Pound / Euro Week Ahead Forecast: Beware Profit-taking

- Written by: James Skinner

- GBP/EUR supported at 1.1876, 1.1855 & 1.1830

- Profit taking may prompt setback, test of 1.1830

- Consolidation could follow holiday rally from 1.17

- EUR CPI the highlight in a quiet week for UK data

Image © Adobe Images

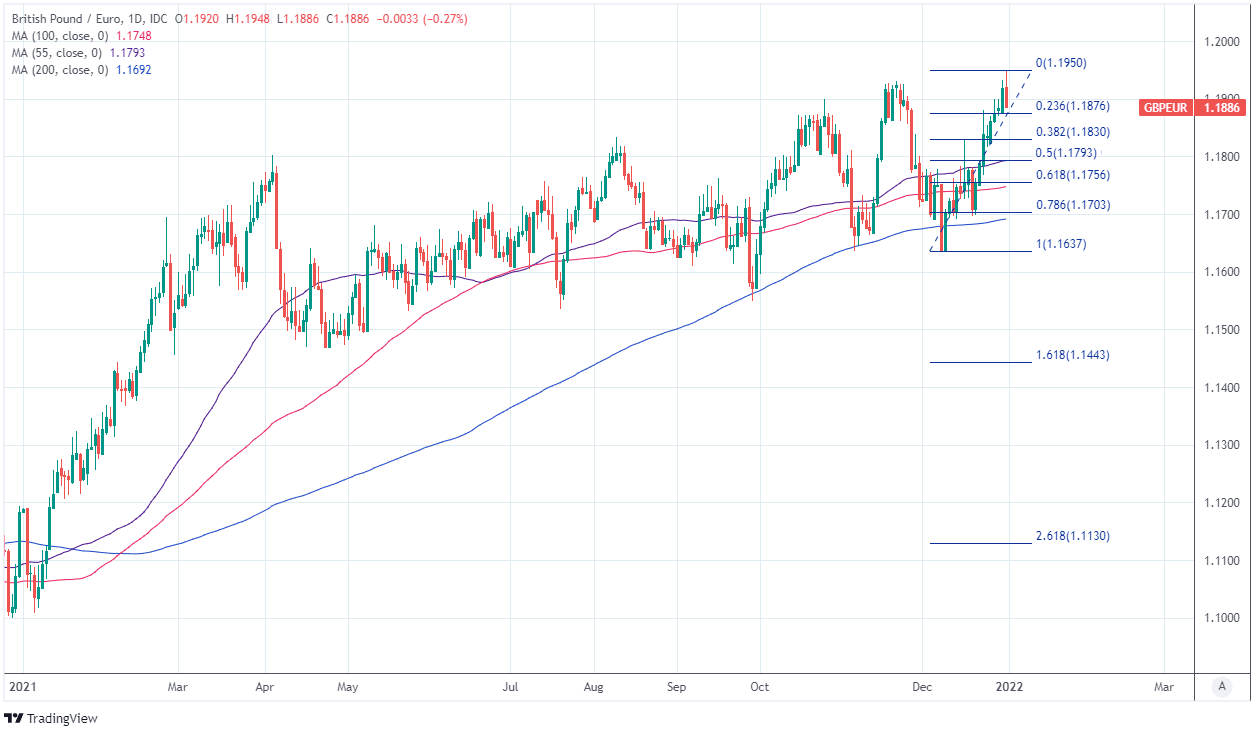

The Pound to Euro exchange rate entered the new week close to one year highs but would be at risk of a corrective setback toward 1.1830 if Sterling’s almost unbroken rally through the festive holiday elicits profit-taking from the market as trading conditions normalise over the coming days.

Pound Sterling was the best performing major currency of the G10 contingent during the final week of 2021 and took third place for the year overall having been eclipsed by only the Canadian and U.S. Dollars, while the Pound-to-Euro exchange rate rose 7.4% during the 12 months to Monday.

The Pound-Euro rate ended the year strong following an almost nine day rally from early December lows around 1.17 in price action that appeared to be at least partly inspired by a ‘hawkish’ revision of the market’s expectations for Bank of England (BoE) interest rates in 2022.

