Euro / Dollar Week Ahead Forecast: Momentum Ebbs but Upside Risks Linger

- Written by: Gary Howes

- EUR/USD momentum ebbing after rally

- But upside risks to linger in short-term

- Amid signs of ECB policy shift in cards

- ECB speeches eyed ahead of U.S. CPI

Image © Adobe Images

The Euro to Dollar exchange rate entered the new week near three-month highs but with momentum behind its nascent rally ebbing the single currency could now struggle to extend its recovery without further inspiration from the European Central Bank (ECB) or incitement from U.S. economic data.

Europe’s single currency rose almost three percent in the week to Monday following its strongest rally since July 27 and the period immediately after European Union members gave their seal of approval to the EU’s coronavirus recovery fund.

While the Euro-Dollar rate’s gains were tempered on Friday by a bumper U.S. payrolls report for January, it remained comfortably above the 1.14 handle early in the new week after last Thursday’s ECB monetary policy press conference prompted widespread speculation in financial markets that a possible end to the era of negative interest rates could be near in Europe.

“We think that the gradual removal of negative rates will have a profound long-term FX impact. For starters, the EUR rate disadvantage will be reduced and trigger the unwinding of EUR-funded FX carry trades, thus supporting the currency vs high-yielders like the USD. Furthermore, the EUR rate advantage over the JPY and CHF will grow and help the single currency outperform,” says Valentin Marinov, head of FX strategy at Credit Agricole CIB.

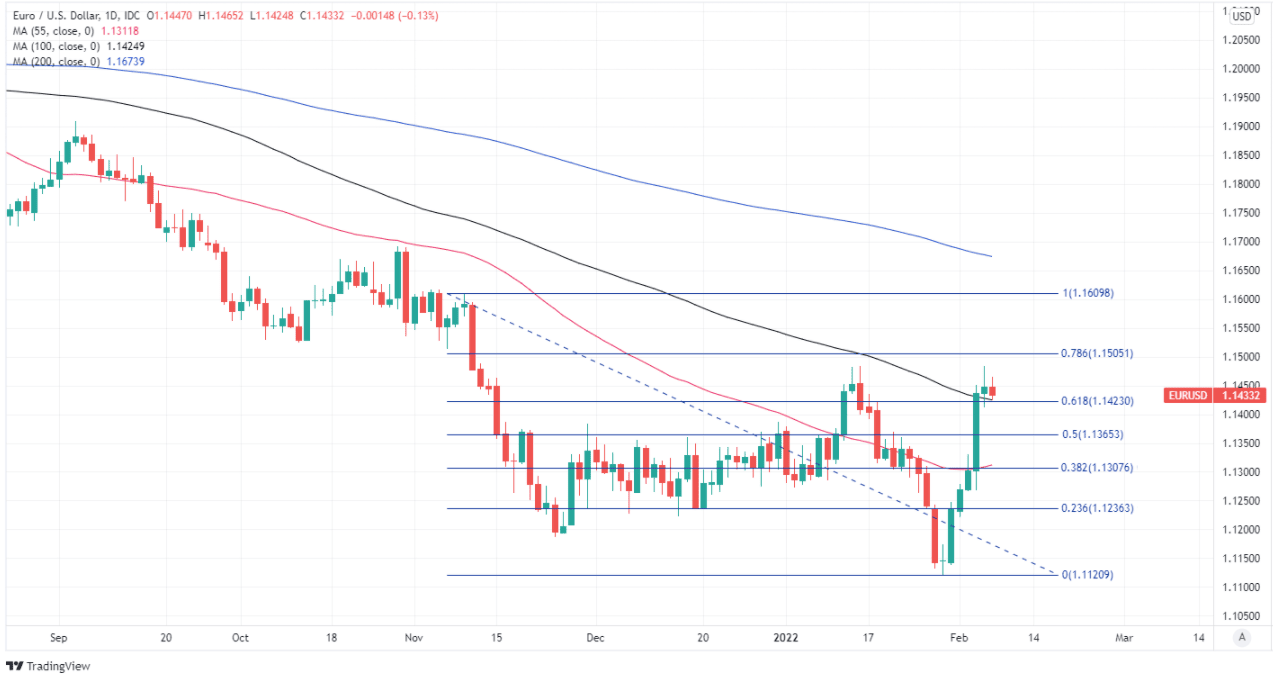

Above: Euro-Dollar rate shown at daily intervals with Fibonacci retracements of November fall indicating possible areas of technical resistance to a further recovery. Major moving-averages denote both supports and resistances.

- EUR/USD reference rates at publication:

Spot: 1.1423 - High street bank rates (indicative band): 1.1023-1.1100

- Payment specialist rates (indicative band): 1.1343-1.1366

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

“In the near term, FX investors will focus on today’s speech by the ECB President Christine Lagarde as well as other ECB speeches this week, looking for indications of the pace of policy normalisation from here. With some positives already in the price of the EUR, we have a more neutral outlook on the currency in the near term,” Marinov and colleagues said in a note on Monday.

