Euro-Dollar Week Ahead Forecast: Finding Feet Above 1.1825 if Dollar’s Dust Settles

- Written by: James Skinner

- EUR/USD looks to stabilise after Fed lifts U.S. yields

- Finding footing above 1.1825 if dust settles over USD

- Fed speak, U.S. yields key in quiet week for EUR data

Image © Adobe Images

- EUR/USD reference rates at publication:

- Spot: 1.1867

- Bank transfers (indicative guide): 1.1450-1.1535

- Money transfer specialist rates (indicative): 1.1760-1.1784

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Euro-Dollar exchange rate is entering a thicket of noteworthy technical support levels, which could enable the single currency to stabilise at or above the 1.1825 level over the coming days after enduring its bloodiest week since March 2020.

Europe’s single currency signed off on a hat-trick of weekly declines this Friday past when it confirmed a -2.08% fall for the five-day period and its largest decline since the final week of March last year.

That is in turn testament of the extent to which the U.S. Dollar came surging back after June’s policy decision and quarterly forecasts emerged from the Federal Reserve (Fed), which included a dot-plot of projections for the Fed Funds interest rate range showing that a majority of eighteen Federal Open Market Committee (FOMC) members now see as many as two interest rate rises coming before the end of 2023; with the first potentially some time next year.

“While we had not expected such a sizeable move in the USD this week, our EUR/USD forecasts have been counter consensus and we have been anticipating a stronger USD this summer. Given the possibility of a partial retracement in the USD’s move, for now we retain our previous forecasts of 1.20 on a 1 month view followed by a move to 1.17 on a 6 month view,” says Jane Foley, head of FX strategy at Rabobank.

“We will review these forecasts over the next week or so when the initial impulse from the Fed meeting has settled,” Foley adds.

Much about the immediate outlook now depends on U.S. government bond yields and how they respond to a series of looming statements from Federal Reserve Chairman Jerome Powell and other Fed officials.

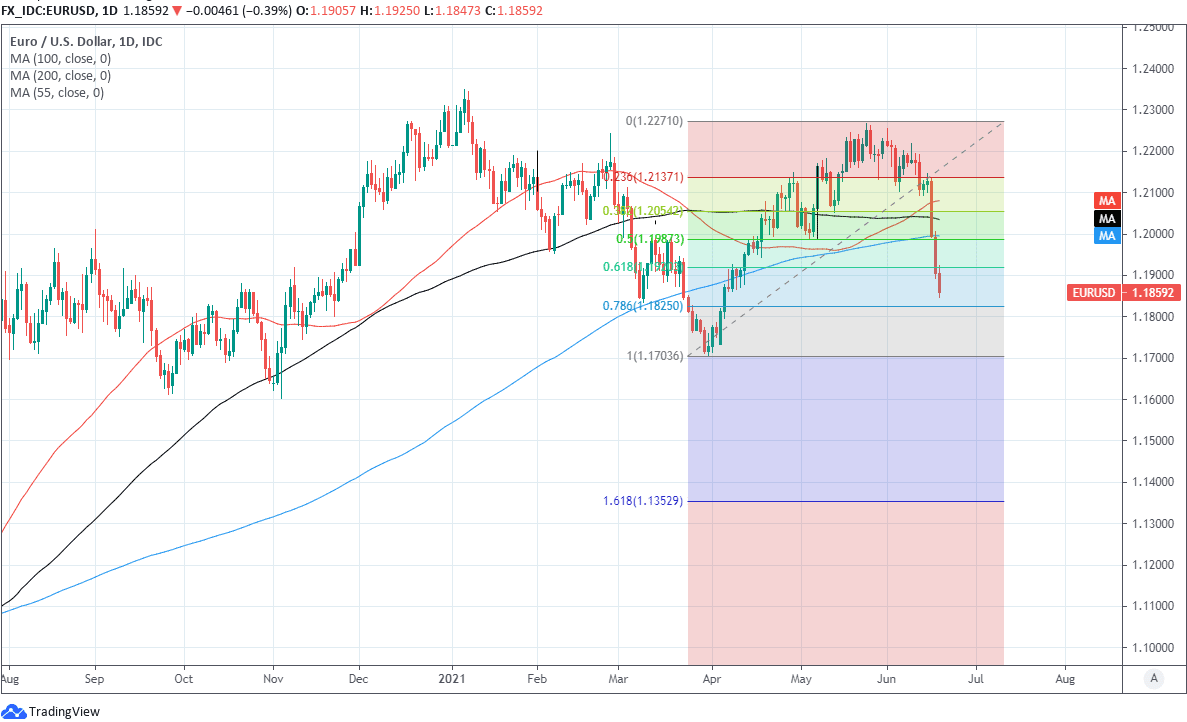

Above: Euro-to-Dollar rate at daily with Fibonacci retracements of April recovery and key moving-averages.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The Dots brought hikes forward. Their inflation forecasts flagged upside risks after base effects. Powell's tone in particular was very positive, acknowledging inflation risks and repeating a number of times that he expected a "very, very" strong improvement of the labor market," says Athanasios Vamvakidis, head of FX strategy at BofA Global Research, who together with colleagues has remained a staunch Euro-Dollar bear in 2021.

“Although we remain constructive on the USD post-FOMC, we would also urge caution as we still see too many moving parts. We would not expect the USD path to be smooth,” Vamvakidis writes, in anticipation of a Euro-Dollar finish around 1.15 for this year.

Despite the evident improvement in the Dollar's medium-term outlook, there's also a number of technical reasons for why the Euro-Dollar rate could find its feet at least temporarily over the coming days.

