Euro-Dollar Rate Forecast: Back to 1.16 Shows New Analysis

- EU's slow vaccine rollout weighs on EUR

- EU rescue fund delay to lead to EUR underperformance

- Inward investment plans likely hit by EU threats to AstraZeneca

From left to right: Mr Charles MICHEL, President of the European Council; Ms Angela MERKEL, German Federal Chancellor; Ms Ursula VON DER LEYEN, President of the European Commission; Mr David SASSOLI, President of the European Parliament. Copyright: European Union

- EUR/USD spot at publication: 1.1790

- Bank transfer rates (indicative guide): 1.1380-1.1460

- Money transfer specialist rates (indicative): 1.1710

- More information on bank-beating rates, here

- Set a rate alert, here

The Euro is expected by a number of analysts to extend its period of weakness against the U.S. Dollar as delays to the rollout of the EU rescue fund combine with a slow vaccination rollout programme and a rapid spread of covid-19 to cast a shadow over the Eurozone.

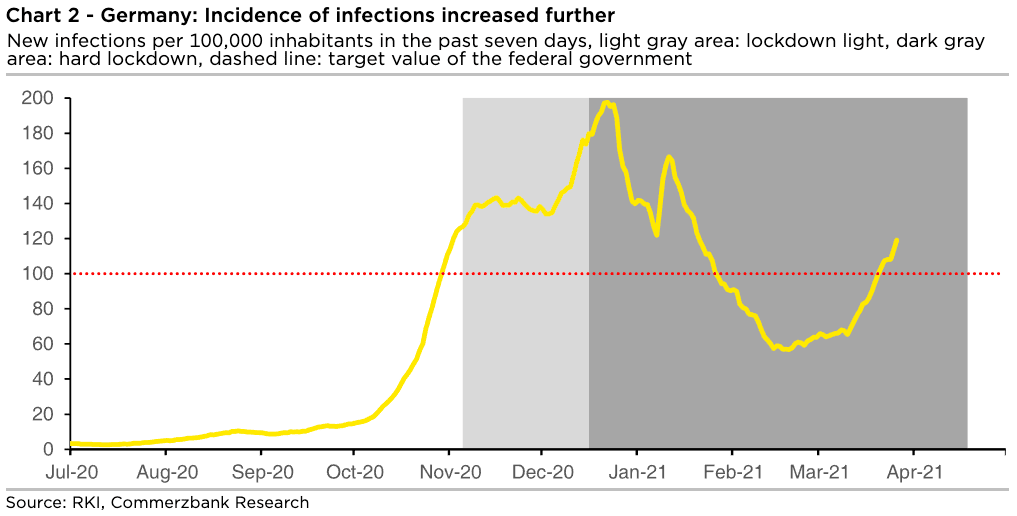

In France, Italy and Germany Covid-19 infection figures are rising significantly suggesting a third wave of infections is now underway.

In Germany - the Eurozone's largest economy - a total of 21,573 new infections were reported on Thursday March 25 which is 4,271 more than on Thursday a week ago.

The 7-day incidence - i.e. the total number of people infected with corona in the past seven days - jumped to 119.1 per 100,000 inhabitants.

Image courtesy of Commerzbank.

The speed of new infections suggests that the nation's relatively slow vaccine rollout will unlikely stop a new wave, which should defer any post-covid economic rebound and reflect poorly on the region's currency.

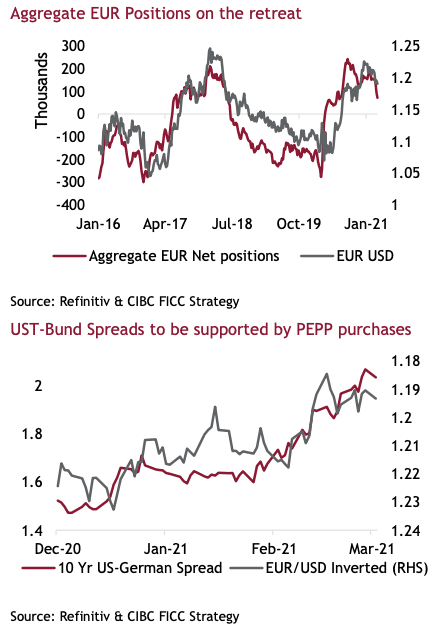

"As the eurozone continues to lag in the global vaccination race we expect EUR longs to continue to be taken off the table," says Jeremy Stretch, Head of G10 Strategy at CIBC Capital Markets.

The call comes amidst a period of underperformance by the single currency that has seen the Euro-to-Dollar exchange rate retreat below the psychologically significant 1.20 level to test 1.1760 this week - its lowest level since November.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The disbursement of EU rescue funds is an H2 story, at the earliest. Therefore, against the backdrop of a relatively small aggregate fiscal impulse, the longer the virus is seen to hold back the unshuttering of businesses the greater the EUR position correction," says Stretch.

The NextGenerationEU recovery fund was agreed in May 2020 and sought to distribute €750BN across the bloc to mitigate the economic and financial impact of the covid-19 crisis. The Euro rallied in the wake of the agreement, but subsequent delays to the fund's distribution have been cited by analysts as a potential contributing factor to the current bout of Euro weakness.

The distribution of funds has been delayed by bureaucracy as national parliaments work through their own legislation required to pass the plan and the EU executive meanwhile delays approval of the individual spending plans of certain countries.

It was reported on March 12 that the recovery fund has run into early trouble with the bloc’s executive arm judging that most national spending plans submitted so far still need work to get approved.

The fund, when approved, is expected by economists to boost economic activity in the region, which is said to meanwhile ultimately be supportive of the Euro.

But the anaemic progress in passing the fund contrasts unfavourably with the rapid injection of generous sums of money in the U.S. where President Joe Biden's administration is distributing up to $1.9TRN worth of stimulus support.

Analysts have said this boost to the U.S. economy is one reason why the U.S. Dollar is performing better than many had expected at the start of the year.

Eurozone growth prospects meanwhile remain subdued given a renewed spread of covid-19 across the bloc, leading to expectations that restrictions on economic activity will last longer than was previously expected.

"The prospect of renewed or extended lockdowns underlines downward growth revisions. A slower rebound underlines a more protracted period prior to the eurozone recovering to pre-pandemic activity levels," says Stretch.

"We expect EUR/USD to drift lower over the coming 1-3M. We acknowledge that negative developments pertaining to the EUR's fundamentals are already in the process of being discounted by FX markets, but we also have questions about the magnitude of the economic rebound in late-Q2/early-Q3, owing to pandemicrelated factors and numerous legacy issues," says Stephen Gallo, European Head of FX Strategy at BMO Capital Markets.

The speed at which EU economies can reopen ultimately depends on the successful rollout of vaccines, which has been notably slower in the Eurozone than is the case in the UK and U.S.

"The EU's 'third COVID wave', the relatively low vaccine take up rate, and a more subdued fiscal impulse will probably cause the Eurozone's recovery to lag North America's by 2-3 months," says Gallo.

A pickup in vaccine supplies to the EU is expected over coming weeks, which analysts say could ease some concerns that a slow rollout in the bloc will delay the region's economic reopening.

"We do expect the EU to step up the pace of vaccination into Q2, providing justification for a more constructive H2 macro outlook," says Stretch.

But vaccine take-up hesitancy amongst European populations is considered by the CIBC analyst to be a potential headwind to the vaccination programme on top of those already created by supply issues.

YouGov polling shows that by early March 2021 willingness to take a COVID-19 vaccine increased to 81% in the UK.

But this compares with 68% in Germany and 52% in France.

"For now, vaccination hesitancy remains a strategic challenge," says Stretch.

CIBC say the combination of risks facing the Eurozone - which go beyond just vaccinations - suggest Euro-Dollar exchange rate downside ahead.

The bank forecasts EUR/USD extending back towards fourth-quarter 2020 lows, near 1.16, prior to finding a base.

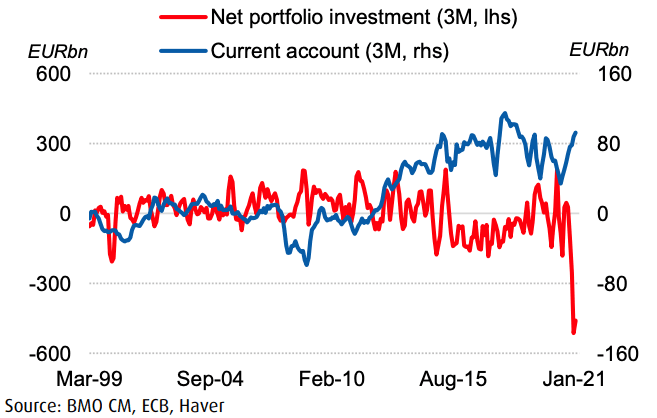

BMO Capital meanwhile tell clients that the EU's vaccination woes might have unintended side effects on business investment intentions.

Above: Eurozone current and financial account data. Image courtesy of BMO Capital.

They say the EU's spat with AstraZeneca - who are accused by EU leaders of hoarding vaccines and not living up to supply commitments - has reflected poorly on the region's 'business friendly' credentials.

Threats of export bans and commandeering vaccine IP in order to secure more doses potentially sends the wrong kind of signal to businesses looking to invest in Europe, a key source of fundamental support for Euro exchange rate valuations. An Italian police raid this week on a company contracted to AstraZeneca only underscores how readily the EU will meddle in the affairs of private businesses.

"The handling of the vaccine rollouts by the EU's executive, and resultant forms of protectionism, could permanently deter inward investment. Net portfolio investment recorded an outflow of €514bn in Q4 alone," says Gallo.

BMO Capital forecast the Euro-Dollar exchange rate at 1.17 in three months and 1.18 in six months.