Euro / Dollar Week Ahead Forecast: Ukraine Headwinds Stifling Upside Potential

- Written by: James Skinner

- EUR/USD suppressed & vulnerable near 1.13

- Elevated conflict risk stifling appetite for EUR

- Ukraine de-escalation no automatic panacea

- NATO grievances a key motivator for Moscow

Image © Adobe Stock

The Euro to Dollar exchange rate recovery was further stifled last week by market concerns about the growing risk of a conflict in Ukraine, the lingering threat of which could continue to have a suppressive effect on the single currency over the coming days.

Europe’s unified unit made a short-lived attempt to revive its early February rally last week after opening close to the round number of 1.13 but the gains made amid its brief retest of the 1.14 handle were steadily undone by the Friday close.

This was after Friday’s evacuation of inhabitants from the breakaway provinces in Eastern Ukraine, to Russia, and an increasing incidence of ceasefire violations made clear an escalating risk of conflict that could be set to linger for some time yet.

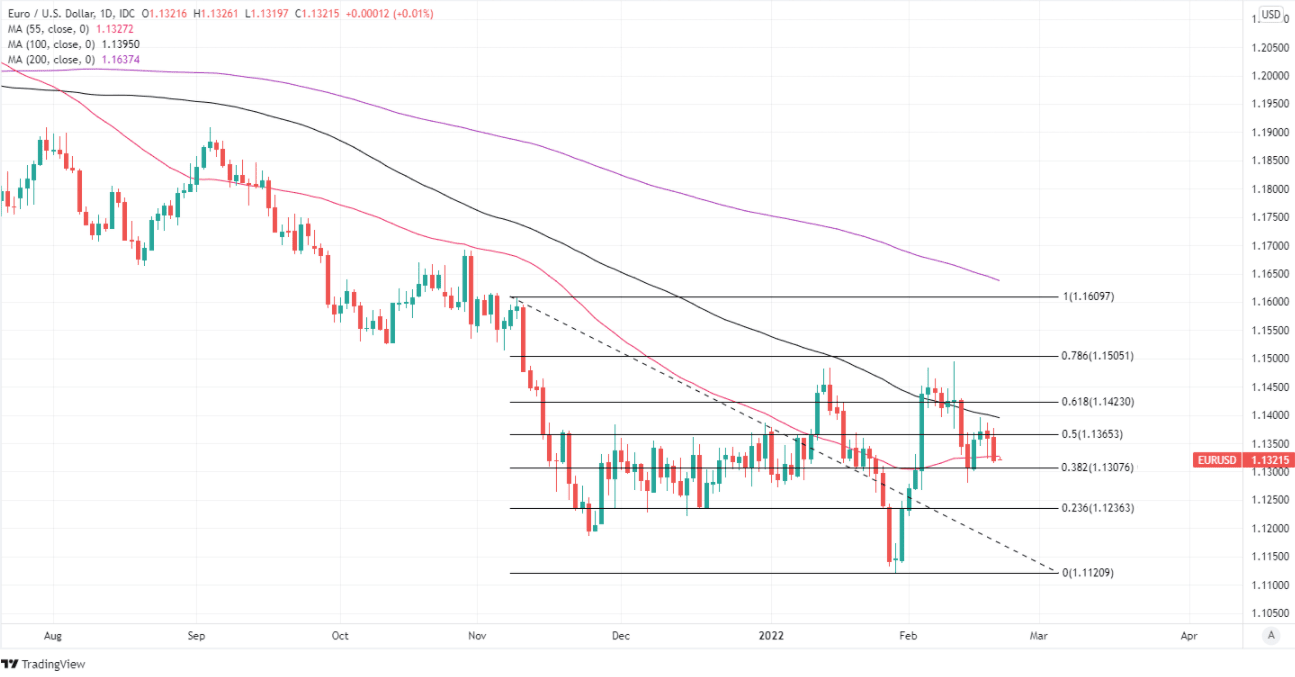

“We expect EUR to extend gains as the year progresses, in part because of our expectation for a weaker USD. An earlier‑than‑expected ECB tightening cycle can also underpin EUR. However, we retain our view that EUR can test its February low of 1.1235 if Russia invades Ukraine,” says Carol Kong, a currency strategist at Commonwealth Bank of Australia.

