Euro / Dollar Week Ahead Forecast: Vulnerable but Major Support Underpins at 1.1002

- Written by: James Skinner

- EUR/USD vulnerable near last week’s lows

- Slip below 1.1107 brings 1.1002 into view

- But dip-buying & major support likely here

- CBR FX selling & risk aversion could weigh

- Ukraine strength & resilience an upside risk

Image © Adobe Images

The Euro to Dollar exchange rate entered the new week under pressure and would be at risk of sliding lower toward a major level of technical support around 1.1002 if either Russian reserve selling or market risk-aversion leads the single currency to slip beneath last week’s low at 1.1107 at any point over the coming days.

Europe’s single currency had enjoyed a strong rebound against the Dollar on Friday as financial markets appeared to serenade an apparently mild international sanctions response to Russia’s attempted conquest of Ukraine, although Saturday’s salvo from the G7 was a game-changer.

G7 countries and the European Union announced on Saturday what is possibly ‘the mother of all sanctions packages’ including an eviction of many Russian banks from The Society for Worldwide Interbank Financial Telecommunication (SWIFT) and a freeze on Central Bank of Russia (CBR) assets.

“Under this package, important Russian banks will be excluded from the SWIFT system. We will also ban the transactions of Russia's central bank and freeze all its assets, to prevent it from financing Putin's war,” European Commission President Ursula von der Leyen said on Sunday.

The latest sanctions are big and heavy blows landed directly on the body of the Russian state and its economy but will have side effects and some of these may be felt in the markets from Monday if fully implementing any asset freeze requires legislative processes to be carried out.

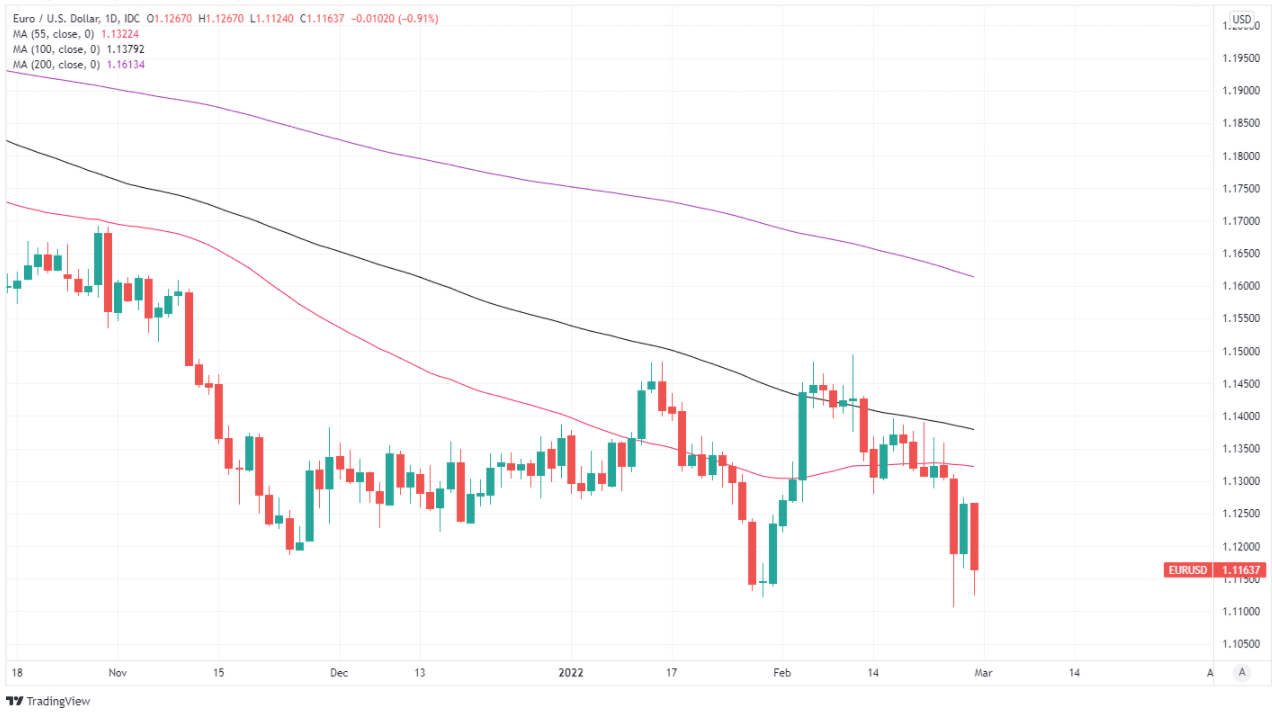

Above: Euro to Dollar rate shown at daily intervals.

- EUR/USD reference rates at publication:

Spot: 1.1185 - High street bank rates (indicative band): 1.0799-1.0878

- Payment specialist rates (indicative band): 1.1090-1.1135

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

For instance, it could be the case that a European Council vote is necessary to implement the EU’s asset freeze - with equivalent steps elsewhere in the G7 - which would create a window for the CBR to convert its reserves into alternative stores of value such as the Chinese Renminbi and gold.

Europe’s single currency is the largest holding in the CBR’s reserve portfolio and so would be likely to bear the brunt of any scenario where it has the opportunity to either back a spiraling Rouble or to convert its reserves into other currencies, which would be bearish for Euro-Dollar in the short-term.

“The risks are tilted to EUR underperforming this week given the ramping up of European tensions with Russia,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“While markets were not expecting an imminent rate hike by the ECB, there is a risk market pricing for tightening in late‑2022 fades, and weighs on EUR/USD. In our view, the downside economic risks opens the way for EUR/USD to test its 1.1106 support level,” Capurso and colleagues also said.

