EUR/USD Forecast Downgrades Mount as Headwinds Grow

- Written by: James Skinner

- Nomura a seller of EUR/USD & eyeing parity

- EUR/USD forecasts downgraded at Rabobank

- But EUR/USD seen bottoming out near 1.03

- If Euro area avoids energy-induced recession

- Credit Suisse sells rallies & looks for 1.0340

- Sees ECB policy offering support short-term

Image © Alfred Yaghobzadeh, European Commission Audiovisual Services

The Euro-to-Dollar rate has fallen close to its coronavirus crisis lows, leading to forecast downgrades and prompting Nomura to target a further slide to parity, although the latest projections from Rabobank and Credit Suisse suggest it could be likely to bottom out around 1.03 in the months ahead.

Europe’s single currency slipped beneath the 1.05 handle again on Thursday and was trading at some of its lowest levels since March 2020 in price action that was likely encouraging for strategists at Nomura who’ve recently advocated selling EUR/USD in anticipation of a fall toward parity.

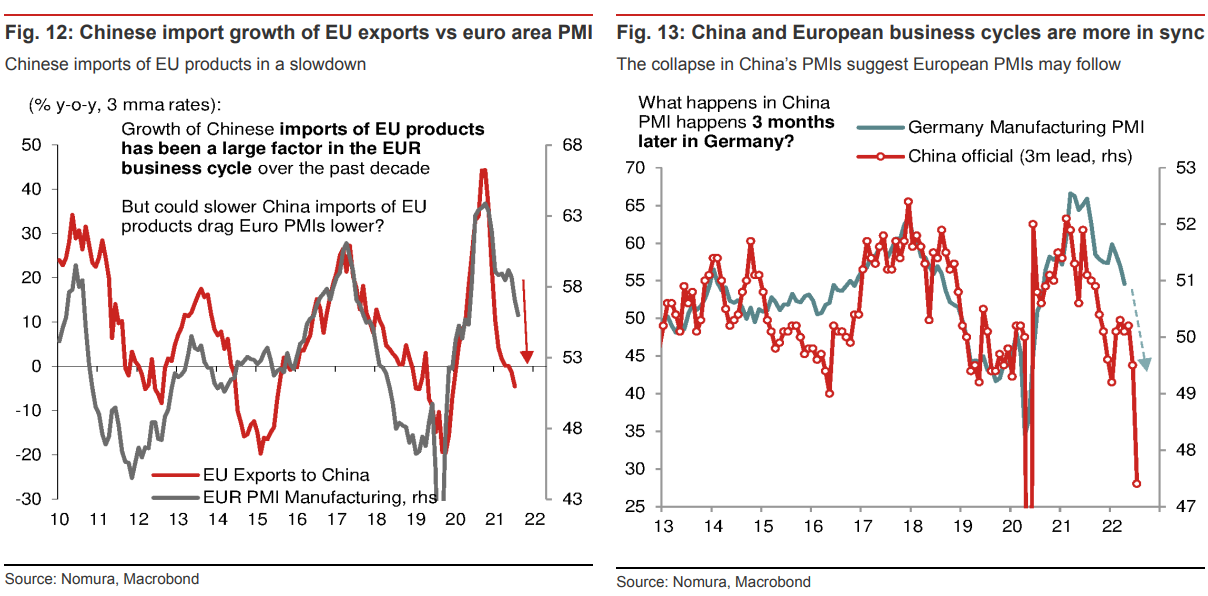

“The euro area is simultaneously facing several exogenous shocks, from the Russia-Ukraine conflict to China, that will weigh on the EUR outlook,” says Jordan Rochester, a strategist at Nomura.

“This is a big part of why we are short EUR/USD, looking for this move to eventually reach parity in the next two months,” Rochester said on Monday.

Rochester and the Nomura team suggested earlier this week that clients of the bank use a currency options structure to bet on further declines that are expected to take the Euro-Dollar rate to parity over the next two months, which would leave the Euro at its lowest level since December 2002.

Source: Nomura. Click image for closer inspection.

Source: Nomura. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Nomura's outlook was motivated by four sets of factors including energy supply risks that have driven up prices rapidly, surging food costs, an economic slowdown in China and a depreciation of the Renminbi.

Each of these is on its own a heavy burden for the currency and collectively those factors account for the bulk of reasons for why the market has recently been contemplating questions about parity with a rampantly strong Dollar.

But some forecasters do expect a brush with parity to be avoided if European gas supplies from Russia continue uninterrupted.

