well into 2023" - Principal Asset Management

- Written by: Principal Asset Management

Image © Adobe Images

The U.S. dollar has been surging in 2022, with higher interest rates, a more hawkish central bank, stronger economic prospects, and global safe-haven flows all fuelling its ascent.

A weaker dollar would loosen financial conditions and enable a global risk rally.

However, it would likely take both an improvement in the global growth outlook, especially relative to the U.S., and a period of Federal Reserve rate cuts, for this to occur.

It is reasonable to suggest that this bull will likely continue into 2023.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

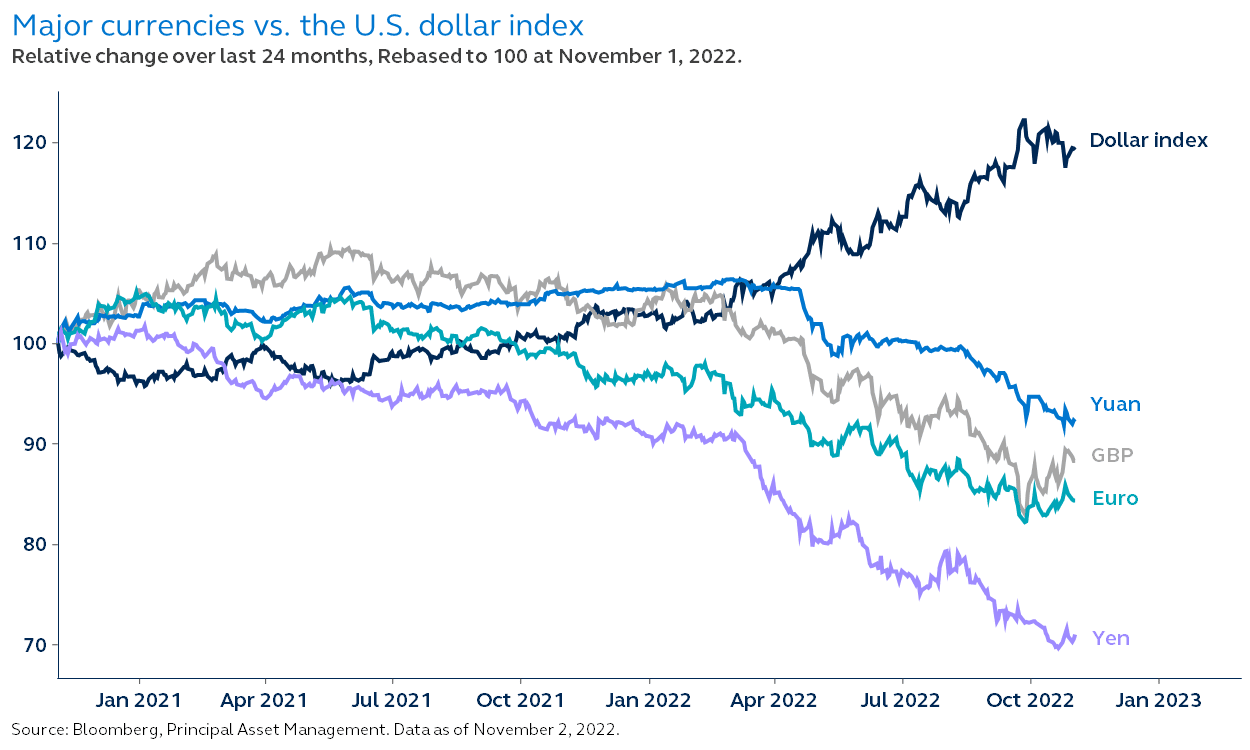

Amid current economic and geopolitical uncertainty, the U.S. dollar has enjoyed strong returns in 2022, sending the U.S. dollar index (DXY) to levels unseen in over 20 years.

Year-to-date, it’s up 13% vs. the euro, 17% vs. pound Sterling, and 22% vs. the yen. This has important implications for international portfolios and, being the world’s reserve currency, also for global financial conditions.

So, what’s driving the dollar higher?

In recognition of domestic vulnerabilities, some central banks have recently slowed their pace of rate hikes—in contrast to the solely inflation-focused Federal Reserve (Fed), which is now widely expected to raise rates above 5%.

Consequently, higher interest rates in the U.S. have continued to attract global capital flows seeking higher returns.

As global economic risks further emerge, the dollar will likely continue to be considered the best safe haven to withstand growth setbacks in both Europe and Asia.

Although a dollar peak may arrive when the Fed does eventually slow its monetary tightening path, this alone may not be enough to trigger substantial dollar depreciation.

In the past, it has also required an improvement in the global growth outlook to drive a dollar reversal.

Therefore, while the dollar’s valuation remains stretched - the drivers of its strength are not yet exhausted.

Investors can expect the dollar surge to likely continue well into 2023.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks