Bank of England Tipped to Hike by 25 Basis Points in August as Economists React to Inflation Undershoot

- Written by: Gary Howes

- Markets now see a 25bp hike in August

- Following sharp fall in UK headline inflation

- But services inflation is 'fly in the ointment'

- Capital Economics raise peak Bank Rate forecast

- AXA sees two more 25bp hikes

- Pantheon says a watershed moment has been reached

Image © Adobe Stock

Economists say although the prospect of a second consecutive 50 basis point rate hike in August has greatly receded following softer-than-expected June inflation figures, an elevated services inflation gives the Bank of England cause to hike on at least two more occasions.

The market now points to Bank Rate peaking around 5.75%, where they had seen rates rising to as high as 6.5% earlier this month.

The fall in two-year bond yields over recent days, a move which has accelerated in the wake of the inflation data, is testament to cooling expectations for the peak in Bank Rate.

The Bank will deliver its next decision and reveal new forecasts on August 03; "the risk of a 50bp hike remains, but in our view the improvement in core and services inflation, which keeps expectations lower, takes some of the immediate pressure off the BoE allowing it to lower the pace of hikes," says Modupe Adegbembo, G7 Economist at AXA Investment Managers.

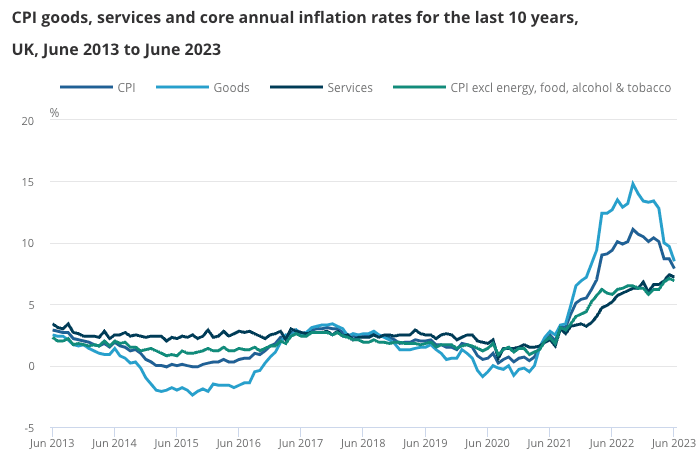

The ONS reported UK inflation rose 7.9% year-on-year in June, which was down from 8.7% in May and below expectations for 8.2%. Core CPI rose 6.9% y/y, down from 7.1% in May, where it was expected to remain in June.

Image courtesy of the ONS.

Importantly from a Bank of England standpoint, services inflation eased to 7.2%, albeit remaining above the 6.7% the Bank forecast for June in its May Monetary Policy Report.

This stubbornly high subcomponent of the inflation matrix could therefore be considered the one 'fly in the ointment' of the July release.

"While the headline figure is now in line with their expectations, the make-up of inflation is likely to be seen as worse. This will likely do little to ease the Bank of England’s concerns that inflation could prove more persistent," says Emma Wilks, UK Economist at Lloyds Bank.

Charles Hepworth, Investment Director at GAM Investments, says the Bank of England will see evidence that their hawkish rate hiking policy is finally having an effect.

"However, it is important not to get too carried away – inflation is still uncomfortably way above the central bank’s target. Hiking from here will continue, perhaps at less speed, but it will continue," he says.

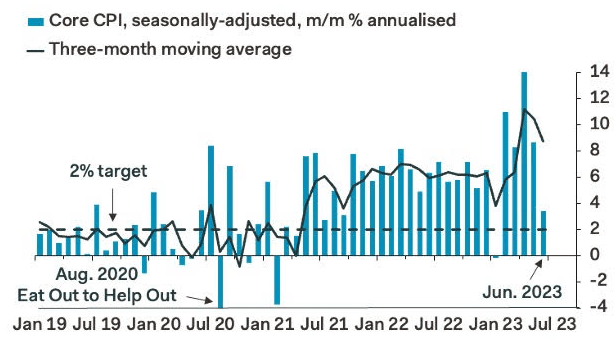

Image courtesy of Pantheon Macroeconomics.