“Whether or not USD strength means that EUR/USD will move to parity in the coming months, remains to some extent dependent on the fundamental backdrop in the Eurozone and on EU policy,” says Jane Foley, head of FX strategy at Rabobank.

“We see a strong chance of a recession in the Eurozone towards the end of this year. How heavily the EUR trades in the coming months is likely to be a function of how the big risks to growth in the region develop,” Foley also said in a Tuesday review of Rabobank’s forecasts. [Ad: For free accurate forex trading signals visit Learn2Trade.]

Above: Euro to Dollar rate shown at weekly intervals. Click image for closer inspection.

Above: Euro to Dollar rate shown at weekly intervals. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Foley downgraded Rabobank’s one and three-month forecasts to 1.03 this week but looks for the single currency to recover to 1.06 by year-end if the Eurozone is able to avoid slipping into recession during the intervening period.

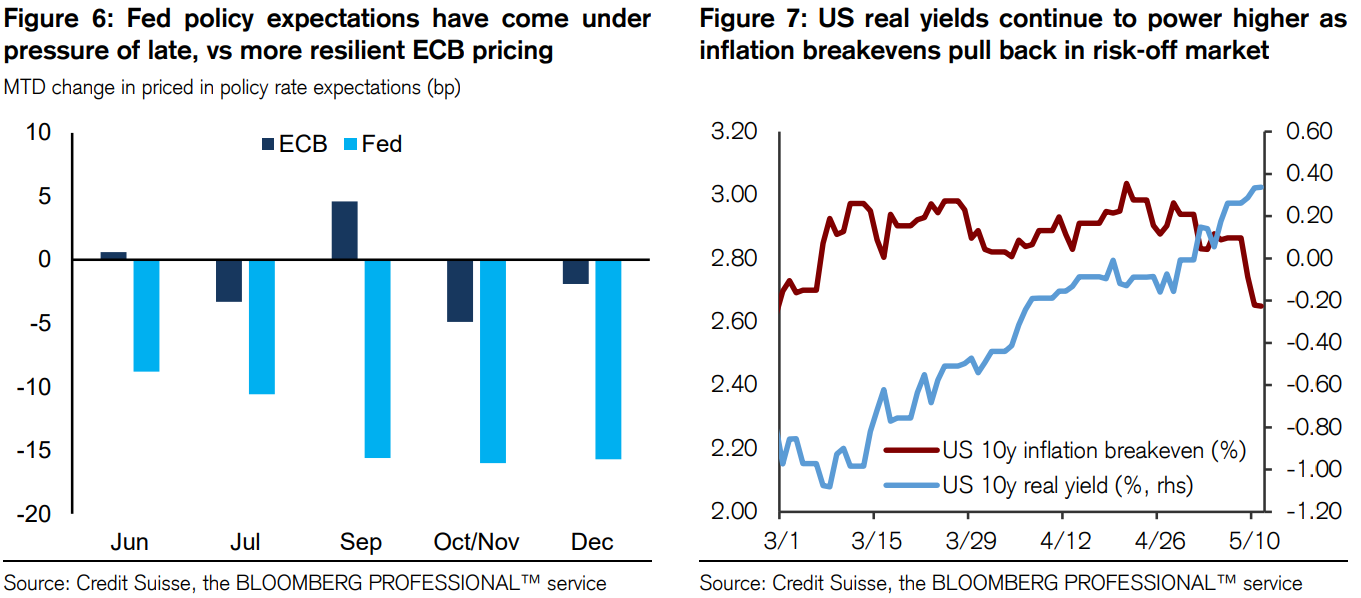

One saving grace for the European single currency is the increasingly widespread array of Governing Council members suggesting the European Central Bank (ECB) is likely to lift its interest rate for the first time in almost a decade during the months ahead.

This is in part because inflation has reached record highs and is widely seen as unlikely to dissipate easily, leaving the ECB with few choices other than to begin withdrawing the monetary stimulus provided to the Eurozone economy during and in the years leading up to the coronavirus crisis.

However, it’s also why some other forecasters are targeting a fall to only around the 1.03 level in the months ahead despite the U.S. Dollar likely continuing to advance against other currencies in the interim.

“We do not see this as enough to force us to change our “sell rallies” view for EURUSD, and we still target 1.0340 near term. But for now, EUR can outperform currencies more exposed to weak global asset prices or less supported by hawkish central bank re-pricing,” says Shahab Jalinoos, head of FX trading strategy at Credit Suisse.

Source: Credit Suisse. Click image for closer inspection.

Source: Credit Suisse. Click image for closer inspection.