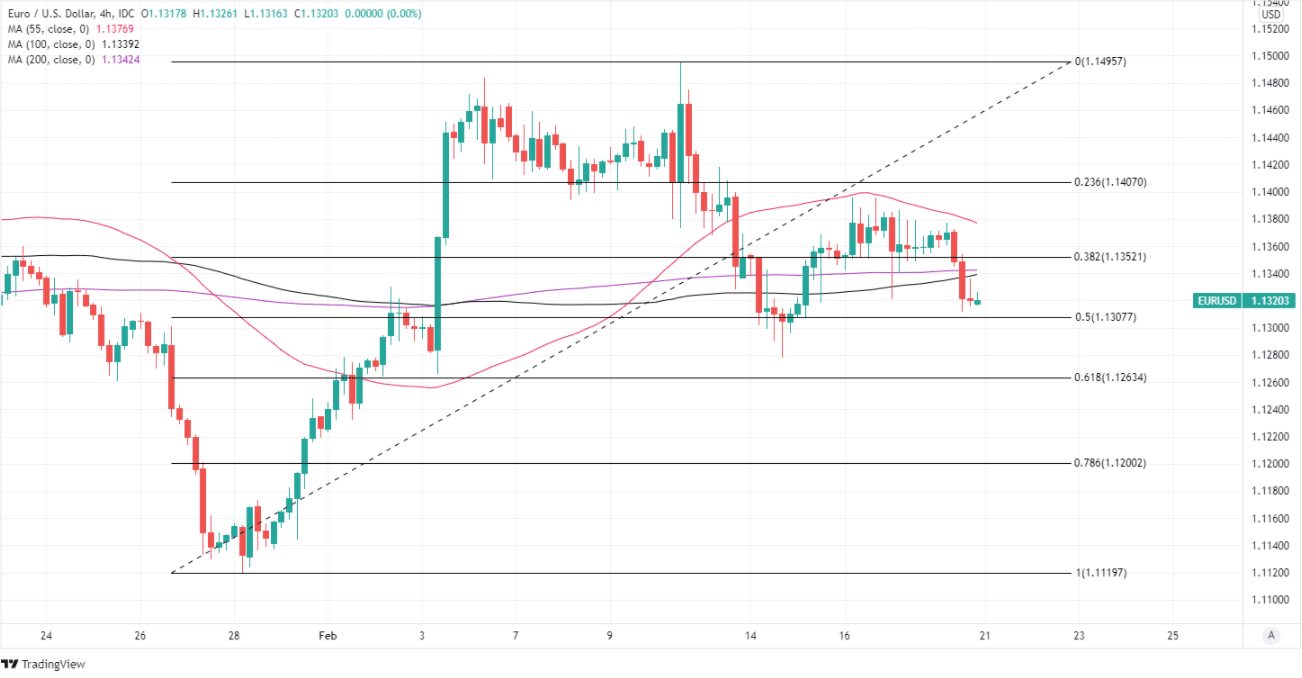

Above: Euro Dollar rate shown at 4-hour intervals with Fibonacci retracements of February rally indicating possible areas of technical support.

- EUR/USD reference rates at publication:

Spot: 1.1377 - High street bank rates (indicative band): 1.0979-1.1058

- Payment specialist rates (indicative band): 1.1275-1.1320

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

While the mood in global markets may be lifted at the opening of the new week after French diplomacy led the White House to announce on Sunday that Presidents Joe Biden and Vladimir Putin would likely meet in person in the near future, this meeting is not necessarily a game-changer.

"We know what Putin will demand at such a summit: a new Yalta/Potsdam - the imposition of which is now threatened by war and economic war anyway," says Michael Every, a global macro strategist at Rabobank, writing in a Monday note.

Global markets have been preoccupied with the large Russian military force amassed on the Ukrainian border but are largely overlooked the parallel and very much connected bid by Russia to coerce from the U.S. and North Atlantic Treaty Organization (NATO) what Moscow calls “security guarantees.”

Russian forces gathered near the border in October and November for “exercises” before Moscow published in December a draft treaty containing a list of security related proposals that it often characterises as “demands” which, if unmet, could lead to unspecified military measures being taken.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Asked directly what these measures might be, [the President of Russia] said: they could come in all shapes and sizes. He will make decisions based on the proposals submitted by our military. Naturally, other departments will also take part in drafting these proposals,” Foreign Minister Sergey Lavrov said in a January 28 interview with Sputnik, Echo of Moscow, Govorit Moskva and Komsomolskaya Pravda radio stations.

Responses from the U.S. and NATO have so far left the Russian government with little reason for optimism, and this could be likely to remain the case.

The sought after guarantees are often mischaracterized into triviality across other media but Ukraine’s national news agency and counterparty to the BBC, Ukrinform, covered most of the bases in the following succinct summation from January 05 this year.

“Russia's leadership, which has violated multiple international laws and moral norms, demands "security guarantees" that, if provided, would mean the de-facto dissolution of NATO and the limitation of the allies’ sovereignty,” the January 05 article read in part.

Above: Euro-Dollar rate shown at daily intervals with Fibonacci retracements of November decline indicating possible areas of technical resistance.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The current encampment of military forces along the Ukrainian border and subsequent push for treaty agreements with NATO and the U.S. follows the same pattern of events from last year when in April and May the same borders were first put upon by a large military formation.

It was at the end of May that Moscow’s defence minister announced that some 20 new “units and formations” would be created in the western military district by year-end due to perceptions of a growing threat from NATO.

That and current events make clear that the real problem underlying the events along Ukraine’s border is Moscow’s grievance with NATO and not any interest in a takeover of Ukraine, which is why tensions could be set to linger for some time yet even in the event of de-escalation in relation to Ukraine.

“The immediate range is well defined at 1.1280/1.1420. I think these parameters hold for now and am inclined to get short around 1.1395/1.1400 with a tight 1.1420 stop. Just looking for a reasonable risk-reward,” says Jonathan Pierce, a currency trader at Credit Suisse, in a Friday market commentary.

Shared borders and economic interlinkages are leading candidates for explaining why mainland European currencies have been the most sensitive to the ebb and flow of perceived conflict risks, which appear to have all but snuffed out the early February recovery by the Euro.