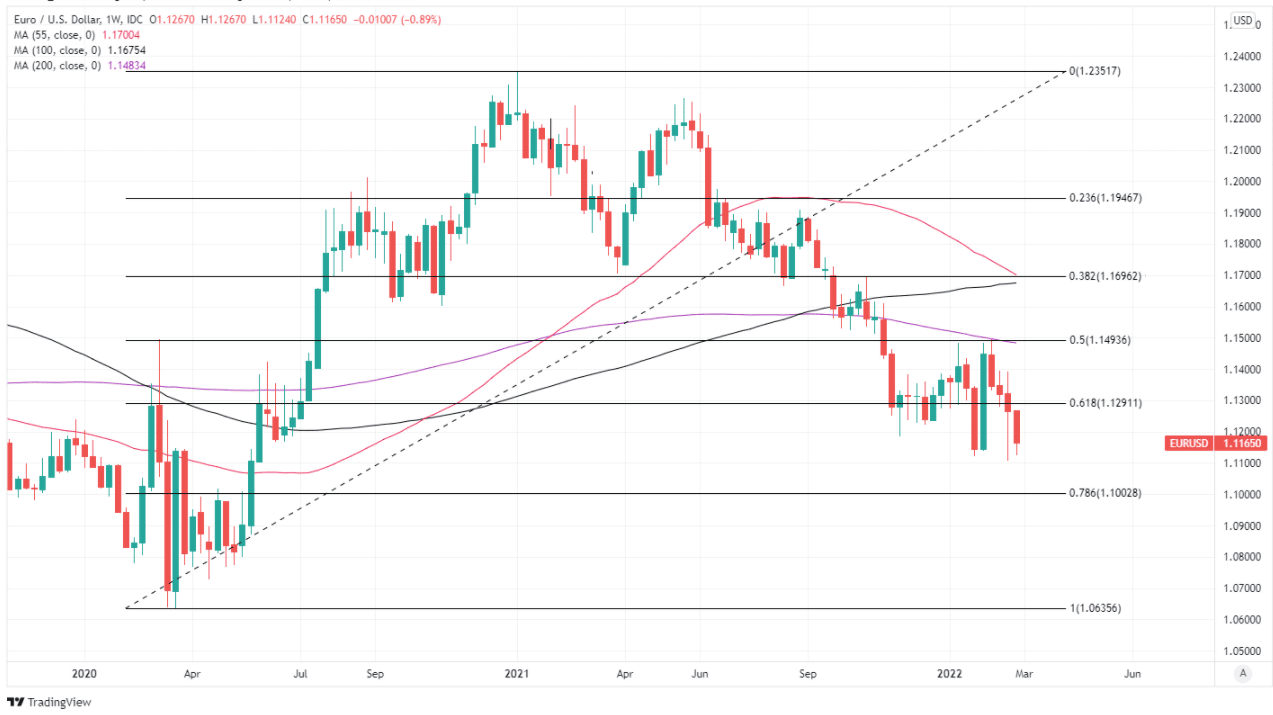

With last week’s lows around 1.1107 aside there’s little by way of technical impediment to arrest any further declines by the Euro once beneath there until it reaches 1.1002 level, which marks the 78.6% Fibonacci retracement of the 2020 recovery rally.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The latter is a significant support level that could be likely to draw dip-buyers from the woodwork if seen over the coming days, although much about price action this week will also depend on developments in Ukraine, which do also pose some upside risks for the single currency.

“One of the first-order responses to the invasion has come in the form or repricing of near-term central bank tightening expectations. Among G10 central banks, we feel this is most appropriate in Europe, primarily for the ECB, given the relatively high direct linkages with both Russia and Ukraine,” says Brian Daingerfeld, U.S. head of G10 FX strategy at Natwest Markets.

“Taken together, we remain short EUR/GBP and see a higher risk that EUR/USD breaches to the downside of the 1.11/1.15 range that has been in place for the past three months,” Daingerfeld and colleagues warned in a Friday research note.

While Friday’s remarks from European Central Bank President Christine Lagarde kept the door open for the ECB to accelerate the normalisation of its monetary policy settings, the danger is that Russia’s attempted conquest of Ukraine knocks the bank off of its present course.

One immediate economic consequence of the ongoing invasion has been an increase in energy prices that threatens to lift inflation further, but also stifle household spending and business investment, making it a potential threat to the Eurozone recovery.

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating likely areas of technical support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The above referenced risks could melt away promptly, however, if Ukraine’s military, its civilian population and political leadership are able to keep up the fierce resistance that has so far left Russia’s invading force floundering without having secured any of its strategic objectives.

“He is prepared to die for his cause, in contrast to leaders who won't even risk a bad opinion poll. Zelenskiy’s people have rallied to him - as will a new foreign legion of volunteers from abroad,” says Michael Every, a global macro strategist at Rabobank.

“Any dreams Putin had of imposing a puppet regime, or of carving up and holding Ukraine, have been shattered by cries of “Slava Ukraini! (Glory to Ukraine!). Overall, the Russian military is performing extremely poorly,” Every told clients on Monday.

The invading force failed in its fourth attempt to capture the capital city overnight ahead of the Monday session, according to a report from Ukraine’s national news agency Ukrinform, while included among the assailing force’s losses from the weekend was the destruction of a large Chechen military formation at the site of an important airfield near Hostomel in Kyiv region.

The latter referenced action in Hostomel was at least the third instance since Thursday in which the invading force had captured and then failed to hold onto that particular location, and it further bolsters the appearance of an invading army failing to secure its strategic objectives and which is at risk of leaving Moscow with a complete and unabridged calamity on its hands.