UK Unemployment Rate Rose Ahead of Reeves' Job Tax

- Written by: Sam Coventry

Image © Adobe Images

The UK's unemployment rate was already rising in the lead-up to Chancellor Rachel Reeves' jobs tax decision, which is expected to lead to an acceleration in the unemployment rate in the coming months.

The UK's unemployment Rate rose to 4.3% in September, said the ONS, up from 4.0% and beating estimates for 4.1%

At the same time, the all-important wage figures beat expectations, suggesting the inflationary impact of wages would remain a concern for the Bank of England.

With bonuses included, average earnings rose 4.3% in the three months into September, up from 3.8% and ahead of expectations for 3.9%.

Average earnings, excluding bonuses, rose 4.8% in the three months to September, beating expectations for 4.7% but dipping slightly on the previous month's reading of 4.9%.

The UK economy is potentially headed for an unsavoury scenario where unemployment and wages rise in tandem.

This means the Bank of England will be limited in the support it can offer via lowering interest rates.

"As we saw in the labour market data that was released this morning, pay growth remains quite sticky at elevated levels and levels that, given the outlook for productivity growth in the UK, are hard to reconcile with the UK inflation target," says Bank of England Chief Economist Huw Pill in a speech released following the release of the labour market statistics.

The foreign exchange market's reaction to these data was relatively muted because much has changed since September.

Most notably, the new Chancellor, Rachel Reeves, delivered her first budget later in October, announcing a significant tax increase on employers.

Economists and business leaders warn it will result in higher levels of unemployment.

From April, employers' National Insurance contributions will increase from 13.8% to 15%, while the income threshold for these contributions will decrease from £9,100 to £5,000.

The dropping of the threshold has been deemed particularly significant, and business leaders have warned that it could kill off part-time work.

Novo Constare, CEO and Co-founder of Indeed Flex, says, "these changes will increase hiring costs, placing extra pressure on smaller businesses. In sectors like hospitality, leaders have warned these tax hikes could lead to job cuts and even closures."

"These changes will increase hiring costs, placing extra pressure on smaller businesses. In sectors like hospitality, leaders have warned these tax hikes could lead to job cuts and even closures.

For markets, it will be the more timely economic surveys that will give clues as to how Reeves' budget is having an impact.

Data from the Institute of Directors (IoD) shows that for the first time since October 2020, a higher percentage of business leaders are expecting to reduce their headcount (28%) in the coming year than are expecting to increase it (24%).

"The combination of measures in the Employment Rights Bill and the large increase in employers' National Insurance contributions is taking a serious toll on employers' hiring intentions. The cumulative effect of these changes will ultimately be to stifle job creation," says Alexandra Hall-Chen, Principal Policy Advisor for Employment at the IoD.

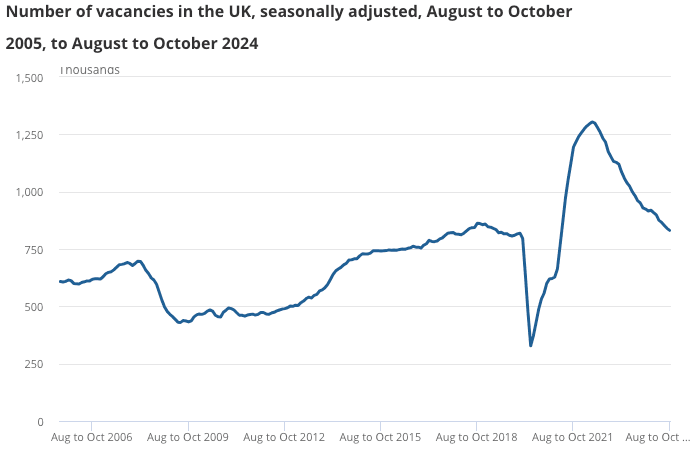

The ONS also reported a 28th consecutive decline in the number of vacancies available, which is a leading indicator of the labour market.

Total estimated vacancies were down by 13.6% at 130K in the three months to October when compared to the same period a year ago.

"This morning’s monthly labor market report was mixed but, on balance, showed further signs of softening. The number of job vacancies continued to decline through October. Payrolled employees fell in September and the preliminary data for October indicated another fall," says Tullia Bucco, an economist at UniCredit Bank.