The Euro rallied strongly against all major counterparts after ECB President Christine Lagarde said that uncertainty about the Eurozone inflation outlook has increased and that risks are tilted to the upside along the immediate path ahead, while also appearing to abandon the earlier view that an ECB interest rate rise would be “highly unlikely” this year.

While that may yet turn out to be a premature judgment, the market hasn’t wasted any time chasing the Euro higher and will likely pay close attention to testimony from President Lagarde before the European Parliament Economic and Monetary Affairs Committee at 15:45 London time on Monday.

“Should she feel the need to correct any of the sharp adjustments seen in European interest rate markets (and correct the pressure on BTP-Bund spreads), today's introductory comments could present such an opportunity. We have a slight preference for EUR/USD drifting back to the 1.1380 area today,” says Chris Turner, head of global markets and regional head of research for UK & CEE at ING.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The US runs a large positive output gap (compared to the negative output gap in the eurozone) and the US tightening cycle will likely be far larger than that seen in Europe. That is why we favour EUR/USD proving toppish near the 1.15 area, rather than calling a major upside breakout,” Turner and colleagues also said on Monday.

Monday’s testimony from President Lagarde is the highlight of the week for the European calendar, after which market attention could turn quickly to Wednesday’ release of U.S. inflation figures for January.

This could potentially reinforce expectations for the Federal Reserve to begin lifting its interest rate in March and might be likely to prompt a fresh market bid for the Dollar if the data surprises on the upside of expectations.

U.S. inflation is widely expected to have reached a new high of 7.3% in January while consensus suggests the core inflation rate likely climbed to 5.9%.

The Fed is itself commonly viewed as likely to far outpace the ECB when it comes to lifting interest rates this year and next, which is why despite its recent recovery, some analysts doubt the Euro-Dollar rate will be able to sustain its rebound.

“We have a hard time seeing how EUR/USD can make sustainable forward progress. The greater risk of a more abrupt and sustained policy tightening still resides on the US side,” says Richard Franulovich, head of FX strategy at Westpac.

“OIS markets are already braced for a notable widening in the cash Fed Funds - ECB deposit rate spread, from +62.5bp currently to +130bp by end-2022. That kind of cash rate differential should provide USD with supportive ongoing tailwinds,” Franulovich and colleagues also said on Monday.

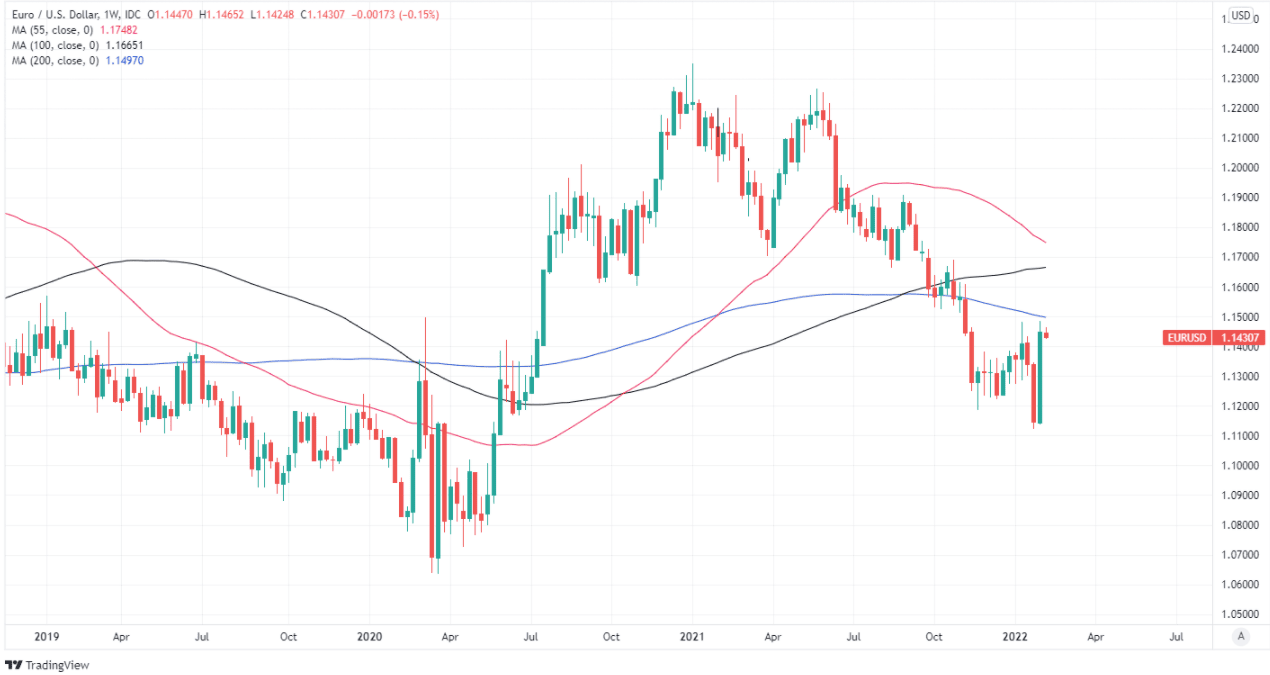

Above: Euro-Dollar rate shown at weekly intervals with major moving-averages.