Despite the unexpectedly large fall in headline and core inflation, independent research house Capital Economics says it is raising its Bank Rate forecast.

"We think there is enough momentum in wage growth and services inflation to raise our forecast for the peak in Bank Rate from 5.25% to 5.50%," says Paul Dales, Chief Economist at Capital Economics.

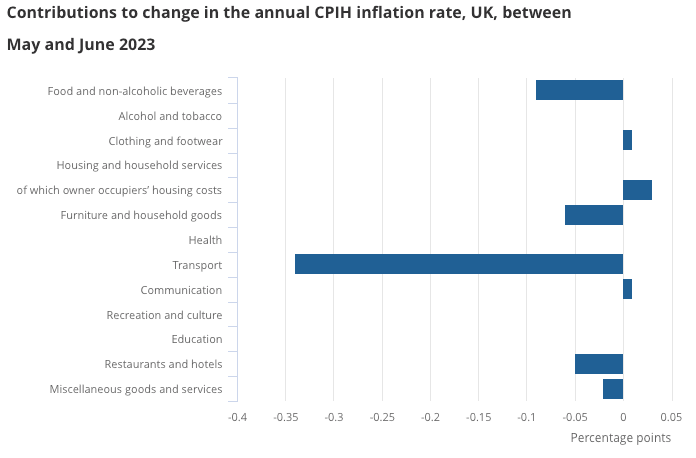

AXA meanwhile expects headline inflation to moderate over the coming months with the direct contribution of energy playing a key role as another sharp drop in energy prices will be reflected in August when July's data are released.

Energy prices are set to fall by 17%, reducing the contribution of energy by around 0.8ppts.

Image courtesy of the ONS.

In October, base effects from the anniversary of last year's energy price hikes will also see inflation shift lower.

"To add to this, the recent strength of sterling is likely to add to the deflationary pressures for core goods inflation over the next year, says Adegbembo.

AXA expects a further 25bp hike from the Bank in its September meeting, bringing Bank Rate to 5.50% where they expect it to pause.

At present, AXA pencils in 50bp of cuts over 2024 bringing Bank Rate to 5%.

However, Huw Davies, Investment Manager of Jupiter Asset Management's Fixed Income – Absolute Return fund, says he expects bond yields to fall further as the peak in Bank Rate falls.

"But we suspect that the UK may exit this inflation phase with a more entrenched inflation problem than when we entered it, a longer-term problem for the UK economy that the BOE will have to take some responsibility for," he adds.

If this view is correct then the odds of a meaningful rate-cutting cycle in 2024 are diminished.

The July inflation report is nevertheless "a watershed moment" according to Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

"We continue to think that the worst is over for U.K. households and that the MPC will not need to raise Bank Rate all the way to 6.25%, as markets priced-in yesterday," he says.

Pantheon predicts Bank Rate will be raised by 25bp next month and by a further 25bp in September, before then standing pat with Bank Rate at 5.50% in the final two meetings of this year.

Pantheon sees energy and food inflation declines as playing a key role in dragging headline inflation rates lower over the coming months.

In addition, the rally in the Pound in 2023 will also weigh given Bank of England models would imply the ~5% appreciation of trade-weighted sterling since the end of 2022 will depress the consumer price level by 1.4% in the medium term, according to Tombs.

"Some of this disinflationary pressure might emerge towards the end of this year—a little earlier than usual—given that businesses recently have been repricing more frequently than usual," he says, adding:

"Insurance costs, which have leapt by 21.0% over the last 12 months, boosting the core rate of CPI inflation by 0.2pp, also should rise less quickly, in lagged response to the recent stabilisation of both car prices and home rebuilding costs."