Europe’s single currency was fast closing in Friday on the 78.6% Fibonacci retracement of its April recovery located around 1.1825, which is one area that could break its fall this week, while on the weekly chart the single currency was left testing its 55-week moving-average.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

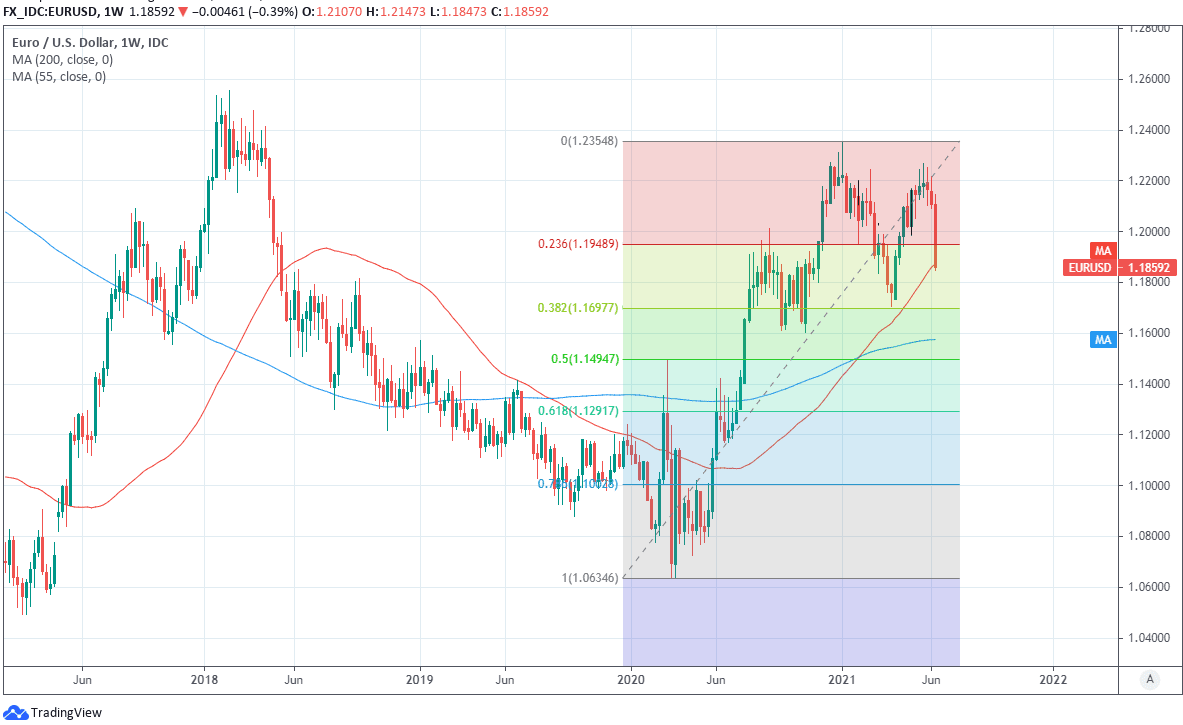

Further down on the weekly chart (below) there is a large as well as tried and tested 38.2% Fibonacci retracement level of the Euro’s overall recovery from March 2020 lows located around 1.1700.

“The FOMC statement caused a widening of US-EUR rate differentials and accelerated the unwinding of long EUR positions. The break of key technical levels in rapid succession culminated in a decline below 1.19. That could open a return towards 1.17 this summer if strong incoming US data advances the policy debate on tapering at the next FOMC meeting in July,” says Kenneth Broux, a strategist at Societe Generale.

In addition, there's another Euro-supportive factor in the form of the starting level for the all-important two-year U.S. government bond yield over which the Fed exerts tight control.

Movements here have knock-on implications for all currencies, but especially the ones offering lower interest rates and accompanying bond yields like the Euro, Japanese Yen and Swiss Franc.

Above: Euro-to-Dollar rate at weekly intervals with Fibonacci retracements of 2020 recovery and 55-week moving-average.

“Movements at the shorter end of the US yield curve are a dollar positive – especially against the low yielders. The US data calendar is light in the week ahead, but there are several Federal Reserve speakers every day. The highlight may be Fed Chair Powell’s testimony to Congress on Tuesday,” says Chris Turner, global head of markets and EMEA regional head of research at ING.

The two-year yield reached 0.25% on Friday and the very top of the current Fed Funds rate range of 0% to 0.25%, but given that Chairman Jerome Powell himself played down the significance of the Fed ’s dot-plot as a predictor of interest rates last Wednesday, this is highly unlikely to rise much further in the very short-term as the Fed has in a roundabout way somewhat obliged itself to ensure as much.

As a result, and especially if this Tuesday’s appearance before Congress by Chairman Powell leads the currency market to second guess whether an interest rate rise for 2022 really became any more likely last week, the Euro could finds its fall broken and itself cushioned by declining bond yields and calmer conditions in U.S. exchange rates at least through the early stages of the week ahead.

“Price action has all the hallmarks of a short, sharp position adjustment – suggesting the bulk of the correction may have occurred. Yet we feel Fed speak could see EUR/USD correct a little further lower this week. Look out for speeches from ECB President Christine Lagarde and board member Isabel Schnabel – likely to repeat remarks by Chief Economist Philip Lane distancing the central bank from any early hawkishness,” ING's Turner adds.

Above: Euro-Dollar rate shown at daily intervals alongside U.S. 02-year bond yield.