Euro / Dollar Rate Week Ahead Forecast: "Emphatic Failure at the 5-month Downtrend"

- Written by: Gary Howes

Image © Adobe Images

- EUR/USD reference rates at publication:

Spot: 1.1574 - High street bank rates (indicative band): 1.1169-1.1250

- Payment specialist rates (indicative band): 1.1470-1.1516

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Euro could be on course to retest the 2021 low against the Dollar according to a noted technical analyst, although where it ends the week could depend on the outcome of the Federal Reserve's November 03 policy update.

The Euro to Dollar exchange rate (EUR/USD) rose to its highest level in a month on Thursday October 28, before suffering a substantial 1.0% fall on the Friday that saw it wipe out virtually all of October's gains.

The losses were the result of a substantial appreciation in the U.S. Dollar which rose against all its peers in response to some eye-opening U.S. Data, the details of which can be found here.

The Euro's largest one-day decline against the Dollar since June makes for a significant technical failure which bodes for further weakness in the near-term.

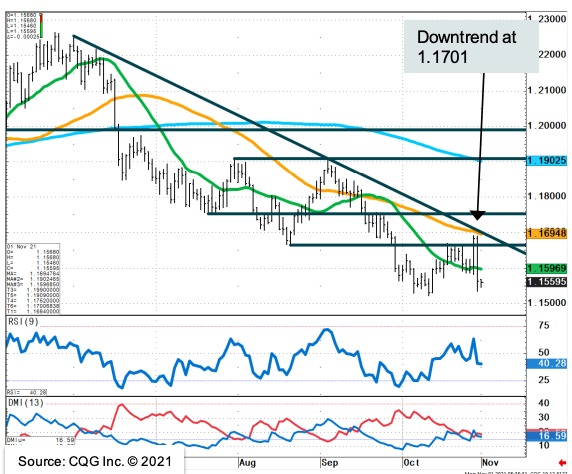

"EUR/USD last week rallied towards and failed just ahead of the 55-day ma at 1.1695 and the 1.1701 5-month downtrend. The emphatic rejection from here implies that the 1.1522 recent low is exposed," says Karen Jones, Team Head of FICC Technical Analysis Research at Commerzbank.

Above: EUR/USD technicals courtesy of Commerzbank.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Below 1.1522 lies the 50% retracement of the move from 2020 and the March 2020 high at 1.1492/95. Key support is the previous downtrend (from 2008) which is now located at 1.1366," says Jones.

Commerzbank's technical analysis team holds a bias for EUR/USD weakness in both the short-term and longer-term timeframes, saying only a move above the resistance line at 1.1701 will alleviate immediate downside pressure and would allow for a retest of 1.1909 and the 1.1906 200-day moving average.

They say the short-term trend (1-3 weeks) is negative as is the long-term trend (6-9 months), which has scope to extend to 1.1366.

Technical considerations are likely to hold sway of the market into a key decision from the Federal Reserve, due at 18:00 GMT on Wednesday November 03, which will be the main calendar highlight for the EUR/USD exchange rate.

The Fed has signposted for some time that it stands ready to reduce stimulus now that the economic recovery looks solid and inflation pressures are starting to rise noticeably.

Economists are looking for the Fed to reduce its monthly asset purchases by $15BN starting in November, with $10BN coming from Treasuries and $5BN coming from Mortgage-Backed Securities.

A move to reduce the scale of quantitative easing would be a necessary first step ahead of a 2022 rate rise.

It is arguably the timing of that first rise - and how many can be jammed into 2022 and 2023 - that will have the most impact on the market going forward.

Therefore it is the guidance on future policy as opposed to the actual decision to reduce quantitative easing that will matter for the Dollar midweek.

"A confirmation of market expectations may lead to a relief rally in the dollar, especially against lower yielding currencies such as EUR and JPY. However, any upside in the US dollar from a hawkish shift in the Fed is likely to be temporary," says Simon Harvey, Senior FX Market Analyst at Monex.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

He says markets have already priced in a 'taper' that the Fed is still likely to lag other G10 central banks on raising interest rates due to their more tolerable inflation framework.

Recall, the Fed now targets labour market dynamics in addition to inflation, whereas the likes of the Bank of England are explicitly guided to ensure price stability.

"Sustained dollar downside is likely to be visible against currencies where hawkish adjustments to policy have been should the Fed not surprise with a more aggressive outlook for

normalisation," says Harvey.