"Historic Budget" of Spending Splurges and Tax Hikes: Deutsche Bank

- Written by: Sam Coventry

Chancellor Rachel Reeves. Picture by Joseph Foley/DCMS.

The Labour government's proposed changes to the UK’s fiscal framework are poised to bring significant shifts to public spending, taxation, and government debt, according to new research.

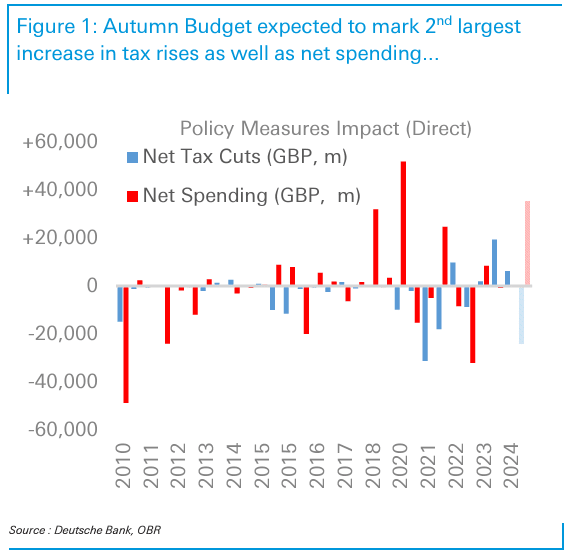

Sanjay Raja, Senior Economist at Deutsche Bank, says this will be "a historic budget... we expect the Autumn Budget to contain the largest single increase in net spending (outside the pandemic) since the Office for Budget Responsibility's (OBR) inception at GBP 35bn."

On the tax side of the ledger, Deutsche Bank expects the Autumn Budget to be the second largest tax-raising fiscal event since 2010.

Public Spending Surge

Labour plans to implement a £35 billion increase in net public spending, marking the largest non-pandemic-related spending increase since the Office for Budget Responsibility (OBR) was established in 2010. This surge will focus on three main priorities:

Protecting Living Standards: According to Raja, Labour's emphasis on living standards will involve "a real living wage, enhanced worker rights, and possibly future tax cuts aimed at easing the burden on working households." These measures are designed to boost incomes and reduce inequality.

Fixing Public Services: Labour intends to address long-standing issues in the NHS, local government, schools, and defense. Raja notes that "hospital productivity, unsustainable local government finances, and falling education standards will be key areas of focus." This could alleviate pressure on strained services, but the success of such measures will depend on effective implementation.

Investing for Growth: Another major focus of the fiscal plan is investment in green energy, housing, and transport, with a projected £20 billion increase by the end of the decade. "Labour is betting on long-term growth through infrastructure investment," says Raja, "but questions remain about how these projects will be funded without adding undue pressure on the budget."

Efficiency and Spending Cuts

Despite the large increase in spending, the Labour government also plans to cut costs and find efficiencies worth £11 billion annually by the end of the decade. This is designed to offset some of the fiscal expansion. As outlined in Labour’s manifesto and fiscal audits, these savings will target bureaucratic overheads and inefficiencies across government operations.

Taxation: Significant Increases on the Horizon

On the taxation side, Raja warns that the UK should brace for "the second-largest tax-raising budget since 2010." The government plans to raise taxes by £24 billion annually, with a particular focus on:

Consumption: This could include increased duties on items like tobacco, alcohol, gambling, air travel, and vehicles.

Wealth: "Taxes on capital gains, inheritance, and pensions are likely targets," Raja explains, as Labour looks to balance spending with more progressive taxation measures.

Debt and Borrowing: A Modest Increase

While the Labour government’s plan is expected to result in a modest increase in borrowing—around £10 billion more per year than previously forecast—Raja emphasises that Labour is not abandoning debt control entirely.

"Despite the uptick in borrowing, Labour aims to reduce the debt-to-GDP ratio to 93.9% by 2029/30," he notes, suggesting a shift away from a strict focus on headline debt figures towards a more flexible fiscal strategy.

Labour is also proposing a new set of fiscal rules that would prioritise a balanced current budget within three years while also introducing longer-term rules aimed at reducing debt relative to GDP and improving public sector net worth over a decade.

Key Risks and Challenges

Raja cautions that there are significant risks associated with these plans. "Tight fiscal headroom means the Chancellor will have limited room for manoeuvring," he says, particularly in the context of a multi-year spending review due in 2025. He also points out that revenue projections from tax increases could be uncertain, potentially undermining some of the budget’s key assumptions.

Another area of concern is market confidence. "The government’s focus on investment could raise eyebrows if the funding mechanisms are not clearly outlined," Raja adds. The potential for unfunded projects could spark worry among investors and markets alike.

Finally, the success of Labour’s ambitious devolution and decentralisation plans will depend on how effectively resources are allocated to local governments and regions. According to Raja, "fiscal decentralisation might require significant planning reforms and additional support to ensure success."