“With the Bank of England already starting to shift rates higher and the ECB unlikely to do so for a while the risk is the EUR/GBP currency pair will continue to slide,” says Karen Jones, a technical analyst and member of the board at the Society for Technical Analysts.

“Our initial focus is on the 2020 low at .8275 [GBP/EUR: 1.2084] and once that gives way the attention will be on the 200-month ma at .8175 [GBP/EUR: 1.2232]. Remember markets tend to mean revert to their long-term moving averages,” Jones said in a recent social media post.

Above: GBP/EUR shown at daily intervals with major moving-averages and Fibonacci retracements of December recovery indicating likely areas of technical support.

- Reference rates at publication:

GBP to EUR: 1.1919 - High street bank rates (indicative): 1.1602 - 1.1685

- Payment specialist rates (indicative: 1.1812 - 1.1859

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Sterling advanced through the holidays after a series of studies suggested the Omicron variant of coronavirus could be milder than its relatives, easing market concerns about its economic impact and prompting investors to anticipate another rate rise from the BoE as soon as February.

This has placed the Pound-Euro rate within close reach of post-referendum highs a short distance above 1.20 although the danger is that its recent nine day rally induces profit-taking and a corrective setback to open the new week.

However, Jones says the Pound would be likely to find strong support around 1.1827 in the event of any weakness over the coming days, a level which coincides closely with the 38.2% Fibonacci retracement of Sterling’s December recovery rally.

“With more interest rate rises coming next year, we expect the pound to be well supported, especially against the euro and Swiss franc,” Thomas Flury, a strategist at UBS Global Wealth Management. “We expect two more 25 basis point hikes in 2022, taking base rates back to their pre-pandemic levels.”

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The first week of January began with a public holiday in many parts of the world and may be a quiet one for Sterling once past the initial market response to its festive rally given that the economic calendar is devoid of major data and other events for the UK.

This leaves the Pound-Euro rate to take its cues from the broader trend in global markets throughout the week until Friday when attention will turn to the release of inflation figures for December in Europe.

“In good news for nervous policymakers, our central case is that eurozone inflation has already peaked (at a record high of 4.9% in November). Unless wholesale energy prices keep rising, it’s just maths that the large contribution they are making to inflation will drop out. And if global supply disruption eases in 2022, other cost pressures should also fall,” says Simon Wells, chief European economist at HSBC.

“More importantly, there is little evidence from pay settlements so far of a significant acceleration in eurozone wage growth. So we see inflation close to the ECB’s 2% target by the end of 2023,” Wells and colleagues said in a recent note setting out their expectations for European economies this quarter.

Above: GBP/EUR shown at weekly intervals with Fibonacci retracements of 2015 decline indicating possible areas of technical resistance to any Sterling recovery. Click image for a closer inspection.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Friday’s inflation data would be a risk for the Pound-to-Euro rate if it shows European price pressures building further into year-end because such an outcome could lead to market speculation about a more persistent overshoot of the European Central Bank (ECB) target than Frankfurt expects.

ECB policymakers say they expect inflation pressures to retreat early in the new year and many economists have generally projected the same also, although all could be led to doubt themselves if Eurozone inflation rates undergo a similar surge to those most recently seen in the U.S. and UK.

“The ECB announced that PEPP would end in March 2022, as planned, with a hand over to a boosted APP. But it left the door ajar for a resumption in PEPP if the pandemic worsens,” says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics, referring to December’s policy decision.

Friday’s data would act as a headwind for the Pound-to-Euro rate if it prompts speculation in the market about a possible acceleration of the ECB’s plan to phase out its €1.85 trillion Pandemic Emergency Purchase Programme of quantitative easing.

However, and on the other hand, if the economist consensus is right to expect that European inflation eased from 4.9% to 4.8% last month it would vindicate the ECB for having insisted last month that recent price pressures are likely to fade of their own accord without meriting a policy response such as an interest rate rise, and so could prove supportive of the Pound-Euro rate.